Key Notes

- BTC futures volume jumped 22.76% to $81 billion as short traders positioned for renewed downside pressure.

- Michael Saylor hinted at another BTC acquisition after Strategy’s Bitcoin holdings value dropped $4 billion this month.

- Despite weekend gains, open interest stagnation signals low conviction among bulls and potential continuation of bearish momentum.

Strategy CEO and Co-founder Michael Saylor dropped a cryptic tweet on Sunday, Oct 19, hinting at another BTC purchase. The post lauded a hypothetical next BTC purchase, accompanied by the firm’s Bitcoin holdings tracker.

The data shows the total value of Strategy’s 640,250 BTC holdings dropping to $69 billion from peaks around $73 billion when the price hit all-time highs of $126,270 on October 6, 2025.

$MSTR is a granny shot https://t.co/OREECm3O4a

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) October 19, 2025

On Saturday, Saylor also made an appearance in an interview with Mark Moss, CEO of Satsuma Technology Plc, a UK-based crypto and decentralized AI firm.

In the interview, Saylor provided technical details about $STRC, Strategy’s perpetual preferred stock, launched in July 2025. The product now delivers 10.25% variable monthly cash dividends backed by 10x overcollateralized Bitcoin to eliminate downside volatility.

Michael Saylor explains how Strategy is stripping away the volatility of Bitcoin to provide investors with a 10.25% dividend treasury credit instrument, $STRC. pic.twitter.com/bpQliXMLhd

— The ₿itcoin Therapist (@TheBTCTherapist) October 18, 2025

By collaring the price between $99 and $101 and dynamically adjusting yields, $STRC maintains stability near par value, allowing MicroStrategy to monetize treasury assets without liquidation.

BTC Short Traders Doubling Down Despite Weekend Recovery

Bitcoin price bounced 1.5% on Sunday, with gains subdued just below $109,000 at the time of reporting. Despite Saylor’s fresh bullish hint on Sunday, derivatives metrics show BTC short traders positioning for more downside action, defying the weekend recovery.

Coinglass data shows Bitcoin futures trading volume surged 22.76% to hit $81.08 billion, with Open Interest only rising 0.59% to $69.1 billion. The large increase in volume with a relatively flat open interest suggests that a significant portion of the trading activity is from existing positions being closed rather than new positions being created.

Without a significant uptick in fresh BTC positions, the weekend recovery may be short-lived.

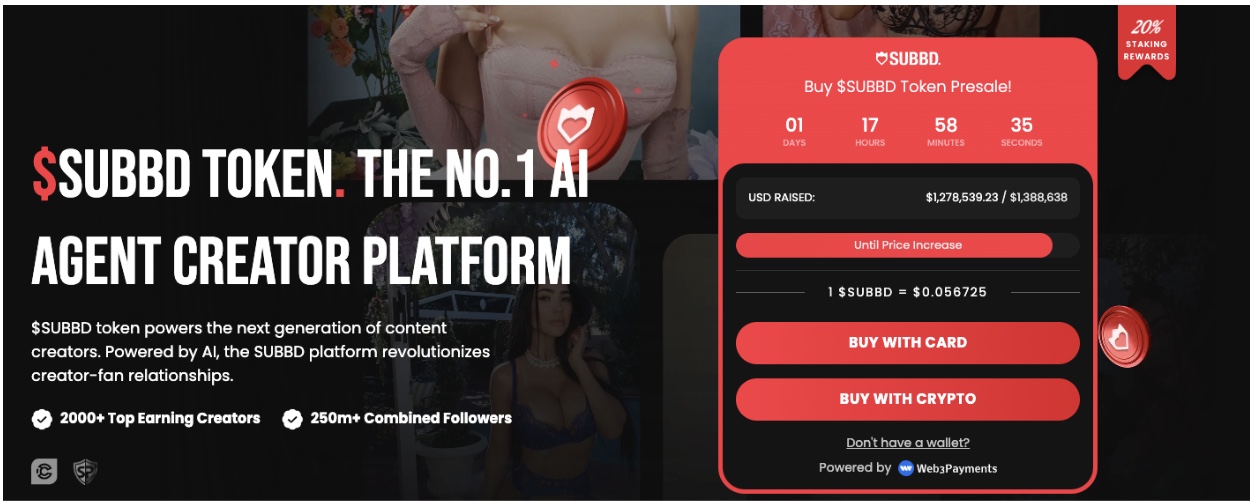

SUBBD Presale Crosses $1.2M as Solana Ecosystem Growth Lifts Web3 Investor Confidence

Bitcoin’s underwhelming performance over the past week has driven investor interest towards new projects like SUBBD.

SUBBD is an AI-driven project with creator monetization tools for influencers and brands.

SUBBD presale

The SUBBD presale has now exceeded $1.2 million of its $1.4 million target, with tokens currently priced at $0.056.

With less than 24 hours before the next pricing tier, early investors can visit the official SUBBD presale site to access up to 20% staking rewards and other community incentives.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

English (US) ·

English (US) ·