Bitwise has joined the growing list of asset managers racing to offer Avalanche exposure through regulated investment vehicles.

Summary

- Avalanche ETF demand heats up as Bitwise submits an S-1 filing to the SEC to launch a spot AVAX fund.

- The ETF will offer direct AVAX exposure via traditional brokerage accounts.

- Coinbase Custody will safeguard tokens with institutional-grade cold storage.

- Bitwise follows similar filings by VanEck and Grayscale, signaling rising institutional interest.

Bitwise has filed an application with the U.S. Securities and Exchange Commission (SEC) to launch a spot Avalanche exchange-traded fund (ETF). This move marks another major step in expanding institutional access to the AVAX ecosystem amid a broader trend of growing demand for regulated exposure to the asset.

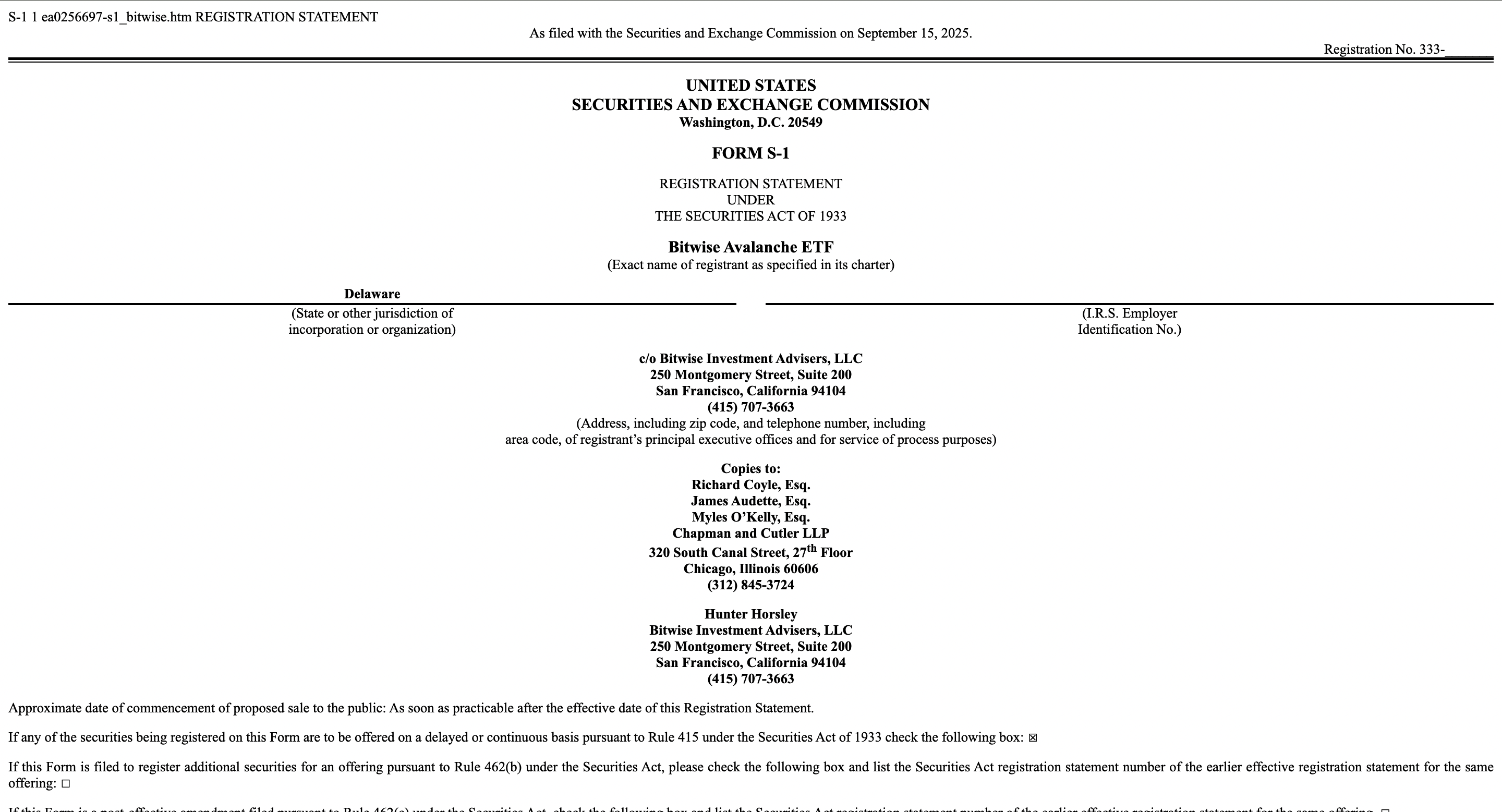

The Form S-1 registration, submitted on Sept 15, 2025, outlines Bitwise’s intention to create a trust-based ETF that provides direct access to Avalanche (AVAX) through traditional brokerage accounts.

Bitwise’s Avalanche ETF filing | Source: SEC

Bitwise’s Avalanche ETF filing | Source: SEC“The Trust provides investors with the opportunity to access the market for Avalanche through a traditional brokerage account without the potential barriers to entry or risks involved with acquiring and holding Avalanche directly,” the filing stated.

The proposed Bitwise Avalanche ETF would offer investors a more accessible and regulated way to gain exposure to AVAX without the complexity of managing wallets or private keys. This is appealing to institutional investors who are restricted from holding crypto directly or lack the infrastructure to do so securely.

Meanwhile, Bitwise’s ETF structure avoids the use of derivatives and instead holds the AVAX token directly in custody. Shares of the trust will be issued and redeemed in blocks of 10,000 shares known as “baskets” which can be settled in either cash or AVAX. Also, the trust’s net asset value (NAV) will track the CME CF Avalanche–Dollar Reference Rate, calculated and published daily by CF Benchmarks.

Coinbase Custody Trust Company, a regulated entity under New York banking law, will act as custodian for the AVAX tokens held by the fund. Assets will be stored in segregated accounts with cold storage protections, aligning with institutional-grade security standards.

Growing institutional interest for Avalanche ETF amid network growth

This latest filing signals Bitwise’s ongoing strategy to broaden its crypto product offerings for traditional investors. It also positions the firm among the growing list of asset managers seeking regulatory approval to offer investors exposure to Avalanche. VanEck filed a similar S-1 for a spot AVAX ETF in March 2025, while Grayscale applied in August 2025 to convert its existing Avalanche Trust into a spot ETF listed on Nasdaq. Neither application has received final SEC approval yet.

Interestingly, the race for an Avalanche ETF comes at a time of heightened activity in the AVAX ecosystem. On-chain data reveals that Avalanche has hit $2 billion in DEX volume for 8 weeks straight for the first time since 2021.

Recently, the Avalanche Foundation also announced plans to raise $1 billion to fund two new U.S.-based treasury entities that would purchase AVAX tokens at discounted rates. This move is seen as both a liquidity injection and a vote of confidence in the long-term growth of the Avalanche network.

English (US) ·

English (US) ·