Bitwise diversifies offerings with Solana ETF application amid expanding crypto market demand.

Key Takeaways

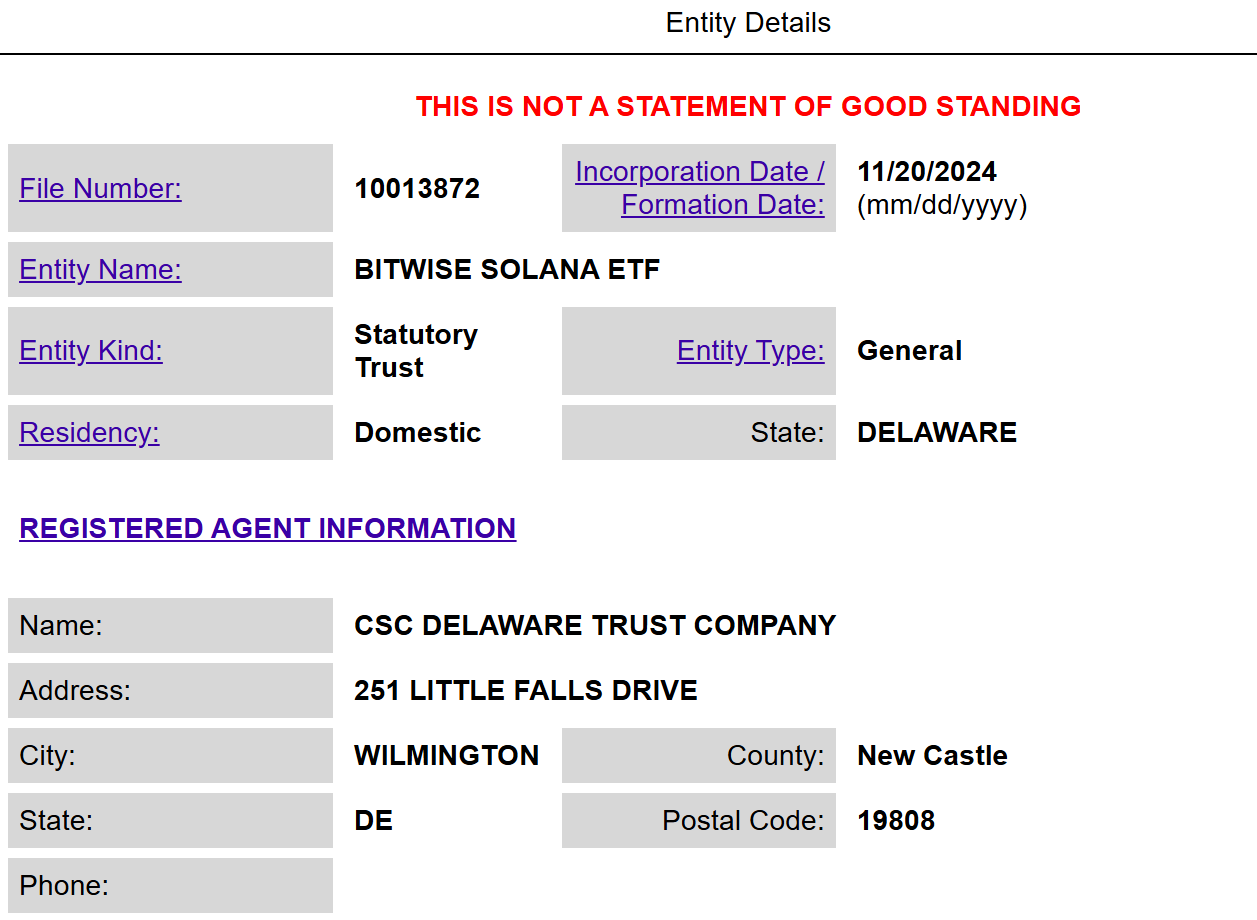

- Bitwise has filed to establish a Delaware trust for a proposed Solana ETF.

- The filing is part of Bitwise's expansion strategy, including recent acquisitions and a jump in assets under management.

Bitwise Asset Management has filed to establish a trust entity for its proposed Bitwise Solana ETF in Delaware—a preliminary step in the process of launching the ETF, which signals a potential submission to the SEC for regulatory approval.

With this filing, Bitwise will soon join a lineup of asset managers seeking to launch a Solana ETF. VanEck made the first move in June, followed briefly by 21Shares. 21Shares called the filing a necessary step while VanEck stated that Solana, like Bitcoin and Ethereum, is a commodity.

Bitwise’s proposed Solana ETF aims to track the price of Solana, the world’s fourth-largest crypto asset by market cap. However, the firm has yet to mention an exchange listing or a proposed ticker.

The move comes after the crypto asset manager lodged an S-1 registration form with the SEC to launch an XRP ETF last month, being the first to file for a fund that provides exposure to Ripple’s native crypto asset.

Bitwise has seen substantial growth in 2024, with $5 billion in assets under management reported as of October 15, representing a 400% increase year-to-date. The company has doubled its AUM after it acquired Ethereum staking service Attestant earlier this month.

Bitwise’s spot Bitcoin ETF, the BITB fund, has attracted $2.3 billion in net inflows since launch, ranking behind BlackRock’s IBIT and Fidelity’s FBTC. BITB’s Bitcoin holdings now exceed $4 billion.

Disclaimer

1 week ago

4

1 week ago

4

English (US) ·

English (US) ·