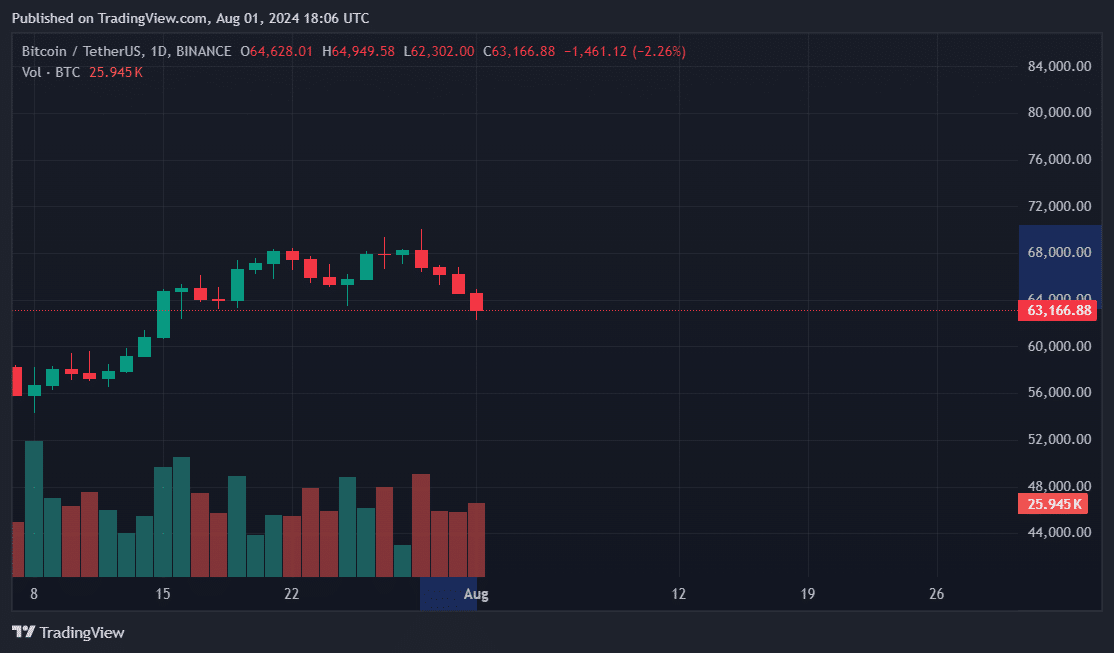

Bitcoin showcased its correlation to traditional markets on Aug. 1 as the cryptocurrency slumped alongside stocks and market indexes.

Bitcoin (BTC) has declined over 10% since July 29, when the cryptocurrency surged toward $70,000 and reached a two-month high after Donald Trump’s remarks in Nashville. As of this writing, the asset was trading under $63,500.

24-hour BTC chart on Aug. 1 | Source: crypto.news

24-hour BTC chart on Aug. 1 | Source: crypto.newsBTC’s 7% slump in 24 hours coincided with significant drops in the S&P 500 and Dow Jones market indexes. Specifically, the Dow Jones Industrial Average fell over 500 points in under an hour. Several large-cap stocks, such as Amazon and Nvidia, also slipped on Aug. 1 amid market fears of a U.S. recession, according to analysts from The Kobeissi Letter.

Volatility in traditional markets and BTC prices also impacted the broader cryptocurrency ecosystem. CoinGecko data showed that the total crypto market cap shed 6%, dropping to $2.3 trillion after a rebound earlier in the week.

Price swings saw leaders like Ethereum (ETH), Solana (SOL), and Ripple (XRP) enter a downtrend as capital fled the digital asset industry at press time.

BREAKING: The Dow Jones Industrial Average just fell 500+ points in 45 minutes.

This came after the ISM Manufacturing Index fell to 46.8, its lowest level since August 2023.

Markets are worried that the US is heading into a recession. pic.twitter.com/OAIyS1hrks

Ether, Bitcoin lead crypto liquidations

Per CoinGlass, margin positions were unspared by market volatility. Over 105,480 traders were liquidated, and the downturn wiped out $324 million in leveraged positions.

Ether longs led crypto liquidations with $72 million, meaning that traders betting on higher ETH prices received margin calls. In close second, BTC posted $69 million in long liquidations. SOL, XRP, and Dogecoin (DOGE) were the three most liquidated assets after Bitcoin and Ether.

English (US) ·

English (US) ·