content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

According to reports from a recent Financial Times documentary, one of Strategy’s own analysts says the company could one day top the list of publicly traded giants. It’s a bold idea. The firm already sits as the largest corporate holder of Bitcoin. But jumping from where it stands now to the very top is a massive climb.

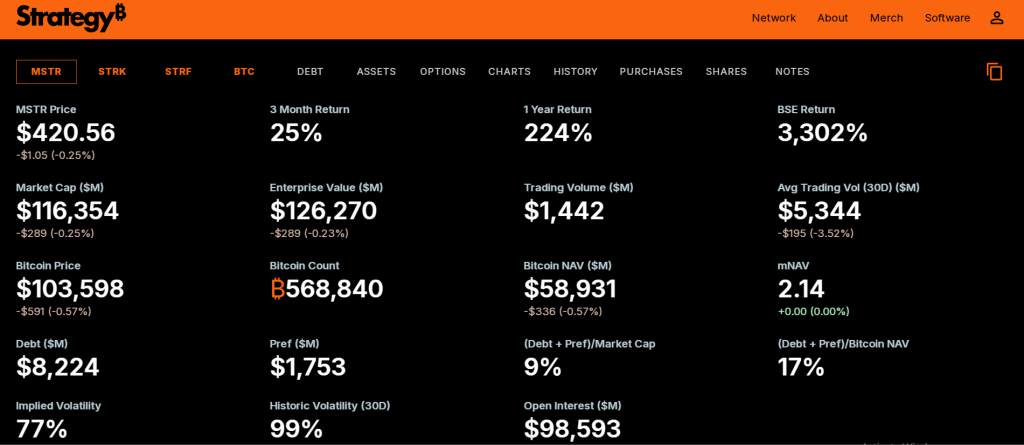

Strategy’s Bitcoin Hoard

Strategy holds roughly 568,840 BTC. That stash is worth nearly $60 billion at today’s prices. Based on reports, the firm pulled in $12 billion during a single 50‑day stretch in late 2024. It’s rare to see that level of fundraising in traditional finance. Short‑term, it shows investors still back the idea of sinking capital into Bitcoin.

Ambitious Growth Plans

The company currently sports a market cap of a little over $117 billion. According to Strategy’s filings, it plans to double its equity raise to $84 billion, ready to buy more Bitcoin. Debt targets are rising too—up from $21 billion to $42 billion, with close to $15 billion still unused.

Michael Saylor, Strategy’s executive chairman, says old‑school bookkeeping won’t limit them. He laid out a path from a $100 billion business to $1 trillion, and then on to $10 trillion. He’s even more optimistic about Bitcoin’s own future, forecasting $1 million per coin within 10 years and $13 million by 2045.

Market Leadership Challenge

To hit the top spot, Strategy would need to overtake Microsoft. Today, Microsoft sits around $3.3 trillion. That’s nearly 30 times larger than Strategy’s present valuation. Converting that gap into Bitcoin terms means a price per coin in the multi‑millions.

It’s a scenario that counts on relentless price gains. It also counts on investors welcoming heavy dilution and more debt as the company issues new shares and bonds.

Peer Moves And Trends

Bitcoin treasury gatherings are not unique to Strategy. On Monday, Metaplanet added 1,241 BTC for more than18 billion yen (or $126 million), taking its total to 6,796 BTC—worth over $706 million. Smaller players are also jumping in.

GD Culture Group Ltd, a microcap firm, aims to raise up to $300 million via a stock offer. It plans to buy Bitcoin alongside a token called Trump Coin. Meanwhile, data show publicly listed firms grew their Bitcoin holdings by 16 % in the first quarter of 2025.

Risks And Reality

The road from epic dreams to real‑world results is littered with hurdles. Bitcoin has seen wild swings of 50 – 70 % in past bear markets. New share and debt sales dilute existing investors’ stakes. If Bitcoin stumbles or investor sentiment turns, all those plans could stumble too.

Strategy is the biggest boat in a sea of Bitcoin treasury ships. When the tide goes out, it may feel the pull more than many others. For now, it’s a story of guts, big numbers, and the hope that today’s digital gold keeps rising.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

English (US) ·

English (US) ·