The price of Binance Coin has fallen from its highest point in May despite a surge in its active users, transactions, and decentralized exchange volume.

Binance Coin (BNB) token dropped to $650 today, June 15, down by 6.70% from its highest point this year and 18% from the year-to-date high.

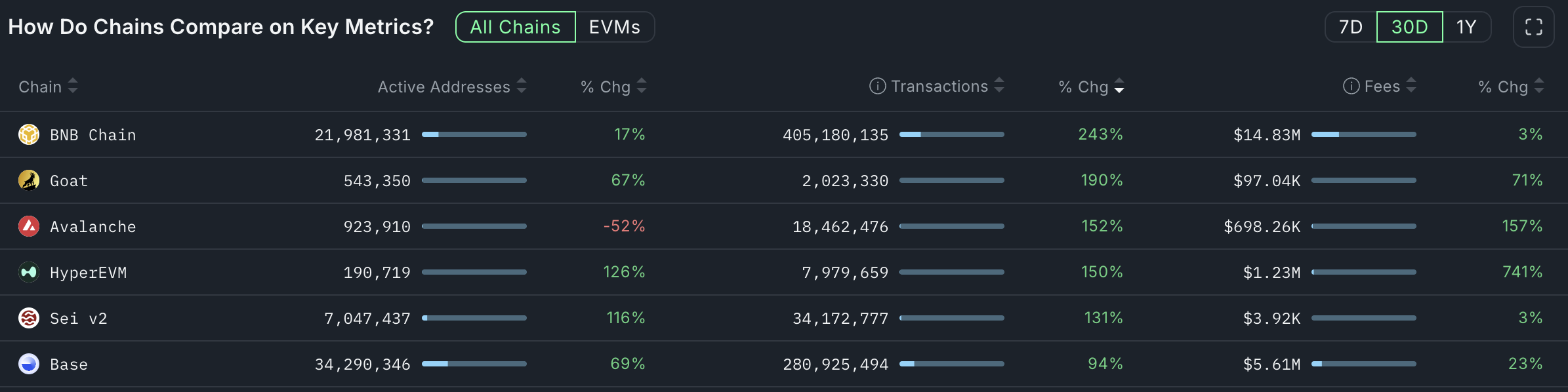

Nansen data shows that BNB Smart Chain has become the fastest-growing chain in the last 30 days. It handled over 405 million transactions, up by 243% from the same period a month earlier.

BSC’s transaction count was much higher than all the other blockchains except Solana (SOL), which handled over $1.9 billion in the same period.

Its transaction grew as the number of active addresses on the network jumped. Its monthly transactions rose by 17% to 21.9 million, higher than most blockchains, including Ethereum (ETH) and Tron (TRX). This growth led to a 3% fee increase, as it made $14.8 million.

Chain transactions, addresses, and fees | Source: Nansen

Chain transactions, addresses, and fees | Source: NansenBNB Smart Chain has also overtaken Solana and Ethereum regarding decentralized exchange volume. Data shows that protocols on its platform handled over $147 billion in volume in the last 30 days. This volume exceeded Sona’s $79 billion and Ethereum’s $65 billion.

PancakeSwap, its biggest DEX platform, has overtaken popular exchanges like Uniswap, Raydium, and Aerodrome. It handled over $3.3 billion in the last 24 hours, higher than Uniswap’s $1.7 billion, Raydium’s $545 million, and Aerodrome’s $343 million.

Rising BSC transactions is important for BNB price because it leads to higher fees, which contribute to its burn rate.

BNB price technical analysis

BNB price chart | Source: crypto.news

BNB price chart | Source: crypto.newsThe 12-hour chart shows that the BNB token price has come under pressure in the past few weeks. It is consolidating at the 100-period moving average and slightly above $644, the highest swing on March 25.

BNB price has formed a bullish pennant pattern, comprising of a vertical flagpole and a symmetrical triangle. The two lines of this triangle have a long way to converge, meaning that its price will likely continue consolidating for a while.

BNB will then bounce back, and possibly retest the key resistance at $697.55, its highest point on May 27. A drop below $625, the lowest point on June 5, will invalidate the bullish forecast.

English (US) ·

English (US) ·