Key Notes

- Whales moved 1,800 BTC to Binance, driving sell-side pressure.

- Over $4B in realized profits suggests strategic exits amid price euphoria.

- Coin Days Destroyed spike signals long-dormant holders repositioning.

After reaching an all-time high of $123K in the past 24 hours, Bitcoin BTC $116 748 24h volatility: 4.6% Market cap: $2.32 T Vol. 24h: $70.83 B dropped to $117K amid a pullback following a massive 20,000 BTC sell-off by a Satoshi-era whale.

Glassnode revealed that BTC investors are now realizing their profits rapidly and this could be just the beginning.

$BTC declined nearly 5% as $3.5B in realized profits were taken. The 14 July edition of Market Pulse anticipated this risk.

By combining on-chain and off-chain indicators, we provide forward-looking context.

Here’s what signaled caution: 🧵👇 pic.twitter.com/FYXWMG6DHF

— glassnode (@glassnode) July 15, 2025

Bitcoin Sell-off Incoming?

In a post on X, Glassnode cited on-chain metrics, indicating that more than $3.5 billion in realized profits has entered the market in the past week, much of it flowing onto centralized exchanges. Major players are not only hedging but actively taking chips off the table.

Glassnode also confirmed that 98.9% of the circulating supply of BTC is currently in profit as the Net Unrealized Profit to Loss (NUPL) ratio had climbed into euphoria levels.

"The Net Unrealized Profit to Loss Ratio has risen significantly […], suggesting a potential state of market euphoria or elevated profit margins […] might signal an increased risk of profit- taking as investors capitalize on gains." pic.twitter.com/J2gmSYjuav

— glassnode (@glassnode) July 15, 2025

The Realized Profit to Loss Ratio had surged from 3.0 to 3.6, confirming that realized profits were far outpacing losses and suggesting a market in active profit-booking mode.

"The Realized Profit to Loss Ratio […] climbed from 3.0 to 3.6 […] high levels could also precede a cooling off if profit-taking increases."

This metric confirmed that realized profits were already dominating – and warned of a possible near-term cooling as a result. pic.twitter.com/fkXpx11whB

— glassnode (@glassnode) July 15, 2025

Uptick in Whale Activity on Binance

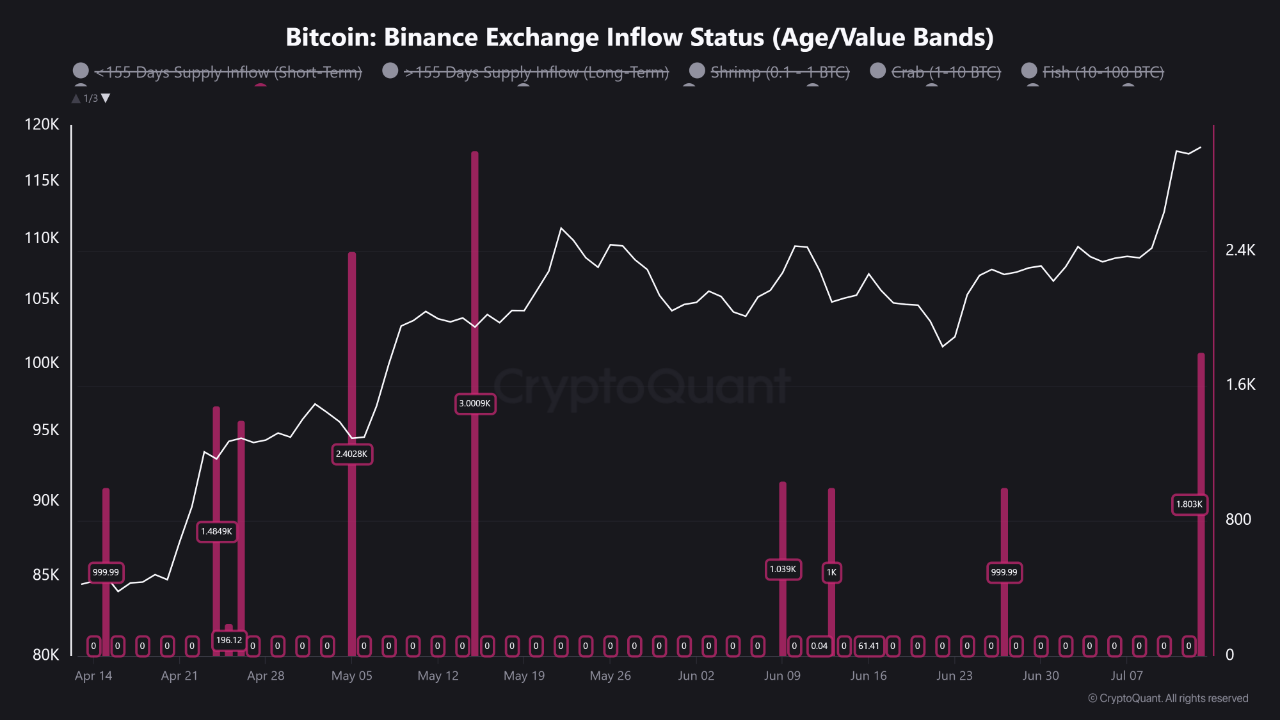

Also, analyst Crazzyblockk has highlighted a sharp uptick in Binance whale activity, with over 1,800 BTC, worth over $210 million at current prices, deposited in a single day. The move was dominated by transactions over $1 million, indicating coordinated, large-scale strategy shifts.

Binance Exchange Flow | Source: CryptoQuant

The coins are not new entrants. These are older, well-positioned coins being mobilized, signaling either profit-taking or leveraged speculation. With Binance accounting for over 25% of global spot volume, such whale-driven flows often precede sharp price moves as whales always time upcoming Binance listings.

CDD and NRPL Spike

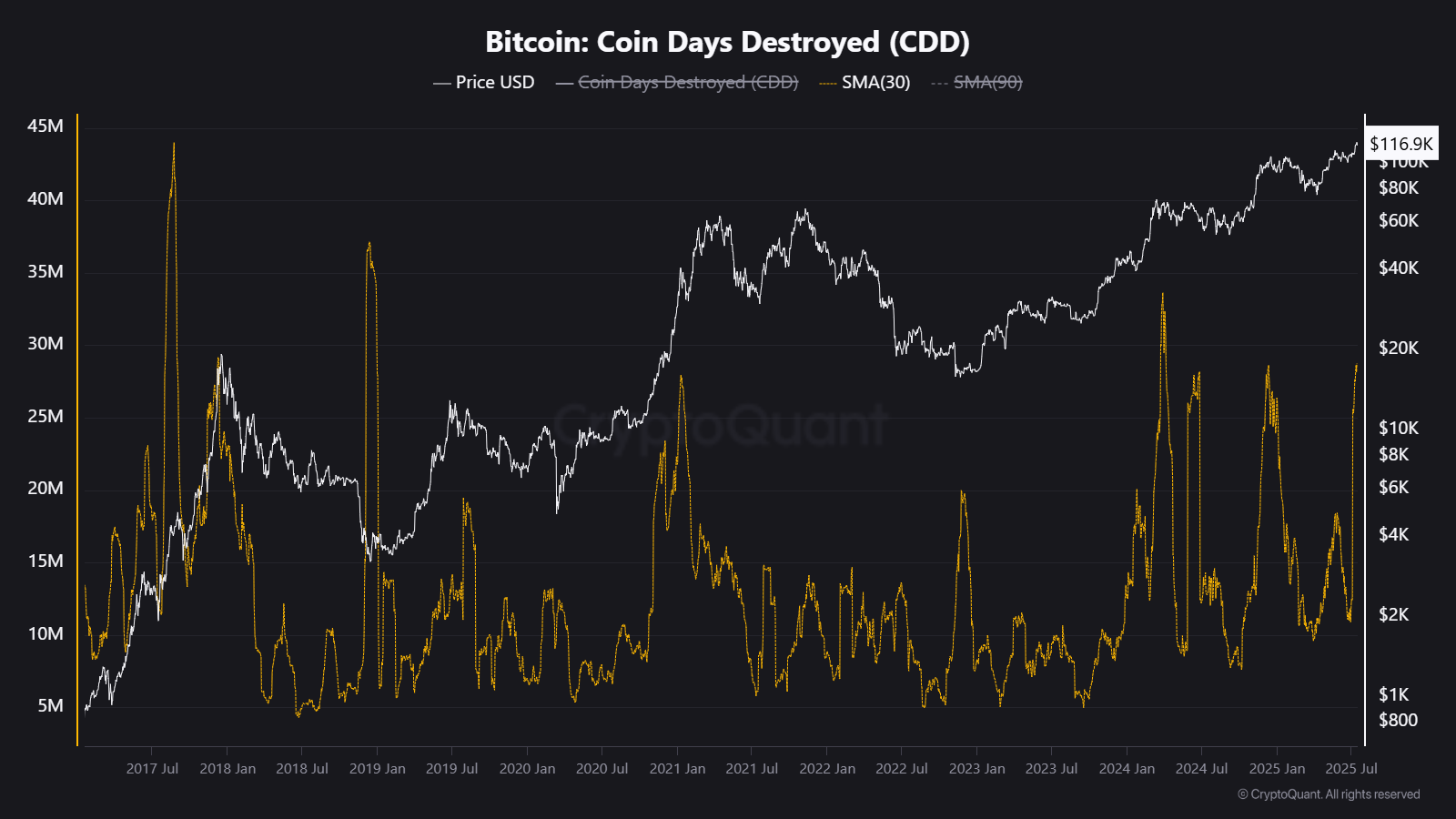

Analyst Kripto Mevsimi noted that Coin Days Destroyed (CDD) has jumped to 28 million, showing long-dormant BTC is now on the move.

Bitcoin Coin Days Destroyed | Source: CryptoQuant

On the other hand, the Net Realized Profit and Loss (NRPL) has crossed $4 billion, the highest in months. Unlike June’s mix of capitulation and modest profits, this wave is dominated by aggressive profit realization, with Bitcoin oddly steady above $117K.

Bitcoin Price Analysis: What’s Next for BTC?

Bitcoin is trading near $117,090, pulling back from its ATH of $123K. Key Fib support lies at $106,000, with deeper downside targets near $99,000. As long as BTC holds above $106K, the bullish structure remains intact.

BTC Daily Chart with Momentum Indicators | Source: TradingView

Momentum indicators suggest caution. The RSI is at 65.7, close to overbought. The MACD remains bullish but shows weakening momentum. The BOP has turned negative at -0.75, and CMF is positive at 0.08, indicating mild accumulation.

If selling pressure builds, BTC may retest $106K–$99K. A clear breakout above $120K could target $130K–$135K. For now, indicators hint at short-term cooling, even as the broader trend remains bullish.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.

English (US) ·

English (US) ·