Key Notes

- Long position closures drove ADA's decline, with open interest falling 9.48% and options volume dropping 92.94%.

- The $0.75 support level aligns with the 20-day Keltner Channel baseline and represents crucial technical defense.

- Holding above $0.75 could enable a recovery toward $1.00, while failure may trigger a slide to $0.70.

Cardano ADA $0.82 24h volatility: 7.0% Market cap: $29.56 B Vol. 24h: $1.68 B led losses in the altcoin market on July 23, tumbling 10.23% intraday to a low of $0.82. Behind Ripple XRP $3.22 24h volatility: 8.8% Market cap: $190.49 B Vol. 24h: $10.38 B , the token was the second biggest loser among the top 10 worst performers, as traders moved to lock in gains after ADA hit $0.93 for the first time in over four months earlier this week.

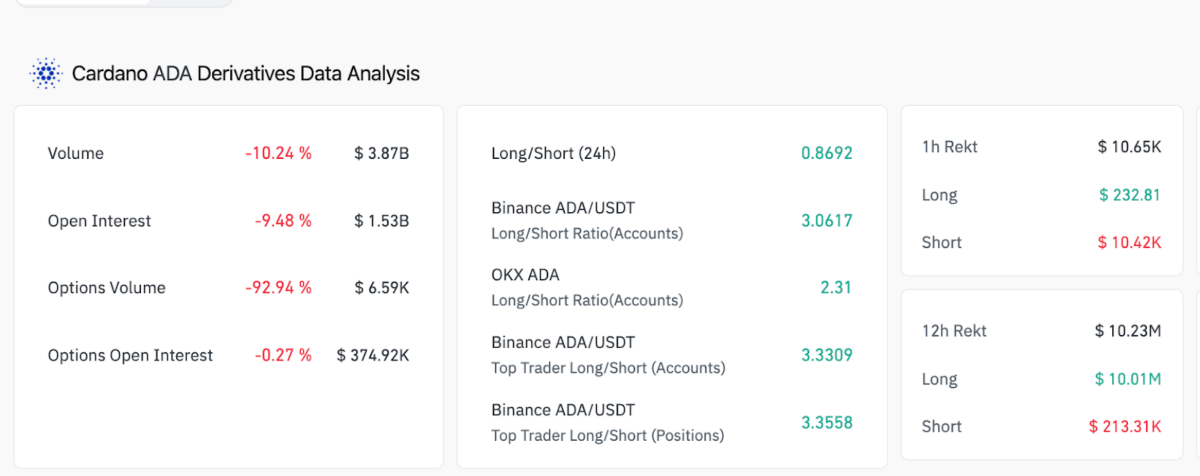

Cardano Derivatives Market Analysis | Source: Coinglass, July 23, 2025

Derivative trading metrics from Coinglass suggest Cardano traders were trimming long leverage exposure rather than flipping bearish.

The token’s open interest dropped by 9.48% to $1.53 billion, closely aligned with the intraday spot price correction. A steep 92.94% drop in options volume further confirms that the majority of the movement was driven by closed long positions, not fresh shorts.

ADA Price Prediction: Why ADA Must Hold $0.75 Support

From a technical standpoint, the $0.75 region represents critical support for bulls. It sits near the 20-day Keltner Channel baseline and coincides with a previously broken resistance level that ADA reclaimed earlier this month.

Losing this area would not only invalidate the recent breakout pattern but also risk triggering a cascade of long liquidations, as $10.2 million in longs were wiped in the past 12 hours.

Cardano (ADA) Price Prediction Chart

Traders who entered during ADA’s July breakout may now await a retest of key support levels, primarily near $0.75, as marked by the 20-day Keltner Channel midpoint. Maintaining this level could trigger renewed bullish interest, especially as the token remains above its 50-day moving average and the daily RSI cools near 63 after briefly entering overbought territory.

If ADA holds above $0.75 and volume stabilizes, bulls may regroup for a fresh attempt toward the $1.00 range. On the flip side, failure to hold support could see the token slide toward $0.70.

Best Wallet Gains Attention as ADA Traders Reassess Strategy

With ADA volatility rising, self-custody tools are back in focus. Best Wallet is emerging as a top choice for traders looking to preserve gains, access presales, and optimize staking rewards without relying on centralized platforms.

Best Wallet Presale

The wallet’s built-in token scanner, presale access tools, and gas fee optimizations make it particularly appealing to ADA holders seeking exposure to Cardano’s DeFi ecosystem.

Visit the official Best Wallet website to join the $BEST token presale today.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Cryptocurrency News, News, Price Prediction

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

English (US) ·

English (US) ·