The Senate hopes to push through a Bitcoin reserve bill in the first 100 days of Trump’s presidency while the Republicans consult on crypto policy.

American Senator Cynthia Lummis expressed optimism that plans to create a strategic Bitcoin (BTC) reserve will be implemented soon after Donald Trump‘s inauguration.

“I believe we can get this done with bipartisan support in the first 100 days if we have the support of the people. It is a game changer for the solvency of our nation. Let’s put America on sound financial footing and pass the Bitcoin Act!”

Senator Cynthia LummisLummis’s post responded to David Bailey, BTC Inc. CEO, who has been actively advising Trump on cryptocurrency policy. Bailey had previously suggested that such a reserve could be created quickly under the new administration.

“The Bitcoin and Crypto industry’s policy wishlist is long and pressing… but the Strategic Bitcoin Reserve is the #1 most urgent and transformational policy on President Trump’s agenda. The downstream effects change everything. We must get it done in the first 100 days.”

David Bailey, BTC Inc. CEOBailey also floated the idea of using Bitcoin more widely in government programs. He suggested that if Robert F. Kennedy Jr. were appointed Secretary of Health and Human Services and assumed responsibility for managing the Social Security program, there would be a discussion about paying 5-10% of Social Security payments in Bitcoin, stored in a strategic reserve.

What is known about the Bitcoin reserve project?

Trump announced the creation of a Bitcoin reserve in the U.S. in July 2024 during a speech at an event supporting his election campaign. A few days before the politician’s announcement, media reports appeared that Senator Cynthia Lummis was preparing a Bitcoin reserve bill called the BITCOIN Act of 2024.

The act proposes creating a network of decentralized vaults nationwide to securely store Bitcoin reserves. The U.S. Treasury Department is supposed to have 200,000 BTC annually for five years, and the U.S. reserves would eventually amount to one million BTC. It is also assumed that Bitcoin reserves will be stored for at least 20 years.

The cryptocurrency can be purchased at the expense of other assets at the authorities’ disposal, such as gold certificates. Lummis proposes to cover the costs of purchasing cryptocurrency by revaluing it.

In addition, the proposal plans to implement a reserve verification system to verify the availability of funds and consolidate all existing BTC that are currently in the possession of the U.S. government into a new reserve.

Bitcoin reserves to make the U.S. new crypto haven

Analysts at CoinShares write that implementing the plan to create strategic reserves in BTC can generate significant institutional and government interest in Bitcoin. According to their forecasts, this will potentially accelerate its growth and raise its value to new heights.

In general, many participants in the crypto community expect that the U.S. bet on Bitcoin can significantly increase the cryptocurrency’s investment attractiveness. For example, Anthony Pompliano, the founder of Pomp Investments, is confident that the initiative will cause the market to experience FOMO.

Lummis’ proposal implies that the pace of Bitcoin purchases may outpace the cost of BTC mining. In this case, a cryptocurrency deficit will form in the market, which can also support the growth of its rate.

Trump’s rally is in full swing. Or just a rally?

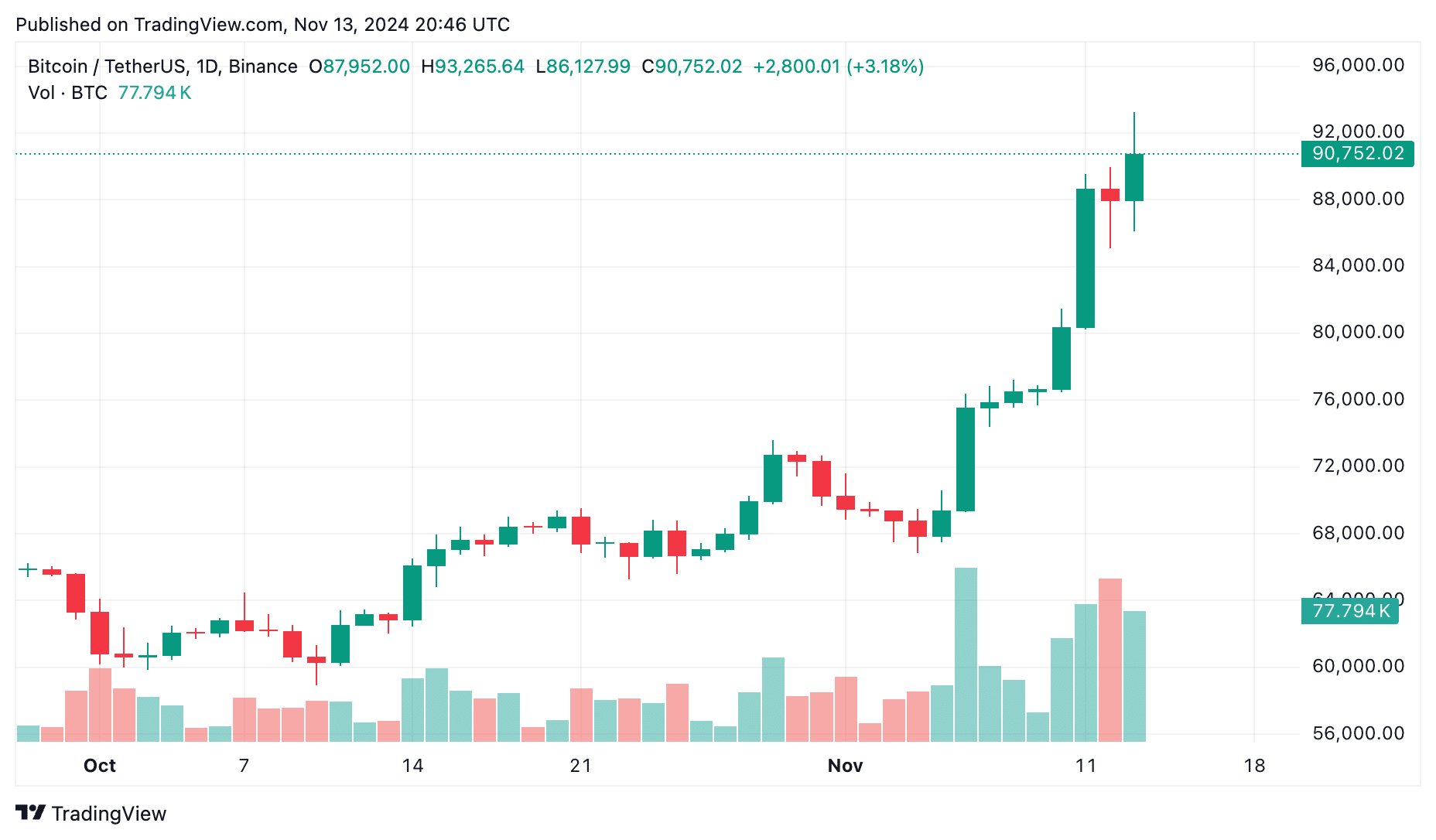

In general, Lummis’ words are confirmed based on the dynamics of Bitcoin and the entire crypto market since the U.S. elections. Over the past week, Bitcoin has repeatedly updated historical highs.

The total capitalization of the entire crypto market has grown by 25% in a week and exceeded $3 trillion. At the same time, the price of Bitcoin has increased by 23.8% in 7 days, several times updating the all-time high and reaching $93,000.

BTC Price Chart | Source: crypto.news

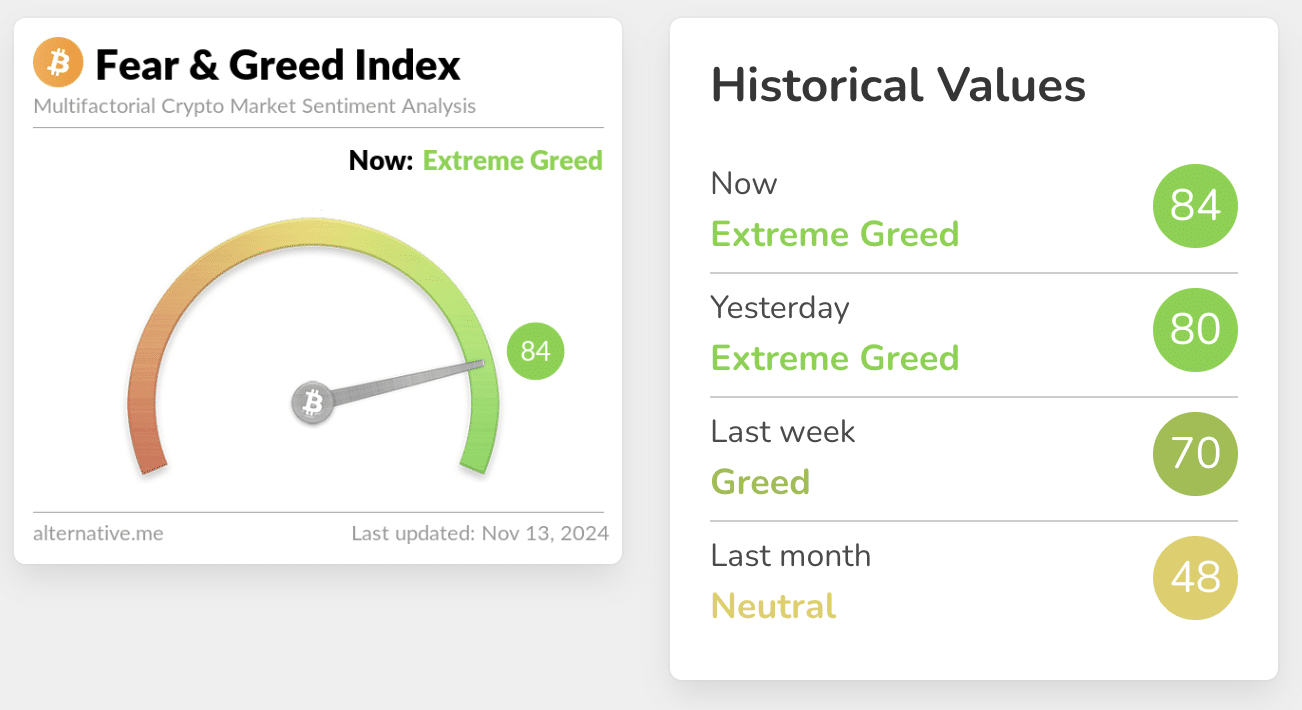

BTC Price Chart | Source: crypto.newsThe crypto market’s index of fear and greed has grown by as much as 14 points in a week—from 70 points to 84 out of 100- indicating the market’s extreme greed.

Source: Alternative.me

Source: Alternative.meHowever, some experts doubted that Trump’s victory was the only growth driver of the crypto market.

Thus, the co-founder of Onramp Bitcoin, Jesse Myers, noted that such crypto market dynamics are routine and predictable after the Bitcoin halving in April. During this time, a shortage of coins has arisen on the market, therefore the price is growing under pressure from demand. This triggers a chain reaction that should lead to another bubble.

If you're wondering what's happening with #Bitcoin…

Yes, the incoming Bitcoin-friendly administration has provided a recent catalyst…

But, that's not the main story here.

The main story here is that we are 6+ months post-halving.

And that means a supply shock has… pic.twitter.com/XkwPoPxrj2

Myers reminded that the same situation happened after each previous Bitcoin halving, so it makes sense to expect something similar this time. The change of power in the U.S. to one potentially more friendly to cryptocurrencies only acted as a catalyst.

English (US) ·

English (US) ·