Key Notes

- BCH reached $500 for the first time in 2025, pushing market cap above $10 billion despite broader crypto market weakness from inflation concerns.

- Double Top formation at $510 with bearish RSI divergence suggests overheated momentum and potential correction toward $363 target level.

- Strong trading volumes indicate sustained buying pressure as investors position BCH as hedge against stalling Bitcoin momentum amid macro uncertainty.

Bitcoin Cash BCH $504.0 24h volatility: 2.7% Market cap: $10.03 B Vol. 24h: $399.24 M price bucked the broader market downtrend on Friday, June 27, rising 2% to hit $500 for the first time in 2025. After logging three consecutive days in the green, BCH has become the week’s top-performer among the top 20 ranked altcoins, outperforming Bitcoin BTC $107 250 24h volatility: 0.1% Market cap: $2.13 T Vol. 24h: $25.97 B , Ethereum ETH $2 426 24h volatility: 0.6% Market cap: $292.89 B Vol. 24h: $13.84 B , and Cardano ADA $0.56 24h volatility: 0.8% Market cap: $20.18 B Vol. 24h: $468.04 M , all of which saw slight declines as fresh US inflation data dampened sentiment on Friday.

BCH traded as high as $506, according to CoinMarketCap data, pushing its total market capitalization above $10 billion for the first time since December 2024. This caps off a three-day run that has seen BCH re-enter the top 15 crypto assets by market cap.

More so, BCH trading volumes printing successive green bars, signals sustained buy-side pressure. Unlike other large-cap assets consolidating or declining amid macroeconomic concerns, BCH continues to attract speculative demand.

Why is BCH Price Rallying Today?

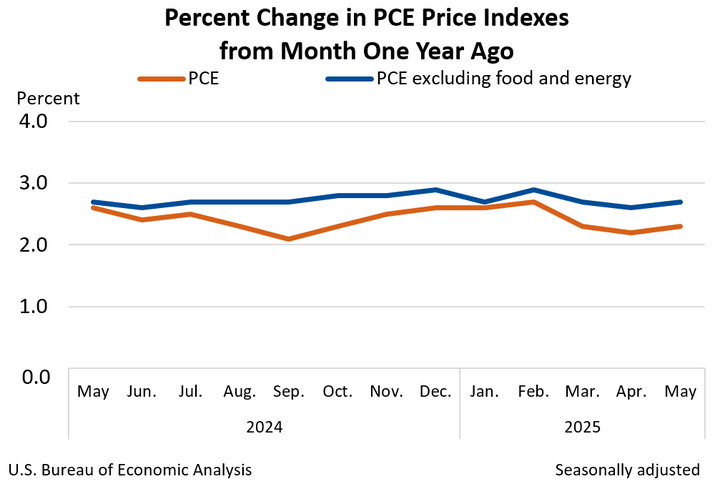

BCH’s strong performance on June 27 stands in stark contrast to major Layer 1 tokens like BTC and ETH, which dipped following the release of higher-than-expected PCE inflation data.

According to the Bureau of Economic analysis, The Core Personal Consumption Expenditures Index (PCE), rose by 2.3%. Closely watched by the Fed, this rise in consumer spending casts doubts on the interest rate cut expectations for the next FOMC meeting slated for July 30.

US PCE Inflation data | June, 27 2025

Rather than retreat along with layer-1 rivals, Bitcoin Cash bulls seized on the lukewarm macro sentiment to extend their rally, possibly betting on BCH as a hedge play amid stalling Bitcoin momentum.

BCH Technical Analysis: Double Top Signals Warning as RSI Nears Exhaustion

From a technical perspective, Bitcoin Cash is flashing early warning signs of a potential trend reversal, despite its impressive 2.9% gain to $503 on June 27. As seen below, the BCH 24 hour chart shows a Double Top formation. This bearish pattern often occurs when price tests a resistance level twice without breaking above it, forming two peaks.

In this case, Bitcoin Cash has printed near-identical highs at $510, with a neckline around $455. If BCH price breaks below this neckline, it often triggers a swift move toward the projected downside target, near $363.

Bitcoin Cash (BCH) Price Forecast

Adding weight to this bearish setup is the Relative Strength Index (RSI), which currently stands at 65.79. The RSI is a momentum oscillator that measures the speed and magnitude of recent price moves. Readings above 60 often signal that bullish momentum is overheated. The RSI also shows a bearish divergence: while BCH price hit a new high, the RSI did not follow suit, implying weakening momentum beneath the surface.

Unless bulls reclaim $510 with sustained volume, BCH risks a technical rejection, with downside targets aligning near $425 first, and ultimately around $363 if the breakdown accelerates.

However, a decisive BCH price close $510 with a corresponding RSI breakout above 70, could invalidate this bearish thesis. Until then, the Bitcoin Cash market appears vulnerable to a cooling-off phase following its three-day price rally to a new 2025 peak amid negative macro signals.

Best Wallet Presale Heats Up as BCH Bulls Seek Secure Gains

As Bitcoin Cash price breaks into 2025 highs, traders looking to preserve profits and earn long-term returns are now turning to a high-anticipated crypto wallet token, Best Wallet ($BEST).

With the total presale haul exceeding $13.5 million, $BEST is gaining serious traction ahead of its next price increase. Currently priced at just $0.0252, the token offers powerful utility for BCH holders and beyond.

Best Wallet isn’t just another non-custodial solution—it’s a full ecosystem with early access to new projects, reduced transaction fees, and high-yield staking options all powered by the $BEST token. Users who stake $BEST also earn governance rights, allowing them to vote on key project upgrades and integrations.

Visit the official Best Wallet website to participate in the final phase of the $BEST Token presale.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Cryptocurrency News, News, Price Prediction

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

English (US) ·

English (US) ·