Bitcoin (BTC) has surged past the $65,000 mark, renewing traders’ optimism for an “Uptober” rally that could extend the digital asset’s bullish momentum.

Is The Bitcoin “Uptober” Rally Finally Here?

In the early hours of October 15, Bitcoin briefly crossed $66,000 before retracing to $65,964 at the time of writing. Over the past 24 hours, BTC has gained 1.4%.

According to a report by crypto exchange Bitfinex, Bitcoin’s decisive move past the crucial $63,000 resistance level, combined with encouraging on-chain metrics, points toward further potential upside move.

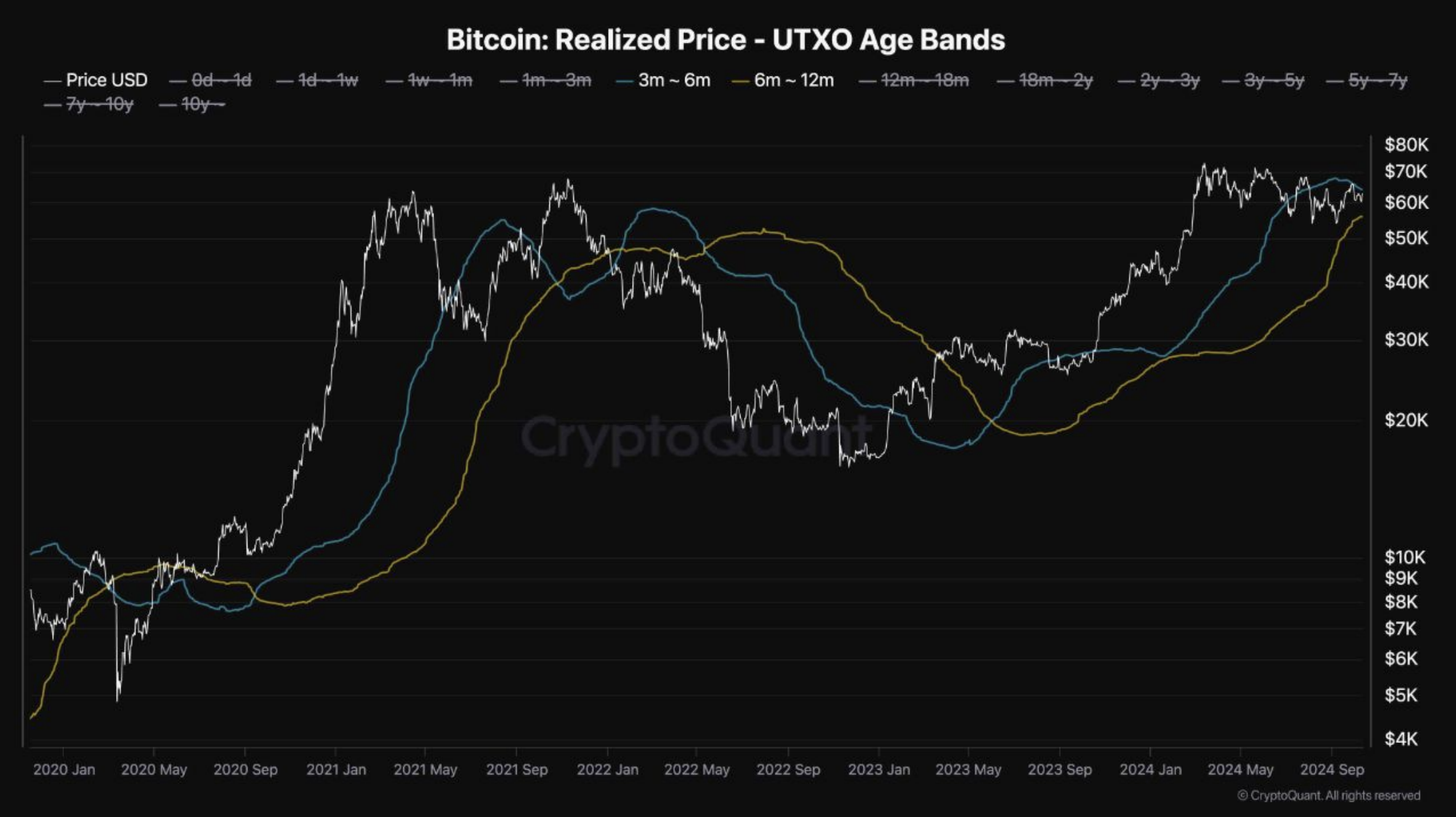

The report mentions that Bitcoin’s realized price of unspent transactions output (UTXO) age bands are a “pivotal on-chain metric for gauging Bitcoin’s market dynamics.”

For the uninitiated, Bitcoin’s UTXO age bands refer to the value at which different groups of BTC – based on their holding duration – were last moved. Essentially, it helps track the average purchase price across various age groups of BTC holders, indicating market sentiment and the profitability of specific cohorts.

Notably, the average realized prices for short-term (3-6 months) and mid-term (6-12 months) holders have historically been key support or resistance levels. The short-term holder price is around $63,000, while the mid-term holder price is $55,000.

Source: CryptoQuant

Source: CryptoQuantWhen Bitcoin trades below the average purchase price of these groups, it often signals a bearish trend. Conversely, a move above these levels can indicate bullish momentum.

Since BTC has surpassed the $63,000 resistance, further gains could be in sight. However, a failure to close above this level could have triggered a potential decline toward $55,000.

Market Displays Strong Appetite For Digital Assets

The report highlights BTC’s weak price action on October 10, when it fell to $58,943 due to lack of aggressive buying in the spot market. Per the report, the majority of the selling originated on Coinbase.

The report mentions the Coinbase Premium Gap Indicator (CPGI) – a metric that shows the difference between the BTC-dollar pair on Coinbase versus other major centralized exchanges.

The CPGI decreased by 100 points as BTC’s price declined below $59,000. The report notes that during the past year, anytime the CPGI fell below 50 points, BTC price has witnessed a subsequent recovery. The report adds:

Bitcoin has been trading within a broad range for the past eight months. In the event of the onset of a bear market, selling typically ensues when the Coinbase Premium turns negative. However, such selling has not been observed, suggesting that despite the fluctuations, the market remains relatively stable without widespread fear-driven divestment. This resilience could indicate underlying strength or a balanced market sentiment that may steer future price movements.

This analysis aligns with a separate report by crypto firm QCP Capital, which noted that the shallow sell-off in the crypto market following geopolitical tensions between Iran and Israel indicates sustained demand for risk-on assets.

In related news, BTC bulls will be relieved to learn that the defunct crypto exchange Mt. Gox has delayed its repayment until October 2025, potentially easing pressure on spot selling.

However, some analysts warn that BTC may face price capitulation due to tightening on-chain liquidity. At the time of writing, Bitcoin trades at $65,964, up 1.4% in the past 24 hours.

BTC trades at $65,964 on the daily chart | Source: BTCUSDT on TradingView.com

BTC trades at $65,964 on the daily chart | Source: BTCUSDT on TradingView.comFeatured image from Unsplash, charts from CryptoQuant and Tradingview.com

English (US) ·

English (US) ·