On-chain data shows Bitcoin has continued to flow out of the cryptocurrency exchange Binance even after its latest high above $93,000.

Bitcoin Binance Netflow Has Been Seeing Negative Spikes Recently

As pointed out by an analyst in a CryptoQuant Quicktake post, the Exchange Netflow for Binance has registered negative values recently. The “Exchange Netflow” here refers to an indicator that keeps track of the net amount of Bitcoin moving into or out of the wallets of a given exchange or group of platforms.

When the value of this metric is above zero, it means the investors are transferring a net number of tokens from their self-custodial wallets to the addresses attached to the exchange. As one of the main reasons why investors use these platforms is for selling-related purposes, this kind of trend can be bearish for BTC.

On the other hand, the indicator being negative suggests the exchange is observing the outflow of a net amount of the asset. Such a trend can be a sign that the holders want to HODL in the long term, which can naturally be bullish for the cryptocurrency’s value.

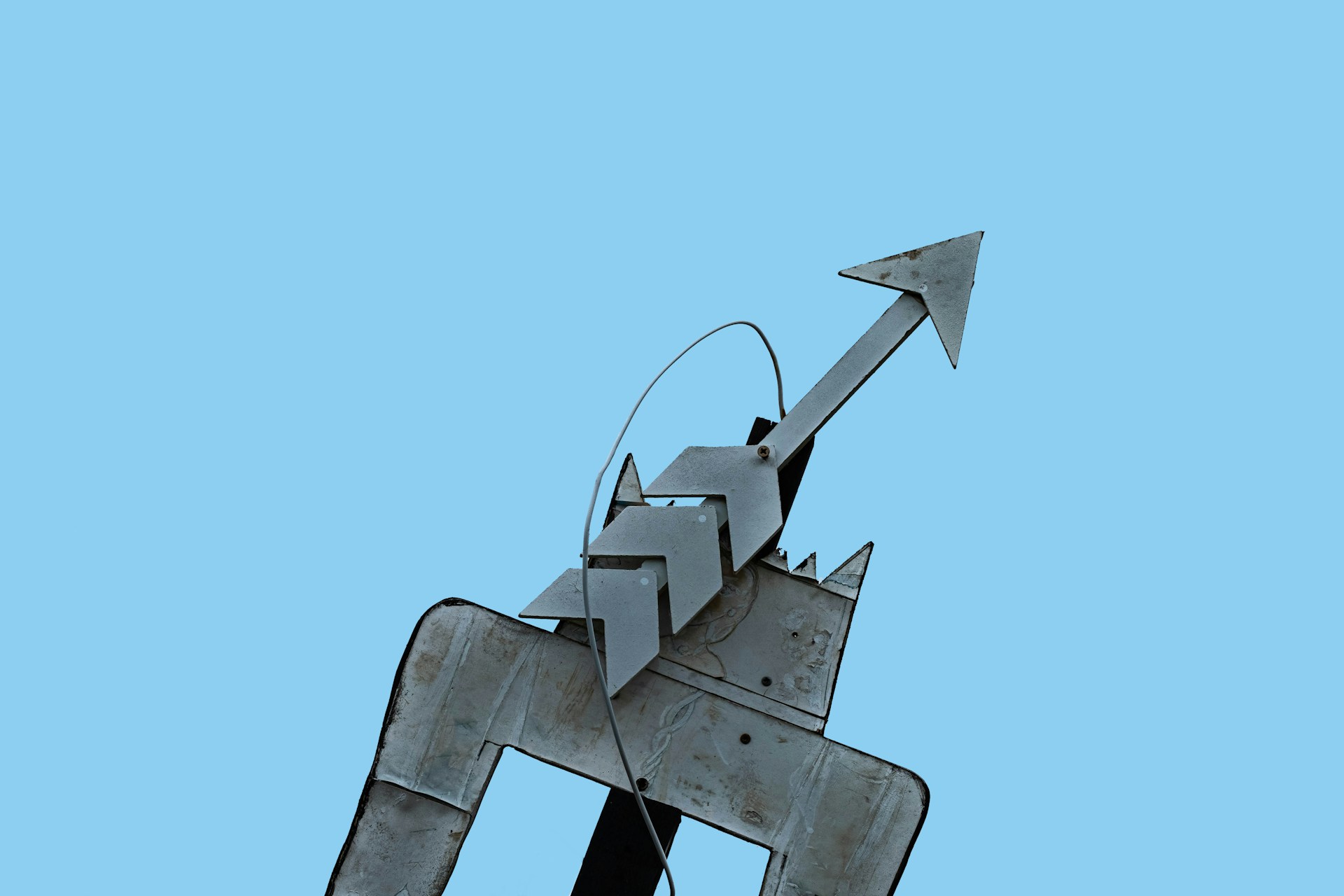

Now, here is a chart that shows the trend in the Bitcoin Exchange Netflow specifically for the Binance platform over the past month:

As is visible in the above graph, the Bitcoin Exchange Netflow for Binance had registered large negative spikes earlier in the month as BTC’s latest leg of the rally had kicked off. Given the timing, it’s possible that these large accumulation moves had helped fuel the run.

This week, the metric saw a reversal into positive territory as the cryptocurrency’s all-time high (ATH) exploration continued, but during the past day, a huge amount of BTC has left Binance once more. More specifically, the investors have withdrawn around 7,600 BTC from the exchange with these outflows, which is of a similar scale as the withdrawals witnessed earlier in the month.

The latest net outflows have come as the asset has set its newest high, which means there is significant demand for Bitcoin even at these expensive rates. This can naturally be a positive sign for the rally’s sustainability. That said, the indicator could still be to keep an eye on.

The reversal into the positive region earlier saw net inflows of a limited scale, but if another surge into the zones sees a significant amount of tokens entering the platform, it could indicate profit-taking of a level that can be a threat to the run.

BTC Price

Bitcoin set a new record above the $93,000 level yesterday, but it seems that the asset has gone through a pullback since then as its price is now trading around $91,100.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

English (US) ·

English (US) ·