Bitcoin dips toward $60,500 amid unexpected core inflation rise, overall YoY declines to 2.4% Liam 'Akiba' Wright · 3 mins ago

Bitcoin dips toward $60,500 amid unexpected core inflation rise, overall YoY declines to 2.4% Liam 'Akiba' Wright · 3 mins ago

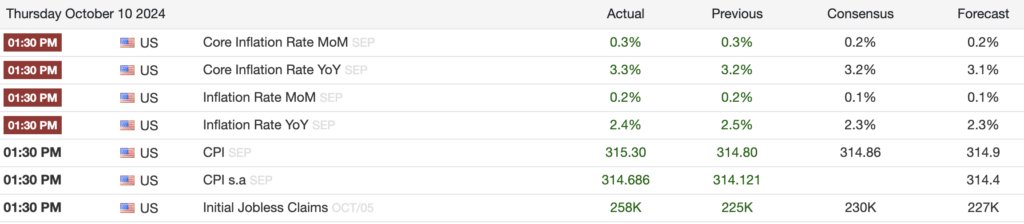

Bitcoin remained above $60,500 after US inflation data released today showed higher-than-expected figures. The Core Inflation Rate year-over-year for September rose to 3.3%, surpassing the consensus estimate of 3.2%. Monthly core inflation increased by 0.3%, exceeding the forecasted 0.2%. Overall inflation rose by 0.2% month-over-month, with an annual rate of 2.4%, slightly above the expected 2.3% but still down from last month’s 2.5%.

Inflation data (Trading Economics)

Inflation data (Trading Economics)Initial jobless claims for the week ending Oct. 5 reached 258,000, higher than the anticipated 230,000, indicating potential softening in the labor market. The Consumer Price Index (CPI) climbed to 315.30, above the consensus of 314.86.

Bitcoin experienced a minimal 0.7% decline following the data to around $60,700. This movement mirrors previous instances where Bitcoin showed resilience amid economic data releases. In September, despite higher-than-expected inflation and a 50 basis point rate cut by the Federal Reserve, Bitcoin maintained stability above $60,000.

The uptick in inflation figures may influence market expectations regarding future monetary policy. Rising core inflation could lead the Federal Reserve to reconsider the pace of rate cuts implemented earlier this year. Additionally, increased jobless claims may signal a shifting economic landscape.

Analysts are assessing how these economic indicators affect Bitcoin’s role as a potential inflation hedge. The relative stability of digital assets suggests that investors may have anticipated modest deviations in inflation data. Ongoing demographic shifts and housing market pressures, such as rising Owners’ Equivalent Rent, continue contributing to inflationary trends.

English (US) ·

English (US) ·