Bitcoin and Ethereum witnessed yet another phase of short liquidations, bringing bullish momentum to the assets.

According to data provided by Coinglass, the total crypto liquidations reached $138.23 million as bullish sentiment dominates the market. Of this tally, over $95 million has been liquidated from short trading positions, showing a 71% dominance over long positions.

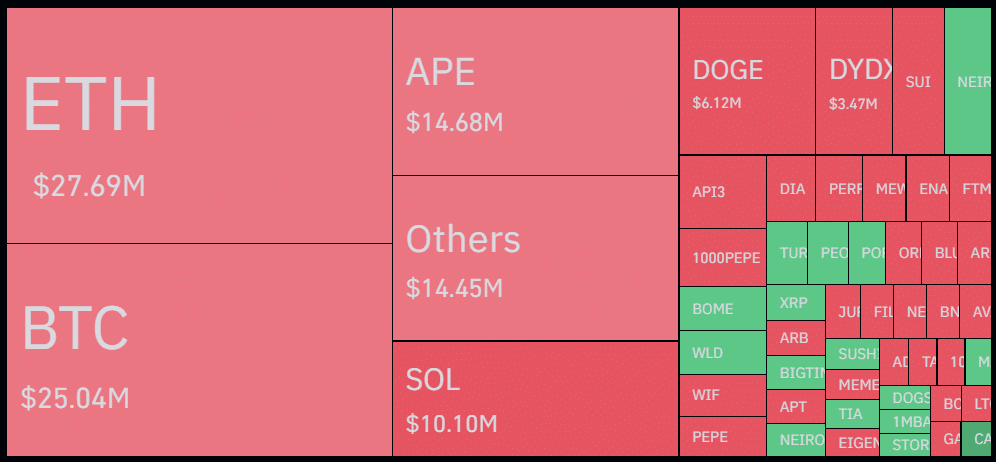

Crypto liquidations map – Oct. 21 | Source: Coinglass

Crypto liquidations map – Oct. 21 | Source: CoinglassIncreased short liquidations usually create buying pressure.

Ethereum (ETH) is leading the chart with $27.69 million in liquidations—$23.84 million shorts and $3.85 million longs. ETH gained 3.1% in the past 24 hours and is trading at $2,730 at the time of writing.

Its daily trading volume rallied by 117%, reaching $17.4 billion, as investors interest increases.

Notably, the largest single liquidation order was executed on Binance, the largest crypto exchange by trading volume, and was worth $6.64 million in the ETH/USDT pair.

Bitcoin (BTC) takes the second spot with $25 million in liquidations—$21 million shorts and $4 million longs. This caused the BTC price to reach a four-month high of $69,460 earlier today. Despite the latest correction, Bitcoin is still up 0.45% over the past day and is changing hands at $68,700 at the reporting time.

The flagship crypto asset saw a 74% surge in its daily trading volume, currently at $24 billion.

The global crypto market cap has also reached a three-month high of $2.49 trillion as the majority of the leading alt-coins record bullish gains, according to data from CoinGecko.

If long positions start to liquidate, it could potentially create significant selling pressure as traders would try to minimize their losses.

English (US) ·

English (US) ·