Bitcoin ETFs see unprecedented growth as investors flock to Blackrock amid rising crypto valuations.

Key Takeaways

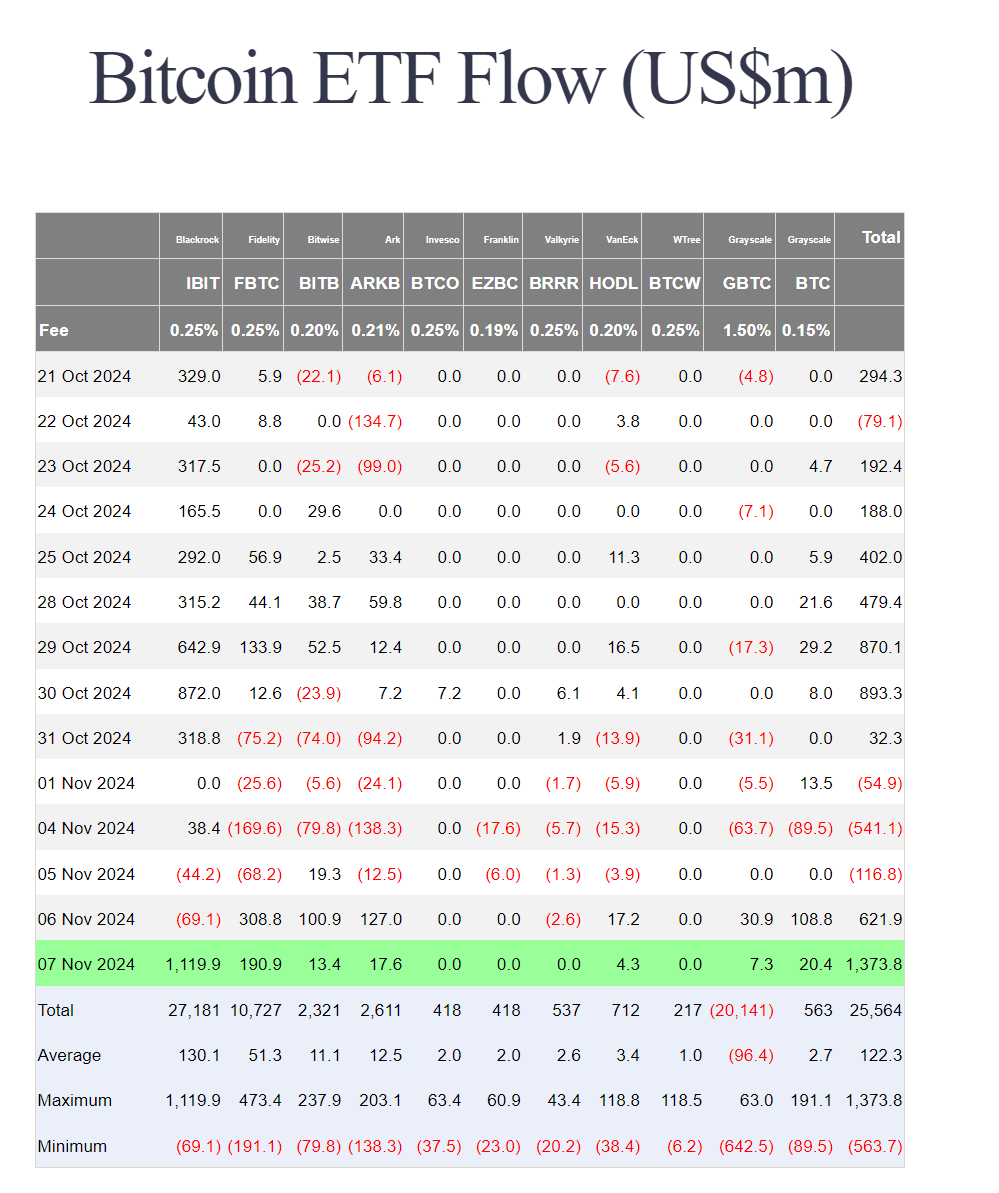

- BlackRock's Bitcoin ETF saw a record single-day inflow of $1.1 billion.

- Total inflows for US spot Bitcoin ETFs reached $1.37 billion during the session.

BlackRock’s iShares Bitcoin Trust (IBIT) recorded $1.1 billion in inflows during a single trading session, marking the largest one-day inflow among US spot Bitcoin ETFs. The total inflows across all Bitcoin ETFs reached $1.37 billion during the session.

source: Farside Investors

source: Farside InvestorsBlackRock’s ETF dominated the day’s activity with $1.12 billion in inflows, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) attracted $190.9 million during the same period.

The substantial ETF inflows coincided with Bitcoin’s price movement, which briefly reached $76,500 before settling around $75,700. The reported flows may reflect activity from the previous trading day due to T+1 reporting, explaining why BlackRock’s ETF showed negative flows in the prior session while other funds saw major inflows.

Since their launch in January 2024, US spot Bitcoin ETFs have accumulated billions in assets under management, with BlackRock’s IBIT emerging as the market leader.

Last month, US spot Bitcoin ETFs reached a record asset value over $66.1 billion, thanks to a six-day inflow streak and a Bitcoin price increase.

Disclaimer

1 week ago

3

1 week ago

3

English (US) ·

English (US) ·