Bitcoin price may be on the verge of its next major breakout, and if the technicals are to be believed, this rally could be one for the books.

Leading crypto analyst Titan of Crypto has issued a series of bullish forecasts for Bitcoin (BTC), pointing to a potential surge that could send the flagship cryptocurrency soaring to $137,000. But Bitcoin isn’t the only asset holders should have on their radar; up-and-coming projects like Minotaurus (MTAUR) could ride the wave of this bullish momentum as the crypto market shifts into higher gear.

Weekly Bitcoin price RSI breakout signals momentum shift

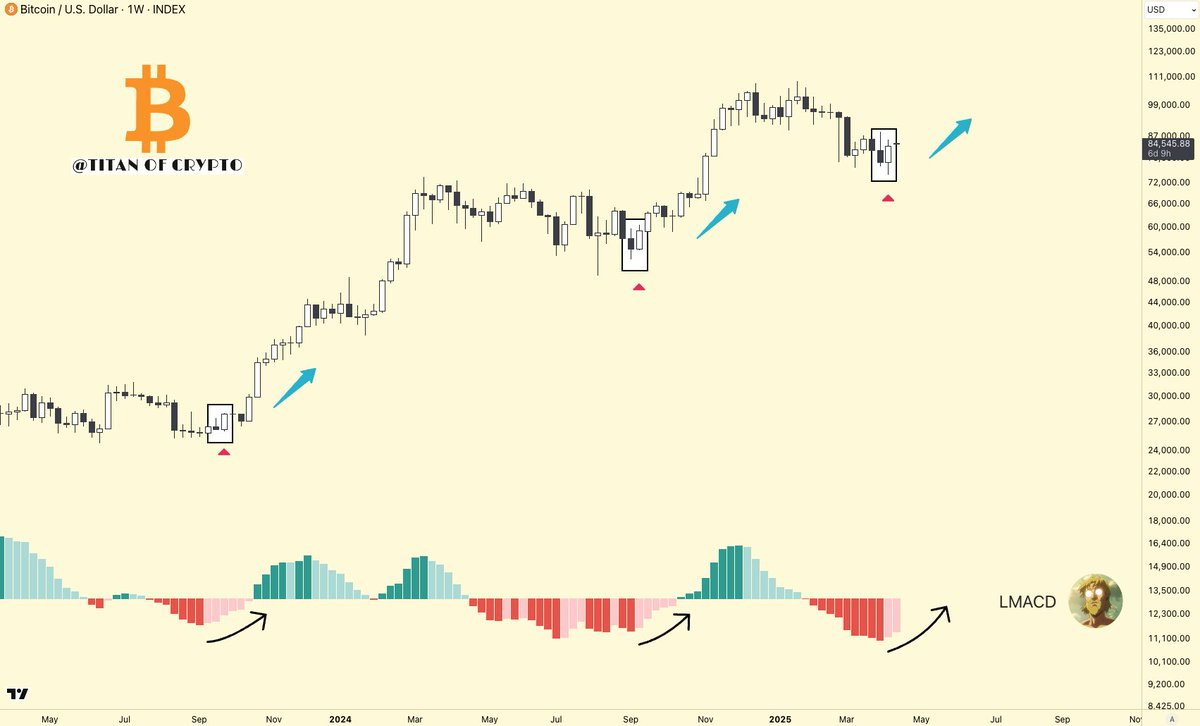

Titan of Crypto’s first major insight centers on Bitcoin’s weekly Relative Strength Index, which just broke above a long-standing downward trendline. This kind of RSI breakout has historically preceded massive price rallies. Titan has identified green circles on past RSI chart breakouts that corresponded with surging Bitcoin prices.

Bitcoin price chart | Source: X

Bitcoin price chart | Source: XThe implication? A potential bullish reversal is underway. When RSI breaks out on the weekly timeframe, it typically signals that downward pressure has weakened and bullish momentum is gaining steam.

LMACD confirms bullish flip

That’s not all. Titan also highlighted a bullish crossover in the Linear Moving Average Convergence Divergence (known as LMACD) of BTC price on the weekly chart. The histogram is flipping from red to green, and the LMACD line is crossing above the signal line, both classic indicators that the trend is turning positive.

BTC price chart | Source: X

BTC price chart | Source: XTitan notes that both technical indicators and price action on the weekly chart support a growing bullish trend. Candlestick formations and increasing buying volume further reinforce this outlook.

Bitcoin price daily bull pennant points to $137K target

Taking things a step further, Titan of Crypto is now eyeing a bull pennant on the Bitcoin price daily chart. This continuation pattern typically forms after a strong upward move (the flagpole), followed by a brief consolidation phase (the pennant). If BTC breaks above the upper trendline of this pattern, the projected move, calculated from the flagpole, could carry Bitcoin to $137,000, setting a new all-time high.

Bitcoin price pennant | Source: X

Bitcoin price pennant | Source: XWhile this prediction runs counter to current market sentiment, Titan’s confidence lies in the alignment of multiple bullish indicators.

Macro tailwinds support the case

It’s not just technicals making the case for Bitcoin. The U.S. Treasury has reportedly injected $500 billion into financial markets since February by drawing down its Treasury General Account (TGA). This liquidity surge has pushed net Federal Reserve liquidity to $6.3 trillion, according to macro analyst Tomas.

While risk assets haven’t fully reacted to this capital injection yet, such expansion often fuels crypto growth, especially for assets like Bitcoin, which are viewed as inflation hedges.

What this means for Minotaurus (MTAUR)

As Bitcoin paves the way, smaller-cap tokens like Minotaurus could benefit immensely from renewed retail and institutional interest. With the crypto market’s momentum shifting, MTAUR, known for its mythologically inspired branding and growing community engagement, could capture attention as holders look to diversify beyond BTC.

Minotaurus is still under the radar, but in a bullish environment, hidden gems tend to outperform. If Bitcoin does head toward six-figure territory, don’t be surprised if MTAUR climbs alongside it, potentially delivering tangible results for early adopters.

Final thoughts

Bitcoin’s charts are lighting up with bullish signals, from weekly RSI breakouts to LMACD crossovers and daily bull pennants. Add in a half-trillion-dollar liquidity boost from the U.S. Treasury, and the stars could be aligning for a serious crypto rally.

Whether you’re riding with Bitcoin to $137K or exploring promising altcoins like Minotaurus (MTAUR), this could be the beginning of a powerful new market phase. As always, technicals are just one piece of the puzzle, but right now, the picture looks very bullish.

English (US) ·

English (US) ·