Bitcoin reached a new all-time high yesterday at $90,243, fueled by a week of intense buying pressure. This latest surge has sparked excitement across the crypto market, with many speculating that the next target could be even higher.

However, as BTC approaches this milestone, we may see a brief consolidation phase before the next upward push. Key data from Glassnode reveals a surprising insight: long-term holders show no signs of extreme greed or aggressive profit-taking despite the rapid price appreciation.

This cautious optimism among long-term holders suggests that they see this rally as the start, not the peak, of a larger bullish phase. Unlike previous euphoric highs, where investors raced to lock in profits, the current sentiment reflects measured confidence in Bitcoin’s potential for sustained growth.

Analysts are watching closely to see if BTC can establish new support around $90,000, setting the stage for further gains. As BTC consolidates near this level, market sentiment indicates that the rally could have significant room to grow, especially if long-term holders remain steady.

Bitcoin Rally Starting

Bitcoin has officially entered its expected bullish phase after a prolonged 8-month period of sideways consolidation and selling pressure.

The price has surged by 20% above its previous all-time high set in March and is now testing uncharted territory. This breakout has sparked optimism in the market, with many anticipating that Bitcoin’s price could continue to rise as it moves further into price discovery.

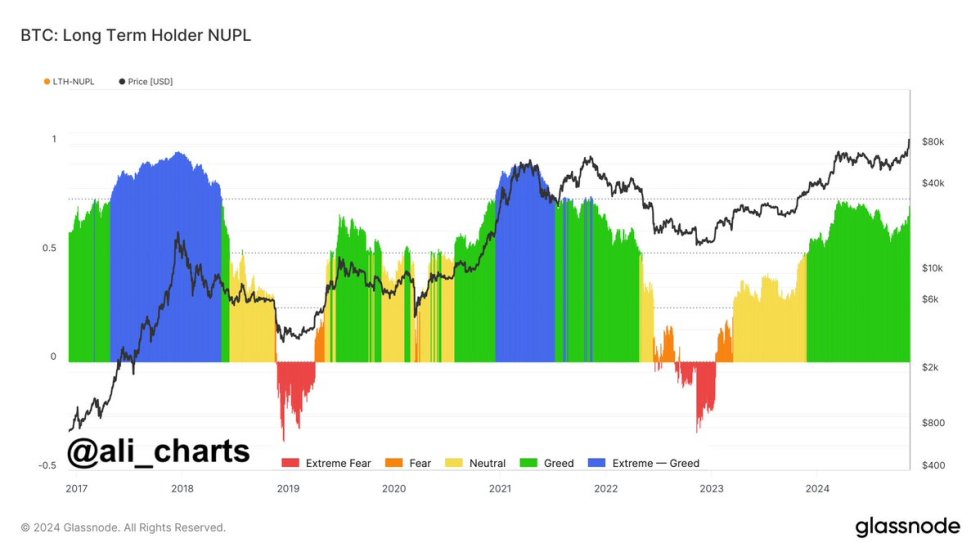

Key data shared by Glassnode and crypto analyst Ali Martinez on X reveals some crucial insights into the current market sentiment. Despite BTC’s impressive price movement, long-term holders are not yet showing signs of extreme greed, suggesting that the market is still in the early stages of this bullish phase.

Bitcoin Long Term Holder NUPL | Source: Ali Martinez on X

Bitcoin Long Term Holder NUPL | Source: Ali Martinez on XThe long-term holder Net Unrealized Profit/Loss (NUPL) metric, which tracks the profitability of coins held by long-term investors, is currently in the “greed” zone but has not yet reached the “extreme greed” levels seen in previous cycles. This indicates that while investors are confident and holding their positions, they are not yet fully consumed by the euphoria that typically signals a market top.

This data suggests that big players, including institutional investors and long-term holders, remain optimistic about Bitcoin’s prospects in the coming weeks.

The absence of extreme greed implies that there’s still room for further growth, as the market has yet to reach the same levels of vitality that often precede significant corrections. As BTC continues to push into new highs, this measured confidence could support a sustained upward trend.

BTC Consolidates Below $90,000

Bitcoin is trading at $87,600 after reaching a new all-time high of $90,243. After a week of aggressive buying pressure, the price seems to have found a local top for now, and it looks poised to enter a consolidation phase below the $90,000 mark. Market participants will likely monitor key levels during this phase to assess whether the uptrend can continue.

BTC Consolidates below $90,000 | Source: BTCUSDT chart on TradingView

BTC Consolidates below $90,000 | Source: BTCUSDT chart on TradingViewIf BTC manages to stay above the $85,000 mark, a retest of this level would be expected, with a potential continuation to higher levels if support holds. This would signal that the bullish momentum is still intact and that Bitcoin is gearing up for its next leg up.

However, if the price fails to hold the $85,000 level, BTC could face a retrace to lower demand levels, potentially around the $82,000 mark. A drop below this threshold could indicate a deeper correction, with further downside testing support levels before buyers re-enter the market.

In the coming days, price action around these critical levels will help determine whether BTC will break higher or take a breather before the next rally. Investors will need to stay alert to the evolving price dynamics.

Featured image from Dall-E, chart from TradingView

English (US) ·

English (US) ·