content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Bitcoin has seen a retrace to $107,000 shortly after social media sentiment reached its highest in months. Did retail FOMO act as a contrarian signal?

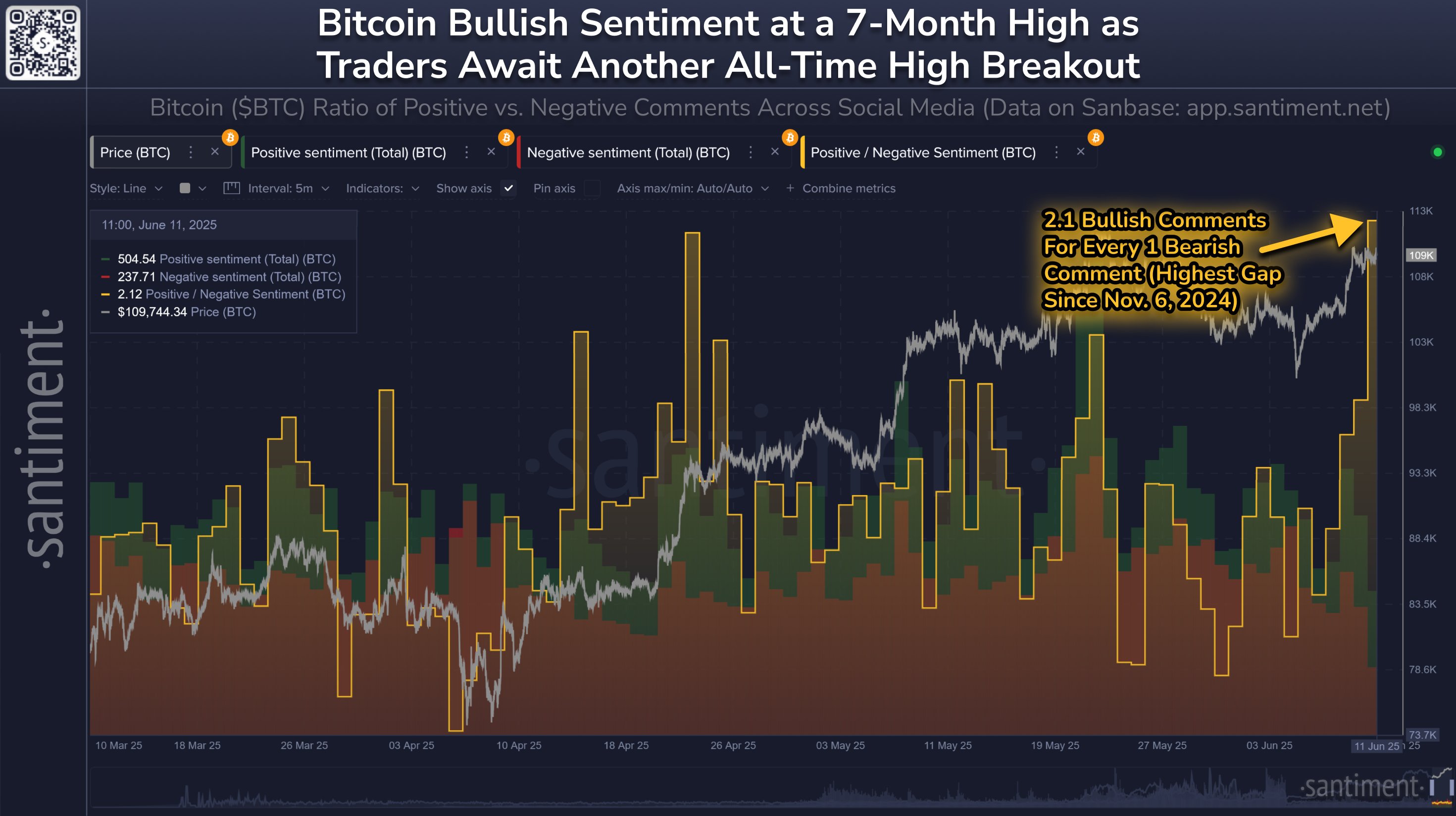

Bitcoin Positive/Negative Sentiment Recently Observed A Sharp Spike

In a post on X on Wednesday, the analytics firm Santiment discussed how the mood was around Bitcoin on the major social media platforms, based on the Positive/Negative Sentiment metric.

The Positive/Negative Sentiment tells us, as its name suggests, how the positive and negative comments related to a given topic or term on social media currently compare.

The indicator works by filtering the posts/threads/messages on these platforms for the keyword and then putting them through a machine-learning model that can differentiate between bullish and bearish sentiment. It counts up the number of posts belonging to each type and calculates their ratio.

Now, here is the chart shared by Santiment that shows the trend in the Bitcoin Positive/Negative Sentiment over the last few months:

As displayed in the above graph, the Bitcoin Positive/Negative Sentiment recently observed a sharp rise in the zone above 1.0 level and reached a high of 2.1. Such a value corresponds to there being 2.1 bullish comments for every bearish comment on social media platforms.

This peak of 2.1 was the largest value for the ratio since Donald Trump‘s re-election as the US President seven months ago. Thus, clearly, it seems the traders were in quite high spirits around BTC.

This bullish mood was naturally a result of the cryptocurrency’s price recovery rally to levels close to its all-time high (ATH). Despite the positive sentiment, though, BTC has seen a plummet during the past day. The trend of a decline taking place following hype on social media isn’t actually an unfamiliar pattern, however, as Bitcoin and other digital assets have seen it take shape time and again.

It turns out that markets often move in a direction that goes opposite to the expectations of the crowd. This can apply both ways, meaning a bearish sentiment can lead to a bottom as well.

How likely sentiment is to affect Bitcoin’s direction may come down to the strength of the opinion among the traders. The Positive/Negative Sentiment indicated a relatively high level of FOMO earlier, so it may have acted as a contrarian signal for the asset.

The sentiment on social media may now be worth keeping an eye on, as how the retail investors react next could once more provide hints about BTC’s future.

BTC Price

Bitcoin was trading above $110,000 just yesterday, but its price has now come down to $107,000 following the drawdown.

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

![11 Best Crypto & Bitcoin Casinos in Australia [2025]](https://coincheckup.com/blog/wp-content/uploads/best-crypto-and-bitcoin-casinos-in-australia-coincheckup-1024x576.png)

English (US) ·

English (US) ·