Key Notes

- Standard Chartered analyst cited past Bitcoin price drawdowns, noting that the bottom could be in and recovery might begin soon.

- On-chain metrics point to capitulation, with traders’ realized BTC loss margin dropping to -16%, below the typical -12% level.

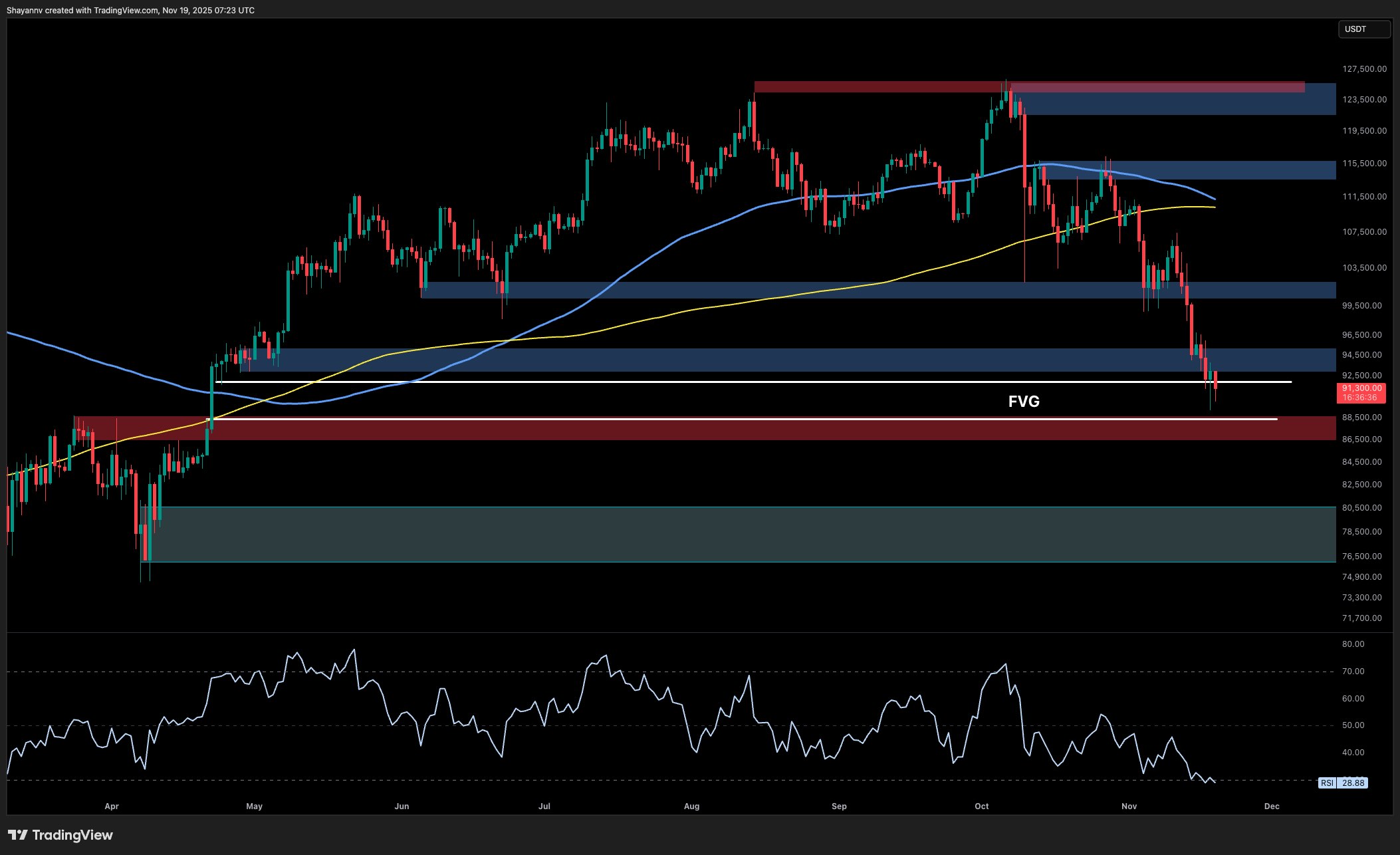

- Technical indicators show BTC in deep oversold territory, with the RSI at 26, the lowest since Bitcoin’s $76,000 bottom earlier in the cycle.

Following the Bitcoin BTC $91 405 24h volatility: 0.3% Market cap: $1.82 T Vol. 24h: $77.82 B price crash under $90,000 earlier this week, the world’s largest asset has bounced back as banking giant Standard Chartered predicts that the bottom is already in.

With BTC already trading closer to $92,000 as of press time, market experts believe that a bounce to $100K could happen quickly.

Standard Chartered Says Bitcoin Sell-Off Is Over

Standard Chartered’s head of digital assets research, Geoffrey Kendrick, said Bitcoin’s recent correction appears to have largely concluded.

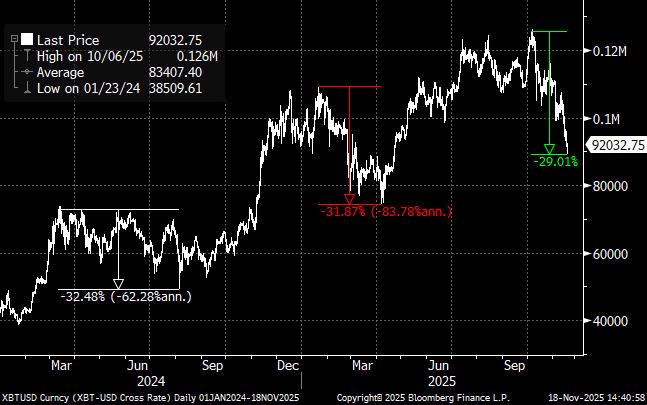

He noted that the recent Bitcoin crash closely mirrors previous drawdowns of similar scale over the past two years.

In a research note sent to Standard Chartered clients on Tuesday, Geoffrey Kendrick said the latest BTC sell-off aligns with the third major pullback of the current market cycle.

The analyst also cited chart patterns showing comparable percentage declines.

Bitcoin’s price’s chart pattern. | Source: Bloomberg

Kendrick added that several market indicators have now reset to extreme levels. Among them is MicroStrategy’s modified net asset value multiple (mNAV), which compares the firm’s market capitalization with the marked-to-market value of its bitcoin holdings.

Kendrick noted that the metric had fallen back to 1.0, hinting that the market has reached a bottom.

“I think this is enough to signify the sell-off is over and to eventually disprove those who think the halving cycle remains valid. A rally into year-end is my base case,” wrote Kendrick.

Standard Chartered is also bullish on the rising blockchain adoption, noting that all global transactions will eventually settle on the blockchain networks.

On-Chain Data Also Supports BTC Recovery Ahead

Crypto analyst Ali Martinez noted that Bitcoin typically rebounds when traders’ realized loss margin drops below -12%. This threshold has historically signaled capitulation and market bottoming.

According to Martinez, the metric has now fallen to -16%. This shows that the Bitcoin price is already facing deeper losses than usual, and could be on the path to recovery.

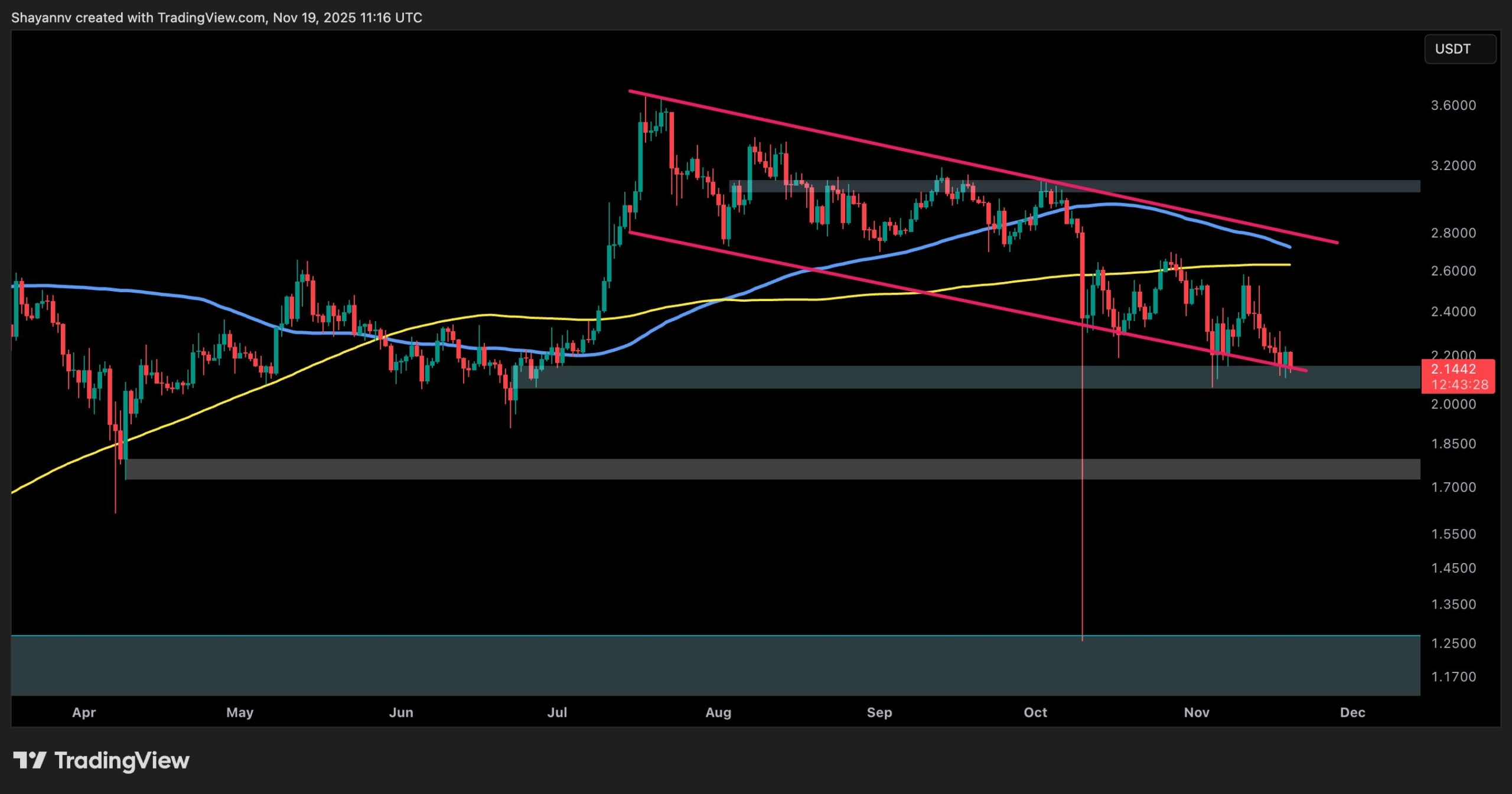

Ali Martinez notes Bitcoin’s realized loss margin at -16%, hinting at a recovery.

BTC’s Relative Strength Index (RSI) indicator has dropped to 26, representing oversold conditions. A similar setup in previous cycles has often coincided with market bottoms.

Bitcoin RSI is currently in oversold territory. | Source: TradingView

The last time Bitcoin’s RSI reached similar levels, the asset was trading near $76,000 before staging a sharp rebound that carried it toward the $120,000 range.

A similar rally could possibly push Bitcoin price to new all-time highs.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

English (US) ·

English (US) ·