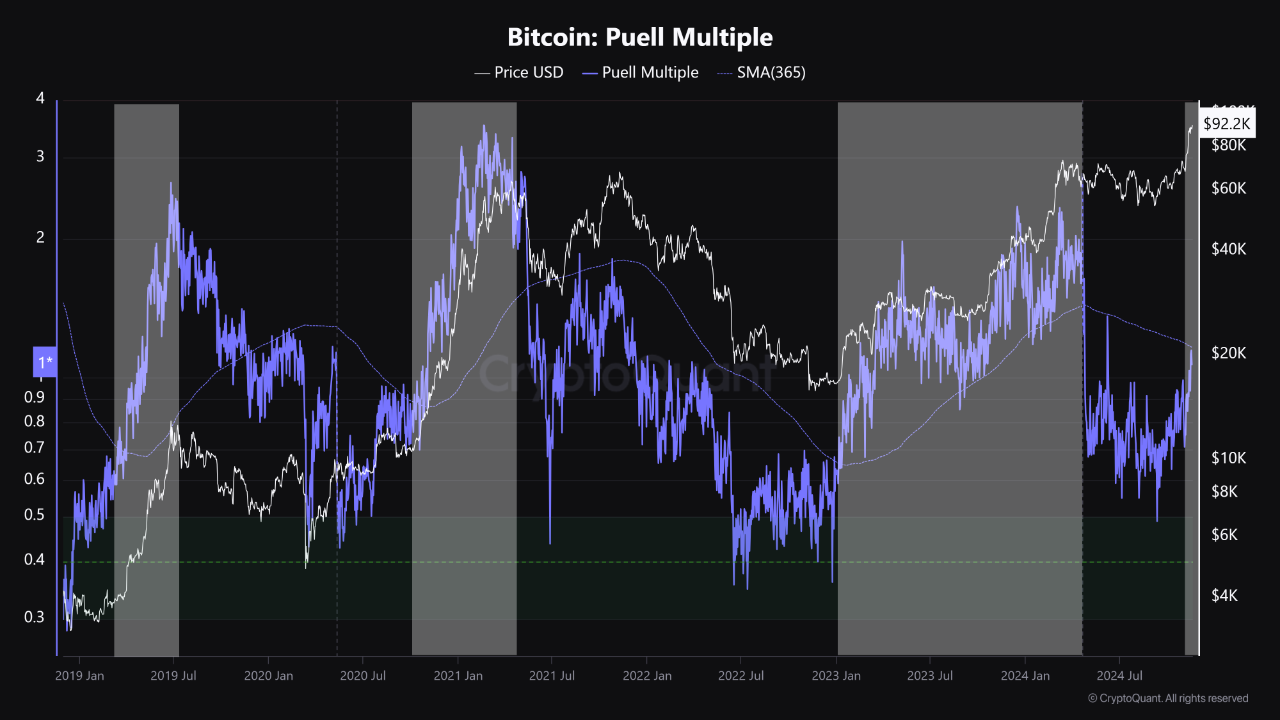

Bitcoin’s Puell Multiple is nearing a breakout above its 365-day SMA, a signal historically linked to major price rallies.

Photo: Jakub Porzycki

Key Takeaways

- The Puell Multiple suggests Bitcoin's price could increase by approximately 90% if past trends repeat.

- The metric indicates periods of high or low Bitcoin issuance compared to historical norms, impacting market entry and exit strategies.

Bitcoin’s Puell Multiple, a key indicator for analyzing mining profitability, is nearing a breakout above its 365-day simple moving average (SMA), according to a CryptoQuant analyst.

Bitcoin: Puell Multiple (Source: CryptoQuant)

Bitcoin: Puell Multiple (Source: CryptoQuant)This signal has historically marked the start of significant price rallies for Bitcoin, with past instances delivering average gains of 90%.

Historical data shows Bitcoin gained 83% after a similar crossover on March 30, 2019, followed by a 113% increase after January 8, 2020, and a 76% rise following January 9, 2024.

The Puell Multiple, which calculates the ratio between the daily value of newly issued Bitcoin and its 365-day moving average, offers insights into mining economics and market cycles.

Miners, often seen as compulsory sellers due to operational costs, can significantly influence market prices through their revenue patterns.

By identifying periods when Bitcoin’s daily issuance value deviates notably from historical norms, the indicator signals potential strategic entry and exit points for investors.

Historically, when this metric crosses above its 365-day simple moving average, it has preceded major price rallies, with the current breakout suggesting the potential for a surge of up to 90%.

Market observers note the current pattern coincides with expectations of monetary policy shifts, including potential rate cuts and anticipated changes in market liquidity conditions.

With Bitcoin stabilizing in a tight range between 88K and 93K, the Puell Multiple’s breakout could be the signal that ignites another major price movement.

Disclaimer

1 day ago

3

1 day ago

3

English (US) ·

English (US) ·