One in four South Koreans owns a digital asset, with speculation, portfolio diversification, and retirement planning cited as the leading motivations for investing.

According to a new study by the Hana Financial Research Institute, 27% of Koreans aged 20-60 have invested in a digital asset as the country’s ‘crypto’ mania hits new heights. 70% of the respondents said they intend to expand their holdings. On average, these holdings accounted for 14% of their overall financial asset portfolio.

Investors in their 40s were the most active in digital asset investing. Half the investors in their 50s hold digital assets as a retirement plan at a time when the growth of the country’s once-vibrant economy has slowed down.

The East Asian nation’s economy is projected to grow by 0.6% in the 2030s and contract by 0.1% in the 2040s, and the older population is now scrambling for any investment with high returns, which has drawn millions to digital currency.

1 in 4 South Koreans now invest in digital assets regularly, while the number of investors who sell in the short-term has reduced slightly, the report further noted.

“Virtual assets play a major role within investors’ portfolios,” commented Yoon Sun-young, one of the lead authors of the report.

“It is necessary to prepare preemptively for the expansion of the investment ecosystem, such as diversifying virtual asset-based financial products, upgrading integrated investment management, and collaboration with the virtual asset industry.”

South Korea has been a digital asset haven for over a decade. Investors’ love for high-risk investments has driven millions to digital assets, leading to the rise of the Kimchi premium, where digital assets trade significantly higher on South Korean exchanges than on other global platforms. In late 2017, the Kimchi premium went as high as 50%.

Regulators have struggled to keep up. With taxes, lawmakers voted to further extend the rollout of the 20% capital gains tax on digital asset profits to January 2027, five years after the first target deadline in 2022.

However, regulators have set strict policies for exchanges and wallets. One of these is that every user must link the exchange account to a bank account, which is meant to reduce fraud. However, according to the new study, it’s the biggest inconvenience for South Korean investors who say they would prefer to link their trading accounts to multiple bank accounts.

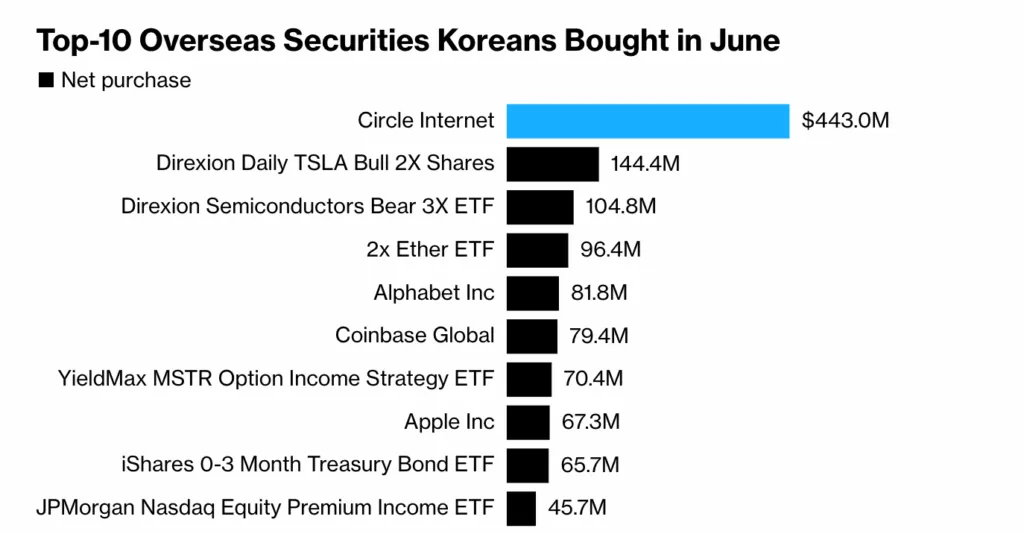

Beyond direct trading, millions of South Koreans have targeted the stocks of digital asset companies in the U.S. Data from the Korea Securities Depository revealed that newly-listed Circle (NASDAQ: CRCL) was the most popular overseas stock for investors in June.

In the three weeks since Circle went public on June 5, South Korean investors poured $443 million into its stock, which has surged over 500%.

Source: Korea Securities Depository

Source: Korea Securities DepositorySouth Korea’s central bank ditches CBDC for stablecoin

As digital assets soar in South Korea, the country’s central bank has abandoned plans for a central bank digital currency (CBDC) pilot scheduled for later this year, with local reports claiming that it’s now focusing on a won-pegged stablecoin.

The Bank of Korea (BOK) has been exploring a digital won for years. Earlier this year, it kicked off the first phase of the CBDC pilot, where 100,000 South Koreans tested tokenized deposits while lenders tested a wholesale CBDC. The second phase was set to start in October.

However, according to local outlets, the central bank temporarily halted the second phase as conflicts emerged with the participating commercial lenders, including Hana Bank, Kookmin Bank, and Kakao Bank.

The conflict is centered on the rapid adoption of stablecoins in the country, with the lenders now switching to competing on the new front.

The new administration, led by President Lee Jae‑myung, has been pushing for won-pegged stablecoins, which was one of the Democratic Party’s campaign pledges. Under the Digital Asset Basics Act, introduced last month, companies can issue a stablecoin with as little as $400,000 in capital.

A source at one of the top banks says the CBDC pilot has been costly for the lenders, and they now intend to channel these resources to issuing a stablecoin.

Watch | The Strategic Shift 2025 Highlights: Transforming industries with SaaS & blockchain

English (US) ·

English (US) ·