Dr. Artur Kirjakulov, CEO and founder of XPMarket, has publicly accused Bitstamp of executing a “rug pull” against the XRP community. This serious allegation has ignited a contentious debate among industry stakeholders, raising questions about the stability and reliability of Bitstamp’s involvement in XRPL-based financial instruments.

Has Bitstamp Rug Pulled The XRP Community?

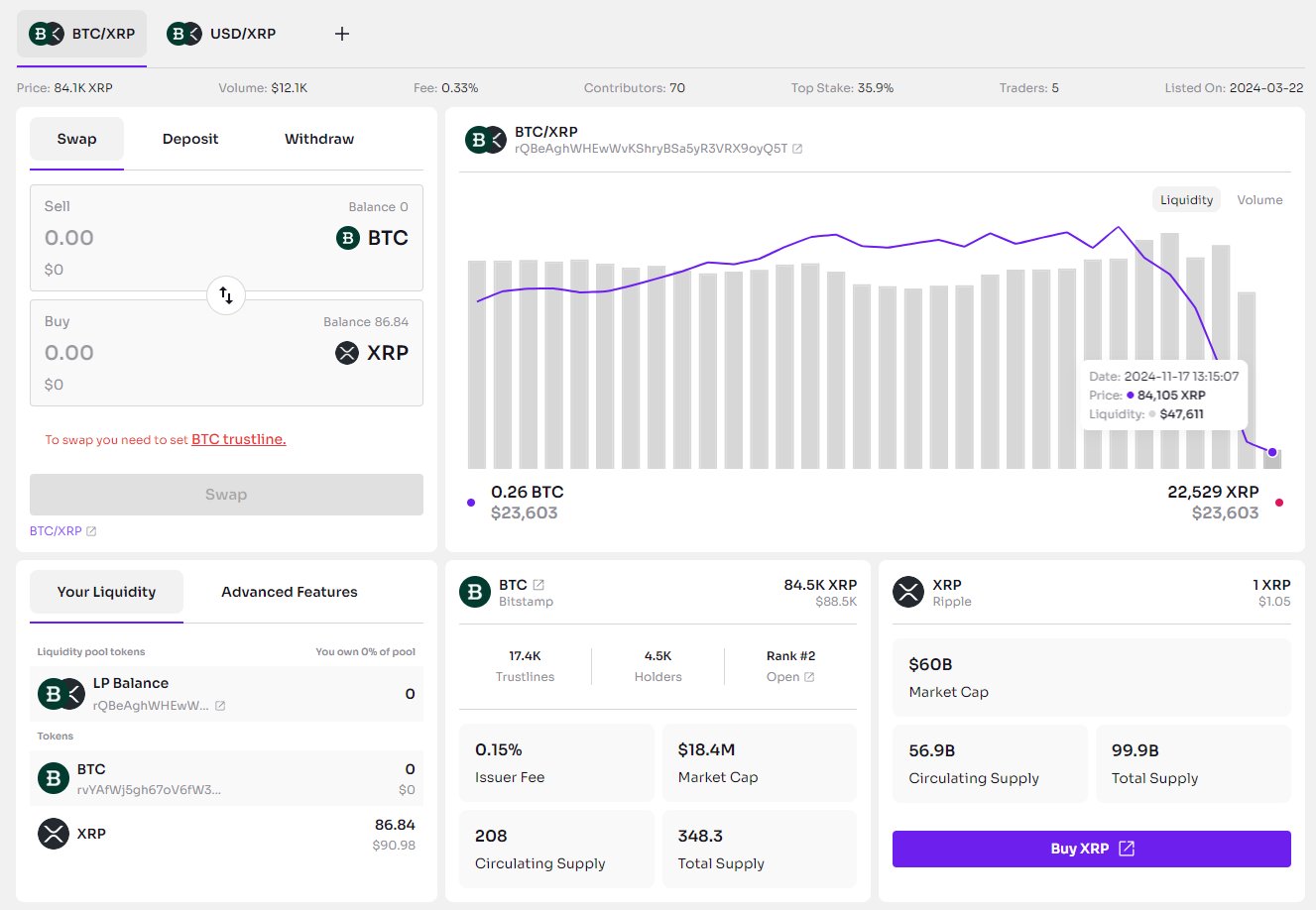

On Sunday, November 17, Dr. Kirjakulov took to X to voice his concerns regarding Bitstamp’s recent actions. “Bitstamp literally has just rug pulled XRPL community,” he claimed and asserted that Bitstamp had “withdrew more than 90% of liquidity from USD/XRP and BTC/XRP AMM Pools,” a move he characterized as a “silent” and unannounced maneuver that has left the XRPL community in a precarious position.

According to Kirjakulov, the absence of any formal statement from Bitstamp or RippleX exacerbates the uncertainty surrounding this liquidity withdrawal, potentially leading to “extremely volatile” trading conditions and significant price impacts for these asset pairs.

Source: X @Kirjakulov

Source: X @KirjakulovDr. Kirjakulov further highlighted the intricate relationship between Ripple and Bitstamp, noting that “Ripple owns an equity share in Bitstamp.” This connection suggests that Ripple’s stake in Bitstamp may influence the exchange’s strategic decisions within the XRPL space. The CEO of XPMarket expressed deep concerns about the assurance of a 1:1 conversion rate for Bitstamp-issued wrapped assets, drawing a parallel to the Stably incident where such guarantees were not honored. He emphasized, “How can anyone trust DeFi on XRPL, when official partners make such moves? Optics are terrible.”

The allegations did not go unnoticed within the XRPL community. Daniel Keller, CTO at Eminence and an XRPL ambassador, responded with skepticism regarding the authenticity of Kirjakulov’s claims. Keller questioned the legitimacy of the accounts associated with the liquidity pools, stating, “Do we know that’s an official Bitstamp account? Looking back on the activation sequence it was activated via Binance, which is weird if Bitstamp runs it.”

In response, Dr. Kirjakulov maintained that the accounts in question were indeed affiliated with Bitstamp. He clarified, “Going through the accounts it is visible that they are clearly associated with Bitstamp, because they are also market making these tokens. There is literally no one else interested here in market making these tokens, because they are niche and unpopular.”

He further explained that the liquidity had been pulled back to a market-making (MM) account, reinforcing his assertion of Bitstamp’s direct involvement. Kirjakulov also dismissed the significance of activation accounts, noting, “Activation account does not mean anything. I activate my account from multiple exchanges specifically to make less traceable.”

Keller pressed for more concrete evidence to support the claims. He asked: “Can you share some of these connecting transactions because if you already looked them up it would be cool to share. An activation account is very important if you are an exchange supporting an LP, because you want people to know it’s your company.

Dr. Kirjakulov responded by emphasizing the strength of the circumstantial evidence pointing towards Bitstamp, stating, “Circumstantial evidence? Yes. But this evidence points rather clearly into Bitstamp, as no one else has such a huge amount of these assets issued by them, other than someone affiliated by them. And circumstantial evidence is no excuse to ignore them.”

The discourse extended to the topic of Bitstamp’s IOU services. Michael Nardolillo, a user on X, defended Bitstamp by highlighting its regulated status and the redeemability of its IOUs. He argued, “There’s no guarantee Bitstamp will honor their IOUs?! That’s like saying there’s no guarantee you can withdraw your crypto from an exchange. Bitstamp is highly regulated, IOUs are always redeemable they are no different than holding an asset on an exchange.”

This defense was met with skepticism from Kirjakulov, who drew attention to past failures in the industry. He countered, “Somewhere FTX creditors did a few facepalms. Again, Stably did not honor 1:1 conversion. And there is nothing on Bitstamp or even GateHub sources to claim there will be 1:1 conversion and absolutely nothing of proof of funds.”

In an attempt to substantiate his defense, Nardolillo shared a screenshot from Bitstamp’s website detailing their IOU service. The screenshot outlines that users can transfer value on the XRP Ledger through IOUs issued by Bitstamp in exchange for real assets like BTC, USD, EUR, or ETH.

Dr. Kirjakulov highlighted a critical oversight in this arrangement. He stated, “And this is the problem. This is the only way how you can make this swap. Also, it says absolutely nothing about 1:1 conversion. What if it depegs by 50%? Will they make 1 bUSD (which is worth 50 cents) swap to 1 USDT (which is worth 1 USD)?”

As of press time, the XRP community awaits an official response from Bitstamp. XRP traded at $1.15.

XRP price, 1-day chart | Source: XRPUSDT on TradingView.com

XRP price, 1-day chart | Source: XRPUSDT on TradingView.comFeatured image created with DALL.E, chart from TradingView.com

English (US) ·

English (US) ·