Cardano, Celestia and dogwifhat are witnessing positive sentiment on social platforms as the broader crypto market.

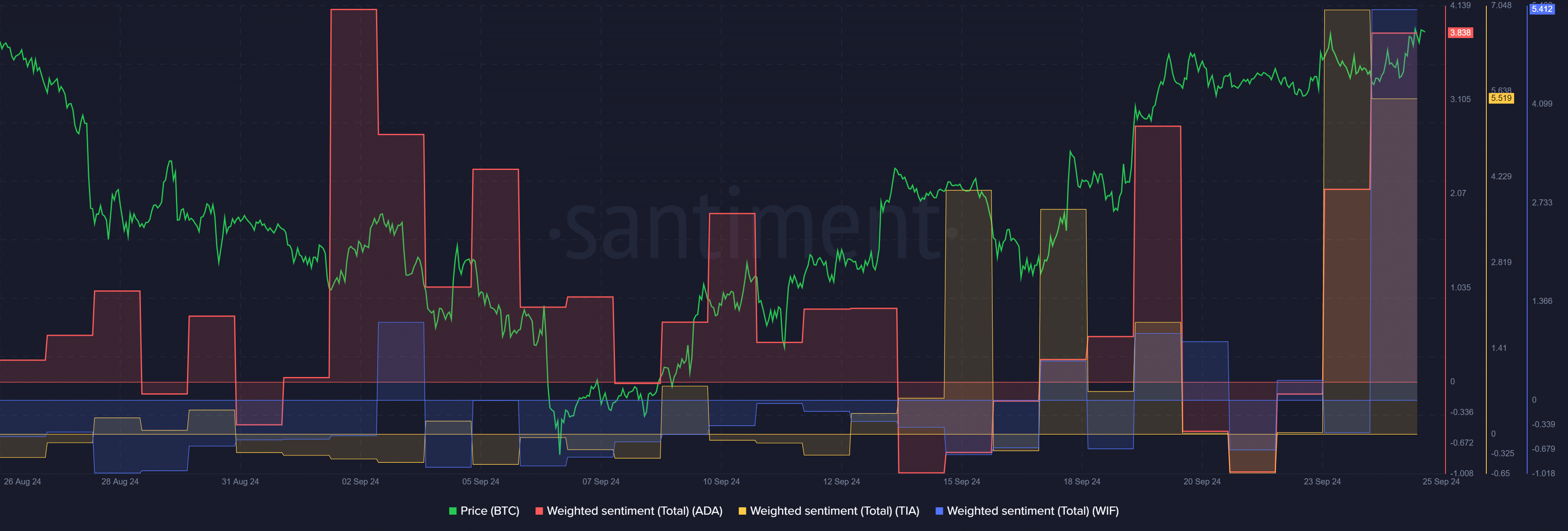

According to data provided by Santiment, Cardano (ADA) and Celestia (TIA) recorded an impressive surge in their respective weighted sentiments over the past two days. Dogwifhat’s (WIF) bullish social sentiment was triggered yesterday, Sept. 24, as the meme coin’s upward momentum started.

Weighted sentiment of ADA, TIA and WIF – Sept. 25 | Source: Santiment

Weighted sentiment of ADA, TIA and WIF – Sept. 25 | Source: SantimentThe dominant positive sentiment around these tokens has brought impressive gains as well.

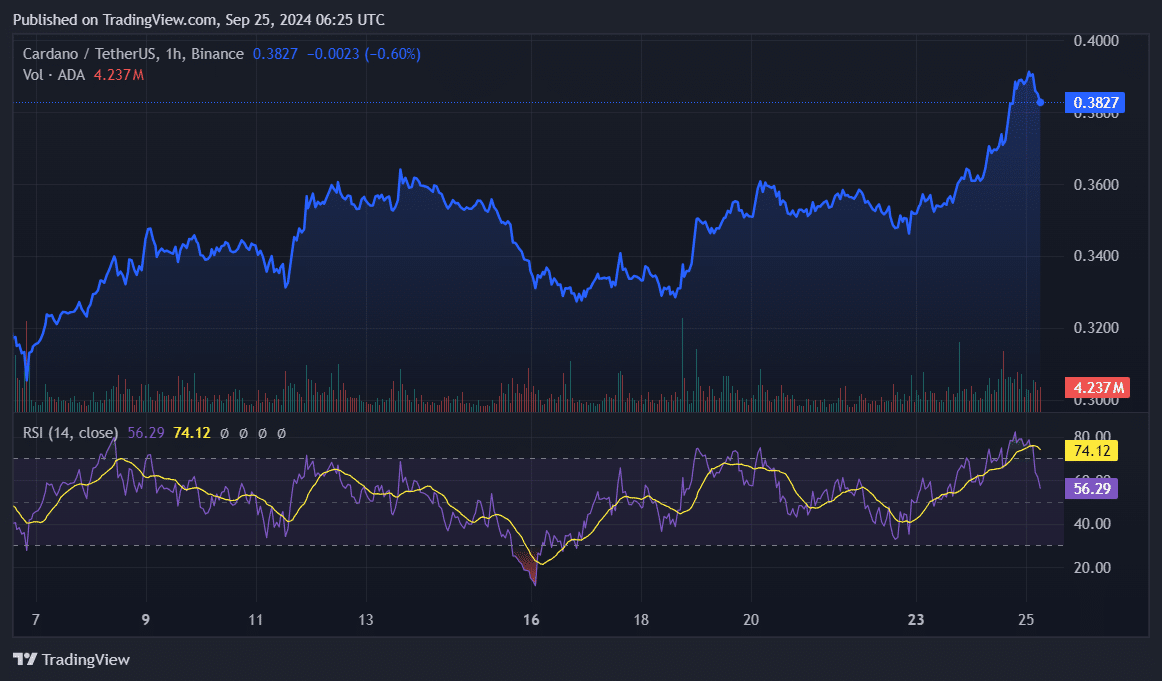

ADA rose by 6.3% in the past 24 hours and is trading at $0.38 at the time of writing. Its market cap is currently sitting at $13.8 billion with a daily trading volume of $350 million.

ADA price and RSI – Sept. 25 | Source: crypto.news

ADA price and RSI – Sept. 25 | Source: crypto.newsCardano’s bullish momentum started after the U.S. Federal Reserve announced a 50-basis-point rate cut on Sept. 18 — unlike the March 2020 rate cut that crashed the ADA price by 57%.

Moreover, Cardano recorded a pretty similar positive sentiment on social platforms on Sept. 2 on the back of its Chang hardfork announcement. The upgrade switched the network’s system to decentralized.

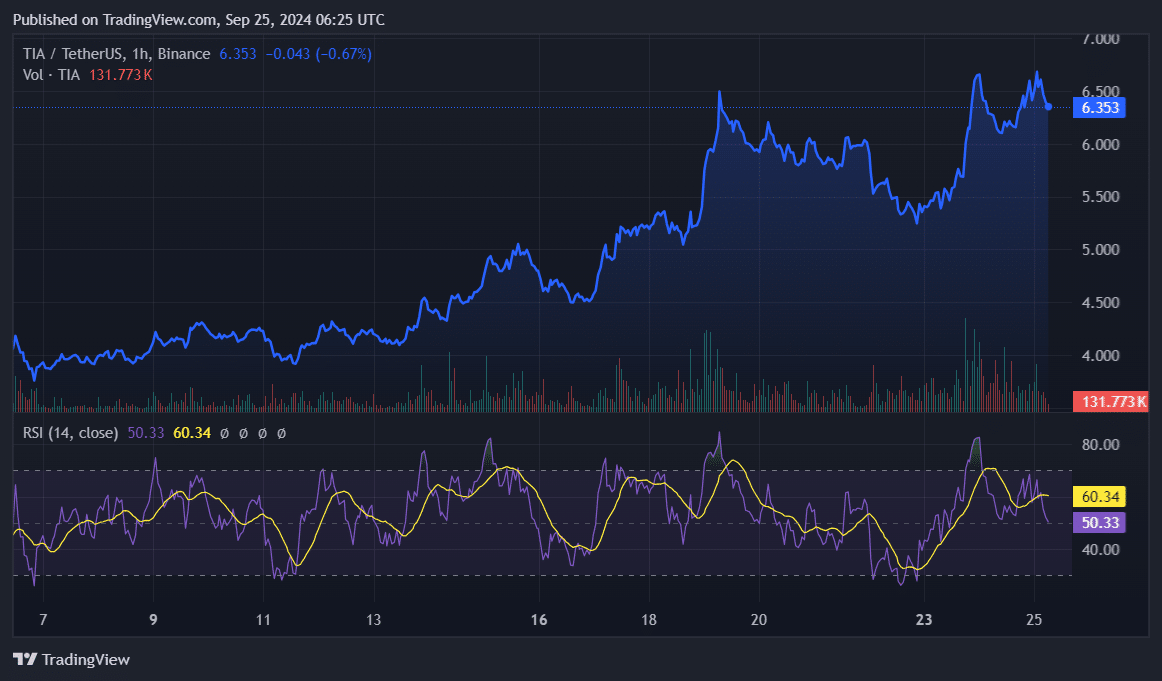

TIA briefly touched a local high of $6.8 earlier today but soon started to decline. At this point, Celestia is up by 1.3% over the past day and is changing hands at $6.36 at the reporting time. The asset’s market cap is hovering at $1.35 billion with a daily trading volume of $240 million.

TIA price and RSI – Sept. 25 | Source: crypto.news

TIA price and RSI – Sept. 25 | Source: crypto.newsCelestia recorded most of its gains yesterday after a $100 million funding round.

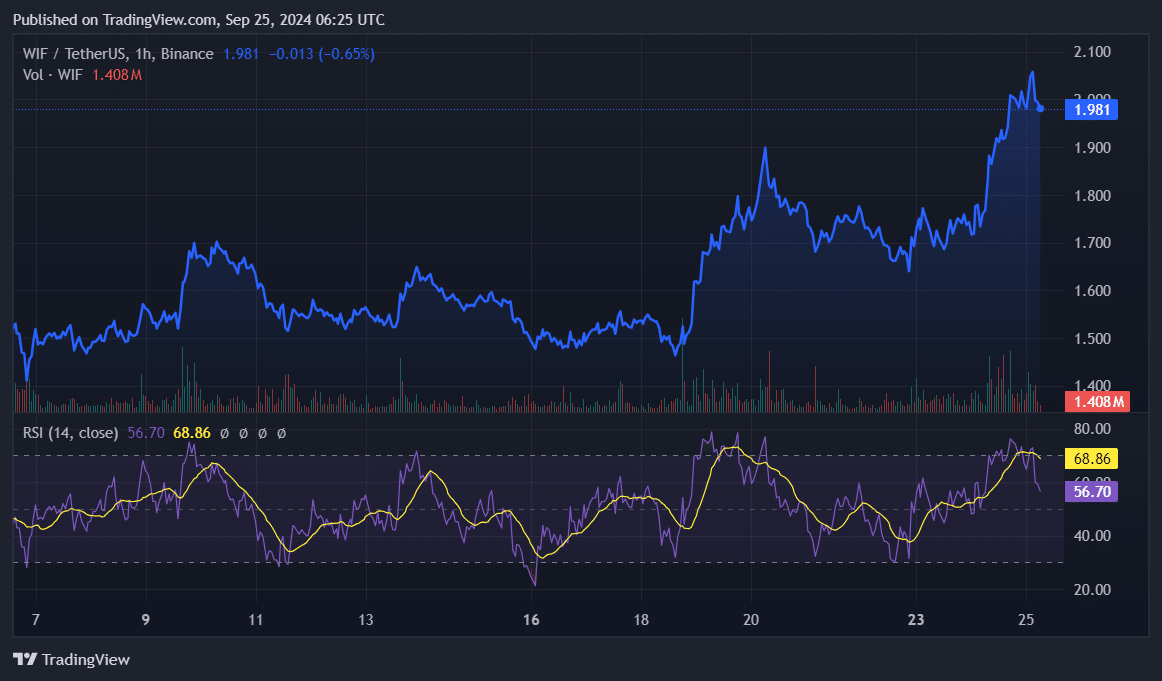

WIF also gained 12.5% in the past 24 hours and is currently trading at $2. The meme coin had been struggling around the $1.5 mark for almost a month and bullish movements after the rate cut news emerged last week.

WIF price and RSI – Sept. 25 | Source: crypto.news

WIF price and RSI – Sept. 25 | Source: crypto.newsDespite the positive sentiment surrounding these tokens, their Relative Strength Index has already heated up.

ADA, TIA and WIF saw their RSIs rise to 74, 60 and 68, respectively. While Cardano has already entered the overbought zone, Celestia and WIF aren’t far away from the 70 RSI mark.

High RSI levels usually bring high price volatility due to increased profit-taking among short-term traders. However, if the market-wide upward momentum is sustained, further gains could be expected for these tokens thanks to the positive sentiment surrounding them.

It’s important to note that macro events can instantly change the direction of financial markets.

English (US) ·

English (US) ·