Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance, and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in November 2025:

- Bitcoin – The world’s oldest and largest crypto

- Zcash – Privacy-focused cryptocurrency

- Solana – Smart contracts platform with high speeds and low fees

- Hyperliquid – Decentralized perpetuals exchange with an efficient order book

- Ethereum – The leading DeFi and smart contract platform

- XRP – The leading crypto remittance solution

- BNB – The native coin of the Binance exchange

- Monero – A privacy-first cryptocurrency with fully obfuscated transactions

- Ethena – Ethereum-based stablecoin protocol

- Cardano – A peer-reviewed blockchain built for smart contracts and scalable dApps

- LayerZero – One of the best blockchain interoperability protocols

- Kaia – A fast-growing L1 chain designed for high performance and cross-chain integration

The best cryptos to buy right now: Discover top investments for November 2025

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them, but they are also anonymous, as the identity of the participants in the transaction is not revealed.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 50% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

Bitcoin fell 6.7% this week to $107,604, trimming recent gains as traders interpret the current range as a healthy consolidation phase. Macro analyst Jordi Visser described the current market behavior as Bitcoin’s “IPO moment,” where early holders gradually offload coins to a broader base of long-term investors. Despite sideways price action between $106K–$116K, fundamentals remain firm — network hashrate continues to reach new highs, ETF approvals are still flowing, and every dip finds strong buyers. Visser expects this consolidation period to last several months, gradually reducing volatility as supply becomes more distributed.

Seasonality also favors the bulls. Historically, November has been Bitcoin’s best-performing month, with an average 42% gain since 2013. Analysts like Markus Thielen say this year could repeat the pattern thanks to rate-cut expectations and easing trade tensions between the U.S. and China. The recent Trump–Xi meeting in Seoul hinted at progress on tariff reductions, while the Federal Reserve’s 25 bps rate cut and the upcoming pause in quantitative tightening have created a supportive backdrop for risk assets. Still, lingering U.S. political gridlock and the ongoing government shutdown could delay ETF approvals and slow momentum in the short term.

Bitcoin ETF inflows, all-time. Source: SoSoValue

Bitcoin ETF inflows, all-time. Source: SoSoValueMacro uncertainty hasn’t shaken institutional conviction. Michael Saylor reaffirmed his $150,000 price target for 2025, citing a favorable regulatory pivot in the U.S. and accelerating ETF demand led by BlackRock’s iShares Bitcoin Trust, which holds over $28 billion in assets. While spot ETFs saw brief outflows last week, total inflows for 2025 remain deeply positive, supporting Bitcoin’s long-term thesis as a “durable monetary asset.” With sentiment still cautious and price action range-bound, traders view the current setup as a late-stage accumulation phase before Bitcoin attempts another breakout above $120K.

2. Zcash

ZCash (ZEC) is a privacy-focused cryptocurrency that was launched in 2016 by Zooko Wilcox-O’Hearn. It is a fork of Bitcoin, designed to enhance privacy and anonymity for its users. Unlike Bitcoin, where transaction details (such as sender, recipient, and amount) are publicly visible, ZCash allows users to choose between two types of transactions: transparent and shielded.

Transparent transactions work similarly to Bitcoin, where all transaction details are recorded on the blockchain and visible to everyone. However, shielded transactions use a cryptographic technology called zk-SNARKs to allow fully private transactions. In shielded transactions, the details are encrypted, meaning that only the parties involved have access to the information, while the validity of the transaction is still verifiable by the network.

ZCash is particularly valued by those who prioritize financial privacy and security, as it offers optional anonymity in a way that few other cryptocurrencies do.

Why Zcash?

Zcash rose 9.8% this week to $391.97, pushing its market capitalization to $6.36 billion and securing its spot as the most valuable privacy-focused cryptocurrency. The move came as ZEC hit an eight-year high, flipping Monero (XMR) after a 45% weekly rally that defied the broader market downturn. Momentum followed renewed buzz from Arthur Hayes’ $10,000 price call, with social FOMO and liquidations driving additional upside. According to Nansen, the number of ZEC holders surged 63% in a week, even as whales took profits, highlighting a major shift toward retail participation.

ZEC’s weekly price action and holder distribution. Source: Nansen

ZEC’s weekly price action and holder distribution. Source: NansenZcash’s 500% October rally has been fueled by high-profile endorsements from figures like Naval Ravikant and Mert Mumtaz, along with over $65 million in short liquidations that triggered a cascading short squeeze. However, technical indicators suggest the rally may be due for a cooldown: analysts point to a rising wedge pattern with resistance near $450, which could precede a 30% correction toward $260–$270 in November if momentum fades. Despite the warning signs, search activity and trading volumes remain elevated, signaling that retail interest in privacy assets is far from exhausted.

ZEC total liquidation chart. Source: CoinGlass

ZEC total liquidation chart. Source: CoinGlassAmid the surge, Electric Coin Company (ECC) released its Q4 2025 roadmap, focusing on enhanced privacy tools and usability for its Zashi wallet. New features include ephemeral addresses for every swap using the NEAR Intents protocol, better Keystone hardware support, and multisig improvements for developer-fund security. Zcash’s shielded supply recently surpassed 4.1 million ZEC, underscoring accelerating adoption of its Orchard privacy layer. With the halving behind it and its technology stack evolving, Zcash is solidifying its position not only as a market-leading privacy asset but as one of crypto’s most active development ecosystems.

3. Solana

Solana is a smart contract platform known for its distinctive architecture, enabling it to handle thousands of transactions per second while maintaining very low costs. It accomplishes this by using a combination of a unique Proof-of-History algorithm and a Proof-of-Stake consensus mechanism. SOL, the native cryptocurrency of the platform, is one of the cheapest to transfer, with users typically paying less than $0.001 per transaction.

Founded in 2018 by Anatoly Yakovenko, Solana’s mainnet went live in March 2020 and experienced a surge in adoption throughout 2021. Despite a significant drop in value during the 2022 bear market, Solana remains one of the most robust ecosystems in the cryptocurrency space and continues to be seen as a potential candidate for significant future growth.

Why Solana?

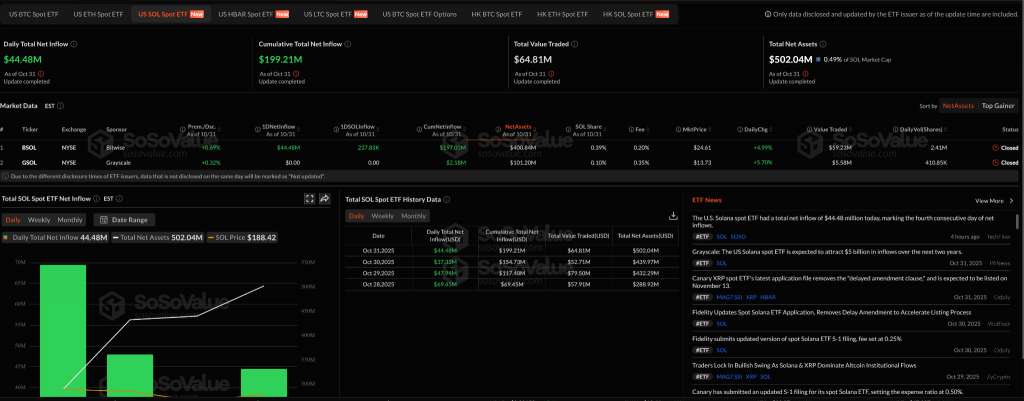

Solana dropped 12.3% this week to $175.79, bringing its market capitalization to $97.07 billion, even as it saw continued demand from institutional investors. According to SoSoValue, spot Solana ETFs recorded $44.5 million in inflows on Friday, marking their fourth consecutive day of gains and bringing total assets to more than $500 million. The Bitwise Solana ETF (BSOL) led the trend, boosted by a 7% staking yield and growing attention from investors rotating capital out of Bitcoin and Ether funds. Kronos Research’s Vincent Liu described the move as a “capital rotation” phase, as traders seek exposure to newer narratives and staking opportunities while major assets consolidate.

Solana ETF inflows. Source: SoSoValue

Solana ETF inflows. Source: SoSoValueInstitutional optimism around Solana remains strong. Bitwise CIO Matt Hougan said Solana offers investors “two ways to win” — by betting on both the expansion of the stablecoin and tokenization markets and Solana’s rising share of those sectors. He expects the blockchain to become a preferred network for stablecoin settlements and tokenized assets, citing its speed, cost-efficiency, and developer-driven ecosystem. Hougan also pointed to growing adoption, including Western Union’s decision to build a stablecoin settlement system on Solana, as proof of the network’s traction with traditional financial players.

Still, analysts note that Solana’s price decline reflects profit-taking after months of strong gains rather than fundamental weakness. Ethereum continues to dominate by overall network value, with over $85 billion in TVL and $163 billion in stablecoins, while Solana trails with $11.3 billion in TVL and $14.9 billion in stablecoins. Yet, the ongoing ETF inflows, institutional partnerships, and staking-driven demand suggest that Solana’s long-term outlook remains intact — even as short-term volatility pressures price action in the near term.

4. Hyperliquid

Hyperliquid is a decentralized perpetual futures exchange built to rival centralized trading platforms in speed, liquidity, and user experience—all while remaining fully on-chain. Unlike traditional DEXs that often struggle with performance bottlenecks, Hyperliquid uses a custom high-performance layer-1 blockchain specifically optimized for trading. This allows it to offer ultra-low latency, high throughput, and a seamless trading experience without relying on external validators or rollups.

One of Hyperliquid’s key innovations is its order book-based model, which is uncommon among decentralized platforms. While many DEXs use automated market makers (AMMs), Hyperliquid implements a central limit order book (CLOB), giving traders more control over order execution and tighter spreads. This design makes it particularly appealing to professional and high-frequency traders who expect the responsiveness of centralized exchanges but want the trustlessness of DeFi. Its deep liquidity pools and tight integration with crypto-native assets further enhance its trading dynamics.

Why Hyperliquid?

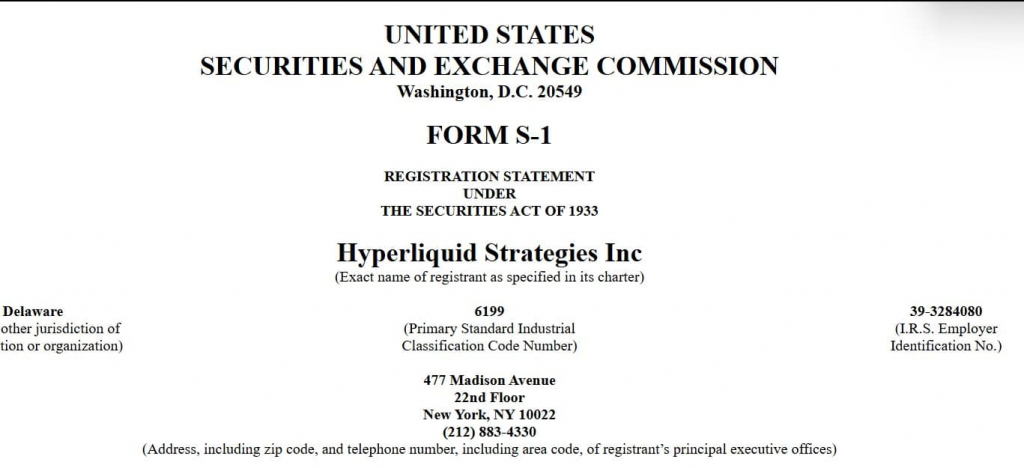

Hyperliquid rallied 22.5% this week to $47.07, lifting its market capitalization to $15.86 billion and marking one of the strongest performances among large-cap DeFi tokens. The jump followed confirmation that Hyperliquid Strategies, the merger entity formed by Sonnet BioTherapeutics and Rorschach I LLC, has filed to raise $1 billion to expand its treasury and purchase more HYPE tokens. Once completed, the merged company is expected to hold 12.6 million HYPE—worth roughly $470 million—plus another $305 million earmarked for future accumulation. The move positions Hyperliquid Strategies as the largest corporate HYPE holder, signaling growing institutional interest in DeFi-native assets beyond Bitcoin and Ethereum.

Hyperliquid Strategies’ planned equity raise. Source: SEC

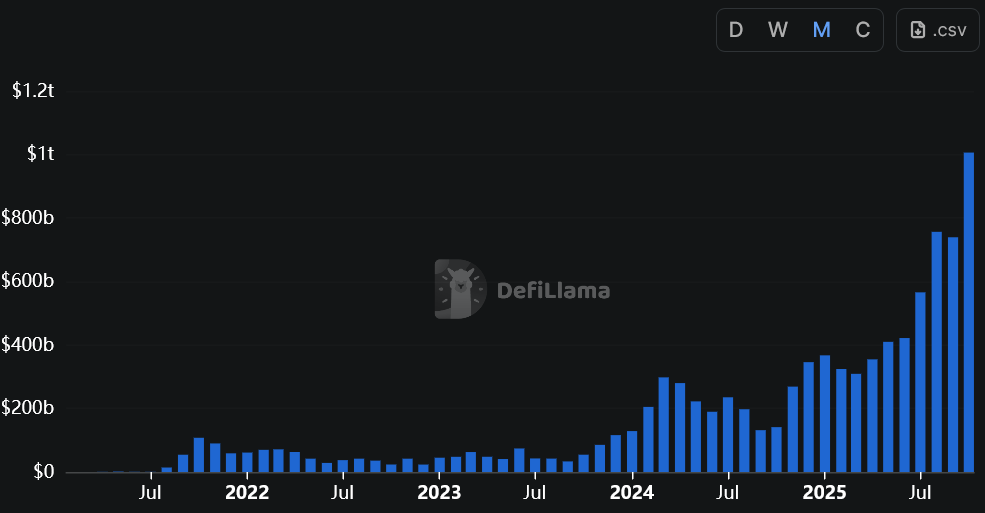

Hyperliquid Strategies’ planned equity raise. Source: SECAt the same time, the decentralized perpetuals market crossed a record $1 trillion in October trading volume, with Hyperliquid leading all platforms at $317.6 billion, according to DefiLlama data. Rivals Lighter, Aster, and edgeX followed at $255 billion, $177 billion, and $134 billion respectively, highlighting a broader boom in decentralized derivatives. Analysts attribute this surge to the appeal of perpetual swaps—24/7 markets with leverage, no expirations, and flexible long/short exposure—which have drawn speculative traders away from centralized exchanges. Infinex founder Kain Warwick described Hyperliquid as the “first DeFi perp exchange to truly get it right,” adding that MetaMask’s recent integration with Hyperliquid will further boost accessibility and adoption.

Monthly decentralized perps volume since 2021. Source: DefiLlama

Monthly decentralized perps volume since 2021. Source: DefiLlamaOn the technical side, HYPE confirmed a bullish breakout from a multi-week falling wedge pattern, extending gains following its listing on Robinhood. The token reclaimed its 200-day EMA near $38, establishing a strong support base, and now targets an upside move toward $56.50—a potential 40% rally by November if momentum persists. Analysts, including Crypto Patel, see $50–$56 as the next resistance zone, while a dip below the $38 support could invalidate the setup and trigger a retest of the $32–$34 range. Despite short-term volatility, sentiment around Hyperliquid remains strongly bullish, underpinned by institutional inflows, surging platform activity, and expanding exchange accessibility.

HYPE/USDT daily breakout structure. Source: TradingView / bitcoinwallah

HYPE/USDT daily breakout structure. Source: TradingView / bitcoinwallah5. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

Ethereum slipped 2.9% this week to around $4,038, with a market capitalization of $475.6 billion. Debate within the community intensified after core developer Federico Carrone warned that venture fund Paradigm’s growing influence could pose a “tail risk” to the network’s decentralized ethos. Carrone argued that while Paradigm’s hiring of key researchers and funding of open-source Ethereum tools have been valuable, its profit-driven incentives may eventually create misalignment with the community’s long-term goals. The concern follows Paradigm’s partnership with Stripe to incubate Tempo, a payments-focused layer-1 blockchain described as a corporate-controlled alternative to Ethereum’s open model.

I hope that someday @a16z and @foundersfund crypto branches hire some capable degens tech people that understand politics and which projects to lead to be able to counterbalance paradigm. These funds are very good in web2 but I don’t think they fully understand crypto, how…

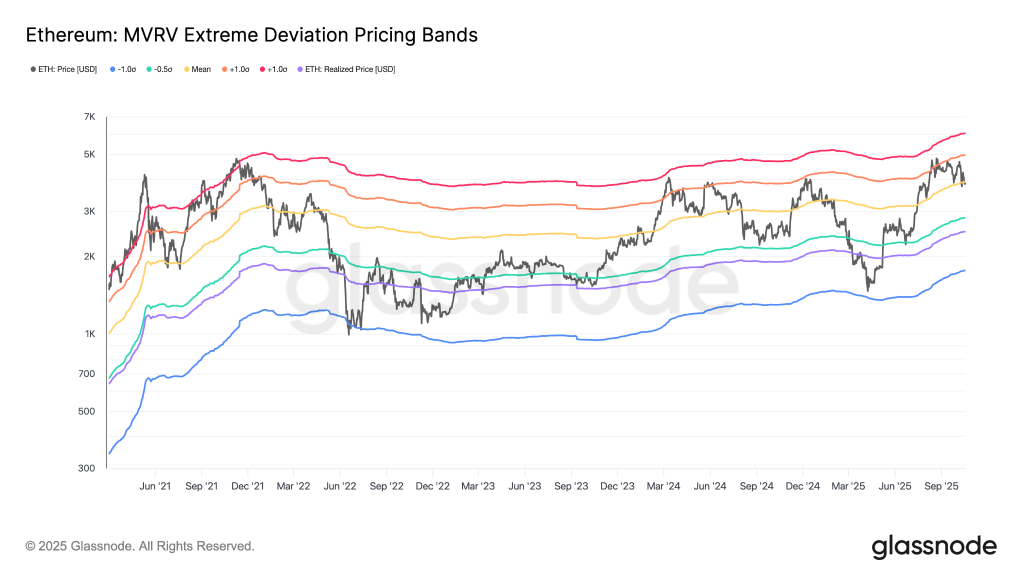

— Fede’s intern 🥊 (@fede_intern) October 19, 2025Meanwhile, Ethereum’s technical structure remains bullish despite recent volatility. ETH rebounded sharply from its two-month low near $3,435, forming what analysts identify as a bull-flag continuation pattern. The 200-day exponential moving average near $3,550 has acted as reliable support, while momentum indicators suggest potential upside toward $4,500–$5,000 in October if the pattern confirms. On-chain MVRV deviation data from Glassnode further reinforces the setup, showing ETH consolidating around its mean band near $3,900—a level that historically precedes major rallies within bull cycles.

Ethereum price structure and MVRV data. Source: Glassnode

Ethereum price structure and MVRV data. Source: GlassnodeAdding to the positive sentiment, BitMine Immersion Technologies, chaired by Fundstrat’s Tom Lee, has accumulated roughly 379,000 ETH worth $1.5 billion since the recent market crash. The purchases, made in three tranches, bring BitMine’s total holdings to over 3 million ETH, representing 2.5% of supply. Lee remains bullish on Ethereum’s long-term potential, comparing its trajectory to how “Wall Street and equities flipped gold post-1971.” While he acknowledged that the digital-asset-treasury (DAT) bubble may be cooling, Lee believes ETH’s fundamentals remain intact as leveraged positions reset. Analysts note that these large-scale buys could underpin Ethereum’s resilience as it eyes the next breakout toward the mid-$4,000 range.

6. XRP

XRP is a digital cryptocurrency that was created by Ripple Labs in 2012. It is used as a means of payment and transfer of value on the Ripple payment protocol, which is designed to enable fast and secure transactions between financial institutions as well as individuals.

XRP is unique in that it is not based on the blockchain technology used by many other cryptocurrencies. Instead, it uses a distributed consensus ledger called the XRP Ledger, which is maintained by a network of validators. This allows for faster transaction processing times and lower fees compared to traditional payment methods.

XRP has been popular among cryptocurrency traders and investors due to its high liquidity and clear potential for broader adoption, especially as a remittance solution. However, it has also been the subject of controversy and legal action, with US regulators alleging that it is a security and should thus be subjected to securities regulations. This has somewhat hindered the potential of XRP as an investment, and handcuffed Ripple’s growth as a company.

Why XRP?

XRP fell 5.7% this week to $2.47, bringing its market capitalization to about $147.9 billion, as Ripple ramped up its corporate expansion with a $1 billion acquisition of GTreasury, a treasury management firm. The deal, Ripple’s third major purchase of 2025, gives it infrastructure to manage digital assets for corporate treasuries — including stablecoins and tokenized deposits — and strengthens its cross-border payment network. CEO Brad Garlinghouse said the move aims to solve “slow, outdated payment systems” and position Ripple as a direct challenger to SWIFT, underscoring its ambition to bridge traditional and blockchain finance.

Today, Ripple is breaking into the $120T corporate treasury payments market with the $1B acquisition of GTreasury.

The past few years have reminded this industry why payments, first and foremost, is THE primary use case for crypto and blockchain. Payments are where Ripple first…

At the same time, Ripple is reportedly planning a $1 billion XRP buyback through a special purpose acquisition company (SPAC) to build a new digital asset treasury (DAT). The plan would make Ripple the largest corporate holder of XRP, adding to its existing 4.5 billion tokens in circulation and another 37 billion locked in escrow. The company’s growing footprint in corporate finance — alongside partnerships with BBVA, Franklin Templeton, and DBS Bank — highlights a broader strategy to position XRP as a settlement and treasury asset for institutions. However, market response has been muted so far, with traders awaiting confirmation of the buyback’s terms and timing.

Despite the bold moves, XRP’s price dropped nearly 9% on the buyback news, extending its correction from October highs. The token continues to trade within a falling wedge pattern, with support near $2 acting as a potential reversal zone. A breakout above the $2.75 level could trigger short liquidations and open the path toward $3, while holding above $2 keeps the long-term ascending triangle pattern intact. Analysts maintain that as long as XRP preserves this structure, a medium-term recovery toward $3.50–$7.75 remains plausible into early 2026 — contingent on Ripple’s execution of its treasury and institutional strategy.

XRP/USDT technical setup showing wedge and triangle structures. Source: TradingView / Cointelegraph

XRP/USDT technical setup showing wedge and triangle structures. Source: TradingView / Cointelegraph7. BNB

BNB (formerly Binance Coin) is a cryptocurrency created by the popular cryptocurrency exchange Binance. Binance is the largest cryptocurrency exchange in the world, allowing users to buy, sell, and trade a wide range of digital assets.

BNB was initially one of the ERC-20 tokens on the Ethereum blockchain but has since migrated to its own blockchain, known as BNB Chain. BNB is used as a utility token within the Binance ecosystem and has a variety of use cases. For example, users can use BNB to pay for transaction fees on the Binance exchange, receive discounts on trading fees, participate in token sales on Binance Launchpad, and purchase goods and services from merchants that accept BNB as payment.

One of the unique features of BNB is that it has a deflationary model. Binance uses a part of its profits each quarter to buy back and burn BNB tokens, reducing the total supply of the token over time. This mechanism is designed to create scarcity and increase the value of BNB over time, with the end goal of reducing the circulating supply of BNB from the initial 200 million to 100 million BNB.

Why BNB?

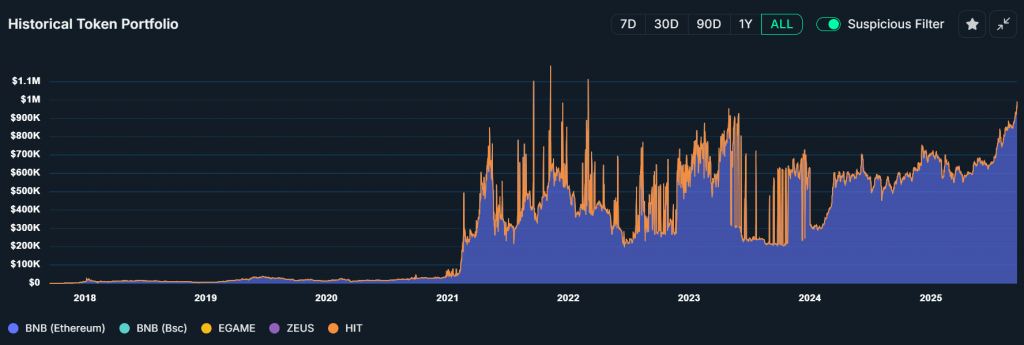

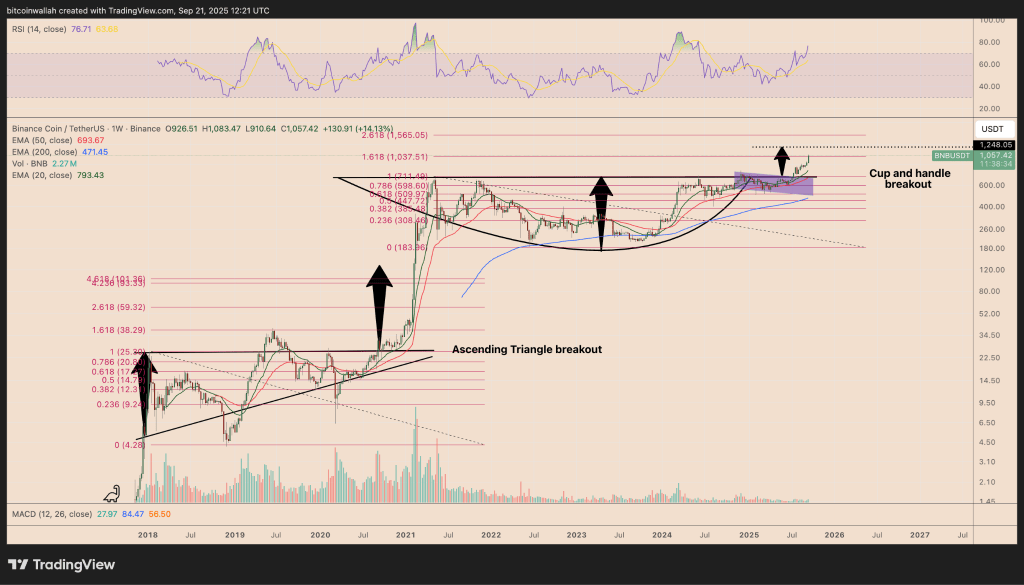

BNB has remained into four-digit territory despite falling by 2% in the past week to trade at $1,006. The price surge was driven by a mix of long-term investor sentiment and bullish onchain signals. One standout story came from a “diamond hand” holder who turned a $1,000 BNB purchase in 2017 into a $1 million unrealized profit — and continues to hold. Meanwhile, traders are pointing to breakout patterns that could propel BNB to as high as $1,250–$1,565 by year-end.

Token returns of the “0x850” wallet. Source: Nansen

Token returns of the “0x850” wallet. Source: NansenOn a technical level, BNB recently cleared the key 1.618 Fibonacci level near $1,037 and has flipped it into support. Analysts are now watching for a continuation of the rally, with the token potentially eyeing the 2.618 Fib level at $1,565. Despite short-term RSI overbought signals, onchain data like Net Unrealized Profit/Loss (NUPL) shows sentiment leaning bullish — a setup that last occurred during the early stages of the 2020–2021 bull run.

Weekly BNB/USD price chart. Source: bitcoinwallah/TradingView

Weekly BNB/USD price chart. Source: bitcoinwallah/TradingViewThe fundamentals behind BNB also appear strong. Utility on the Binance exchange remains a core driver, while broader institutional interest in high-quality altcoins is picking up. Trading volume recently hit $3.28 billion, and long-short ratios continue to favor the bulls. BNB’s resilience and unique position as both an exchange token and DeFi asset contribute to its growing narrative as one of the cycle’s top performers.

In the short term, analysts see $970 as a key support level that could spark a bounce toward $1,150 if retested. As the year progresses, the confluence of technical patterns, onchain optimism, and real-world use cases may keep BNB on a strong upward trajectory — even if price discovery includes intermittent pullbacks.

8. Monero

Monero is a privacy-focused cryptocurrency designed to offer anonymous and untraceable transactions. Launched in 2014 as a fork of Bytecoin, Monero was introduced through a whitepaper written by the pseudonymous “Nicolas van Saberhagen.” Unlike Bitcoin or Ethereum, Monero conceals sender and receiver identities, as well as transaction amounts, through advanced cryptographic techniques such as stealth addresses and ring signatures. This strong focus on privacy has made Monero a favorite among users seeking true financial confidentiality.

Monero runs on a Proof-of-Work (PoW) consensus mechanism and is deliberately resistant to ASIC mining to support decentralization. It can be mined efficiently using consumer-grade hardware, and its privacy-preserving features also improve fungibility—individual XMR coins are indistinguishable from one another and can’t be blacklisted. Despite its strong standing within the crypto community, Monero has been the subject of regulatory scrutiny due to concerns over its potential use in illicit activities. Nonetheless, it remains the most widely adopted privacy coin in the market today.

Why Monero?

Monero rallied over 7% this week despite facing one of the largest security incidents in its history. On Sunday, the privacy-focused network experienced an 18-block reorganization that reversed 117 transactions—an event triggered by Qubic, a layer-1 AI blockchain that had previously amassed over 51% of Monero’s hashrate. The attack renewed long-standing concerns about Monero’s vulnerability to 51% attacks and the structural risks of low-hashrate proof-of-work networks.

Notably, the price of XMR barely reacted during the reorg, then spiked from $287.54 to $308.55 just hours later, bucking broader market weakness. Some community members speculated that Qubic may have engineered the event to prevent further price drops, although this remains unconfirmed.

The incident has intensified internal debates around Monero’s decentralization model. Developers are now weighing temporary centralization measures like DNS checkpoints to prevent deep reorganizations in the future. Others have floated longer-term changes such as transitioning to merge mining or integrating ChainLocks—a technique used by Dash to mitigate similar threats.

While Monero has historically been seen as the gold standard among privacy coins, this second major reorg in a month has sparked public skepticism. Prominent developers and community members are now calling for urgent consensus changes, warning that failure to act could undermine Monero’s reliability as a censorship-resistant payments network.

Despite the network instability, Monero has held up relatively well price-wise since July, down less than 6% over that period even as hash rate centralization worsened. The resilience highlights a loyal user base but also the precarious balance the network must now strike between decentralization and security.

9. Ethena

Ethena is a protocol built on the Ethereum blockchain that issues a synthetic dollar known as USDe, along with a yield-bearing counterpart called sUSDe. The stability of USDe is maintained through the protocol’s strategy of hedging its collateral with futures contracts.

By aligning the size of these hedges with the price exposure of the underlying assets, Ethena reduces the effects of market volatility as losses or gains in the assets are generally offset by opposite movements in the hedge.

This mechanism helps ensure that the collateral’s synthetic USD value remains relatively stable, even in shifting market conditions.

Why Ethena?

ENA is positioned to benefit from the growing trend of crypto-focused treasuries. TLGY Acquisition Corp. and StablecoinX Assets Inc., which plan to merge and debut on Nasdaq under the StablecoinX (USDE) name, have secured a fresh $530 million PIPE round, raising their total funding to $890 million.

The round attracted investors such as YZi Labs, Brevan Howard, Susquehanna Crypto, IMC Trading, and existing backers.

StablecoinX Inc. @stablecoin_x has announced an additional $530 million capital raise as part of its $ENA accumulation strategy.

To date, StablecoinX has raised a total of approximately $895M in PIPE financing, which is expected to result in a vehicle with over 3 billion ENA… pic.twitter.com/pdkl1D8u5x

The capital will be used to purchase locked ENA tokens, Ethena’s native asset, from a subsidiary of the Ethena Foundation. Proceeds from this sale will be reinvested into spot ENA purchases. StablecoinX already holds 7.3% of ENA’s circulating supply and intends to grow that share to 13% with the new financing. The tokens will remain locked, with any potential sales after the SPAC merger requiring Ethena’s approval to avoid excess market pressure.

According to CEO Young Cho, the strategy enables StablecoinX to establish a long-term ENA position while providing investors with transparent exposure to the Ethena ecosystem.

The announcement has fueled strong momentum in ENA markets. The token has climbed 21% against the U.S. dollar over the past week, though it still trades about 49% below its $1.51 all-time high—suggesting there could be considerable room for further upside.

10. Cardano

Cardano is a decentralized proof-of-stake blockchain platform that aims to offer a more sustainable and scalable infrastructure for smart contracts and decentralized applications (dApps). It was launched in 2017 by Input Output (IOHK), co-founded by Charles Hoskinson, one of the original creators of Ethereum. Cardano stands out for its strong academic roots, with its protocol development guided by peer-reviewed research and formal verification methods.

Unlike proof-of-work systems like Bitcoin, Cardano uses a unique proof-of-stake consensus mechanism called Ouroboros, which allows it to achieve network security and decentralization with significantly lower energy consumption. ADA, the native cryptocurrency of Cardano, is used for staking, paying transaction fees, and participating in governance.

Cardano’s development is organized into multiple phases, focusing on areas such as decentralization, scalability, and interoperability. Its layered architecture separates settlement and computation, making it easier to upgrade and maintain. The platform supports smart contracts through its Plutus framework and is actively expanding its DeFi and NFT ecosystems.

Why Cardano?

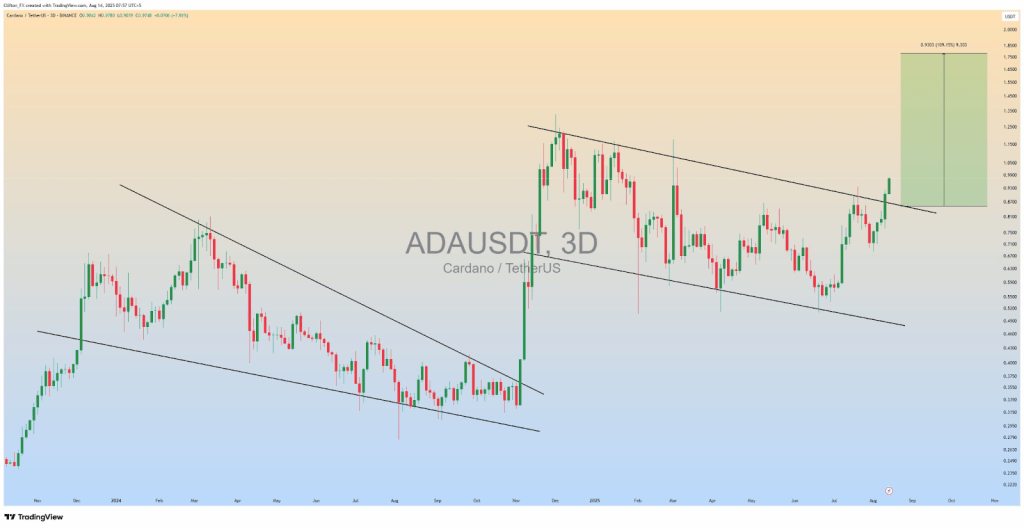

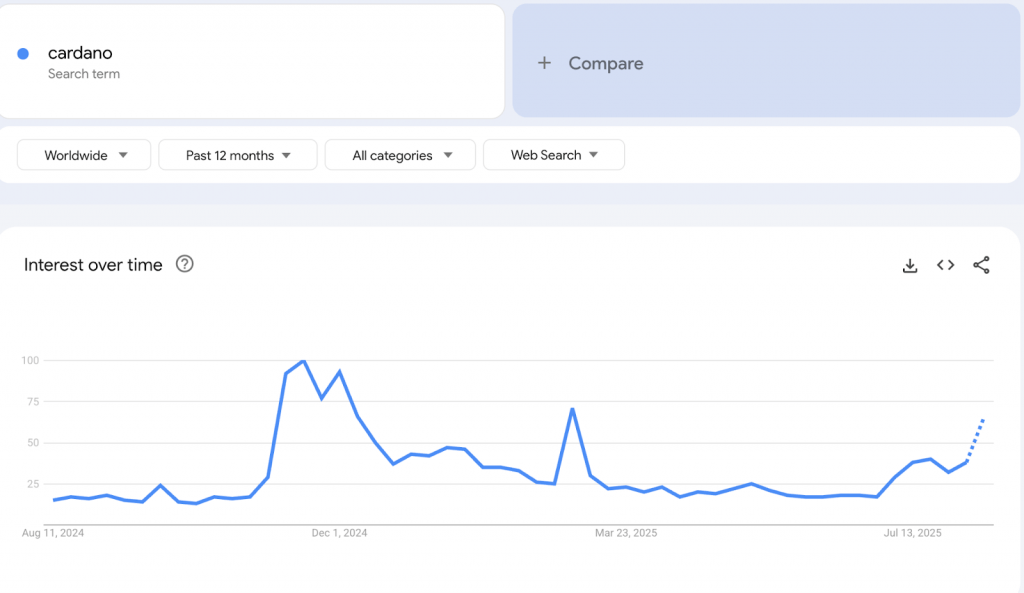

Cardano surged nearly 11% over the past week, briefly breaking above $0.97 and reaching a five-month high. The move comes amid strong altcoin momentum, with ADA outperforming much of the market as capital rotated out of Bitcoin and Ethereum following their respective highs. ADA has traded in a tight range recently, but technical analysts are eyeing a confirmed breakout above resistance as a setup for an extended rally.

Chart watchers have flagged a multi-month bull flag breakout pattern on Cardano’s three-day chart. If the move holds, projections by Clifton Fx suggest the token could gain as much as 150% in the coming weeks, potentially targeting the $1.60–$1.75 range. Trader sentiment is being reinforced by on-chain data showing over 15 billion ADA — roughly 45% of total supply — has remained unmoved for more than a year, signaling long-term conviction. Retail interest is also on the rise, with Google Trends data showing “Cardano” searches at a five-month high.

Cardano’s latest rally also comes after Grayscale registered a “Grayscale Cardano Trust ETF” entity in Delaware — a move that typically precedes an S-1 filing with the SEC. While no official filing has yet been submitted, such developments hint at increasing institutional attention toward ADA. If approved, a Cardano ETF could help boost demand further, particularly among U.S.-based investors.

Adding to the week’s activity was the Glacier Drop airdrop, which distributed NIGHT tokens across eight chains including Cardano. Despite initial technical hurdles for Ledger users, the issue was quickly resolved, allowing Cardano to reclaim a spot in the top 10 cryptos by market cap and surpass Tron. ADA is now one of the biggest gainers both daily and weekly, with analysts watching closely for a potential run toward the $1.30–$1.60 region if momentum continues.

11. LayerZero

LayerZero is an interoperability protocol built to connect different blockchains in a secure, seamless manner. It enables decentralized applications (DApps) to interact across multiple blockchains without relying on traditional, often risky, bridging methods.

Its technology allows developers to create “omnichain” applications that work across various blockchain ecosystems while maintaining strong security and decentralization. By using ultra-light nodes and a unique message-passing system, LayerZero supports trustless cross-chain communication.

As the blockchain space becomes increasingly fragmented, LayerZero’s capacity to unify networks positions it as a key infrastructure project. Its integration into major DeFi and NFT ecosystems has further strengthened its reputation as one of the top interoperability solutions.

Why LayerZero?

LayerZero’s ZRO token could be one to watch this week following the LayerZero Foundation’s $110 million proposal to acquire the Stargate protocol.

— LayerZero (@LayerZero_Core) August 10, 2025The plan involves swapping Stargate’s STG tokens for ZRO at a fixed exchange rate. If approved, the move could bring the two projects closer together under a unified platform. The announcement already sparked a surge in ZRO’s price — up 27% in 24 hours and 39.3% over the past week.

By regaining control of Stargate, LayerZero aims to accelerate its development and expand its use cases beyond bridging, potentially increasing the value proposition of the ZRO token.

While some STG holders have voiced concerns about the fairness of the exchange ratio, the market’s reaction has been largely positive, as traders anticipate the deal’s approval.

The coming days will be pivotal as Stargate’s community discusses and votes on the proposal. If it passes, ZRO could see further upside, making it a coin worth monitoring closely.

12. Kaia

Kaia is a high-performance Layer 1 blockchain designed for speed, scalability, and seamless cross-chain interaction. Initially launched as part of the Klaytn ecosystem, Kaia emerged in 2024 following a strategic merger between Klaytn and Finschia—two major blockchain platforms backed by Korean tech giants Kakao and LINE, respectively. The goal behind Kaia is to create a unified infrastructure optimized for mass adoption in both Web2 and Web3 environments, particularly across Asia.

Kaia uses a Delegated Proof-of-Stake (DPoS) consensus mechanism that enables fast block times and low transaction fees, making it well-suited for high-throughput applications like gaming, NFTs, and consumer-facing dApps. Its architecture supports EVM compatibility, allowing developers to easily deploy existing Ethereum-based smart contracts with minimal adjustments.

One of Kaia’s core features is its strong emphasis on interoperability and regional adoption. The chain is built to connect various blockchain ecosystems while also partnering with enterprise players and public institutions to drive real-world use cases. Kaia’s governance is handled by the Kaia Council, a group of ecosystem partners responsible for key protocol decisions and treasury management.

Still in the early stages of expansion, Kaia is gaining attention for its steady price growth and rising on-chain activity. With strong backing, technical flexibility, and a focus on real-world integrations, it aims to become a major player in the next phase of blockchain adoption.

Why Kaia?

Kaia has surged from roughly $0.15 to $0.20 and is currently trading around $0.19. That’s about a 33% move in days, putting Kaia on the radar as one of the fastest-rising mid-cap tokens right now.

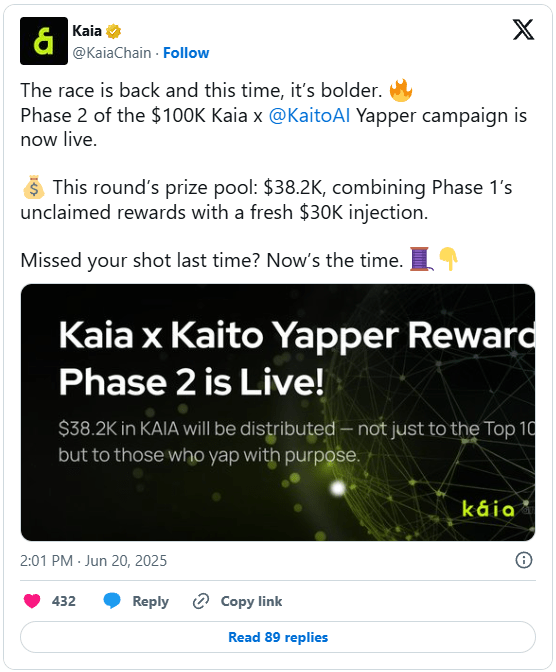

The rally gained a boost from Phase 2 of the $100K Kaia × KaitoAI Yapper campaign, which just kicked off. The campaign adds $38,200 in rewards—combining leftover funds from Phase 1 with a new $30K injection.

Technically, Kaia broke through resistance around $0.17–$0.18, clearing the 50-day and 200-day averages on solid volume. Its RSI is climbing but not overheated, suggesting room for another leg up. Analysts point to bullish chart patterns, with possible targets up to $0.26–$0.30 if the rally continues.

On-chain activity supports the move too: Kaia’s TVL has jumped nearly 50% in the past 30 days to about $121 million, while stablecoin supply on its network rose to $41 million. These metrics show developers and users are engaging more, an encouraging sign for Kaia’s growth story.

Best cryptocurrencies to buy at a glance

| Native Asset | Launched In | Description | Market Cap* | |

| Bitcoin | BTC | 2009 | A P2P open-source digital currency | $2.30T |

| Zcash | ZEC | 2016 | Privacy-focused cryptocurrency | $5.82 bln |

| Solana | SOL | 2020 | Smart contracts platform with high speeds and low fees | $110 bln |

| Hyperliquid | HYPE | 2024 | Decentralized perpetuals exchange with an efficient order book | $15.97 bln |

| Ethereum | ETH | 2015 | The leading DeFi and smart contract platform | $502 bln |

| XRP | XRP | 2012 | The leading crypto remittance solution | $158 bln |

| BNB | BNB | 2017 | The native coin of the Binance exchange | $161 bln |

| Monero | XMR | 2014 | A privacy-first cryptocurrency with fully obfuscated transactions | $6.31 bln |

| Ethena | ENA | 2024 | Ethereum-based stablecoin protocol | $3.62 bln |

| Cardano | ADA | 2017 | Peer-reviewed blockchain built for smart contracts | $24.3 bln |

| LayerZero | ZRO | 2024 | One of the best blockchain interoperability protocols | $353 mln |

| Kaia | KAIA | 2024 | A fast-growing L1 chain designed for high performance | $686 mln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and, thus, losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $500 million as of spring of 2025)

- The crypto asset is available for trading on the best crypto exchange platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

Best crypto for long-term

When deciding which cryptocurrency to buy for the long term, it’s important to consider projects that are well-established, have a strong community, are highly liquid, have a large market cap, and have a clear reason for existing (such as solving a real-life problem, introducing new functionality, etc.). Without these characteristics, a project might fail to survive in the long term, rendering it a bad long-term investment.

It is worth noting that, typically, most long-term crypto investors are looking for projects that have the potential to generate decent returns but also provide a degree of investment stability. Roughly speaking, only the largest cryptocurrencies fit the bill, as others have a low market cap and liquidity that doesn’t bode well for a long-term commitment (unless you’re prepared to take on more risk).

In addition to Bitcoin and Ethereum, there are a number of other cryptocurrencies that fit the criteria of being low-risk, long-term crypto investments.

If you are planning to hold onto your digital assets for a longer period of time, it is best to take care of crypto custody yourself. Holding large amounts of crypto on an exchange can be risky, as we’ve seen over the years with the collapse of high-profile exchanges like Mt. Gox and FTX. Use one of the reputable crypto hardware wallets to store your crypto. Ledger hardware wallets, for instance, allow you to manage your crypto holdings easily and provide a much higher degree of security than crypto exchanges or even software crypto wallets.

Best place to buy crypto

One crucial aspect to consider when choosing which platform to use to buy crypto is the range of cryptocurrencies and trading pairs available. Since different exchanges support varying digital assets, it’s important to choose a platform that accommodates the specific cryptocurrencies you intend to trade.

Additionally, assessing an exchange’s liquidity and trading volume is essential. Higher liquidity generally results in improved price stability and faster trade executions. Furthermore, it is prudent to examine the fees charged by the exchange, encompassing deposit, withdrawal, and trading fees. Comparing fee structures across different exchanges can help you identify the most cost-effective option that aligns with your trading style. With that said, here are some of the best exchanges on the market right now:

- Binance – The best cryptocurrency exchange overall

- KuCoin – The best exchange for altcoin trading

- Kraken – A centralized exchange with the best security

By diligently considering these factors, you can make an informed decision and select a cryptocurrency exchange that meets your requirements for security, variety, liquidity, and affordability.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

Purpose and Use Case

We consider the purpose and use case of cryptocurrency, particularly in a real-world setting. Some cryptocurrencies focus on specific industries or applications, such as decentralized finance, gaming, or supply chain management.

Team and Development

The team and people involved in the project can tell you a lot about the potential of a particular cryptocurrency project. We examine the team’s experience, expertise, and track record and evaluate the development activity and updates to ensure the project is actively maintained and evolving.

The bottom line: What crypto should you buy right now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

If you are looking for more investment ideas, check out our crypto price predictions section.

English (US) ·

English (US) ·