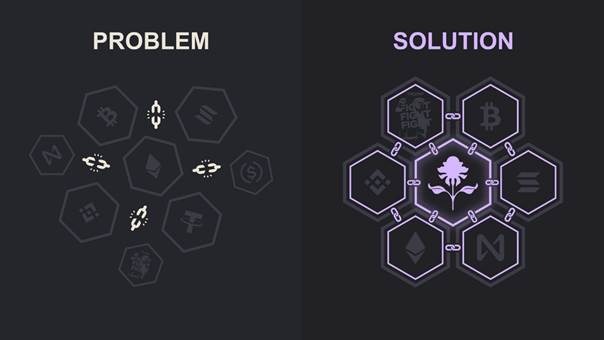

Among the myriad of launchpads on the crypto landscape, Calyx differentiates itself by removing what many projects and investors perceive to be the most painful aspect: cross-chain fragmentation. Based on NEAR Intents and managed by Aurora, this protocol empowers users to join token sales with funds they already hold, no cross, no swaps, no multi-transactions involved. Covering 19+ chains with $100B+ in cross-chain liquidity, and a simple application process for founders, Calyx is leading the way as the hub of choice for easy, multi-chain token launches.

But does it ever live up to its hype? Let’s demystify Calyx and see how it works, what unique advantages it offers, and if it’s right for projects looking to dump or investors looking for the next big break.

Calyx simplifies the process to participate; however, investors should consider the following advantages and disadvantages of the project.

Pros:

- No bridging or swaps, use assets you already hold.

- 19+ chains supported, including Ethereum, BSC, Solana, Arbitrum, and NEAR.

- Instant claims and cross-chain withdrawals, no waiting for bridges.

- Transparent sales with clear funding targets and participant counts.

- Rewards program.

Cons:

- Limited project selection (for now): Calyx is still growing its pipeline.

- Vesting periods apply: tokens aren’t always immediately tradable.

- Competition for allocations: popular sales (like Intellex) can fill up fast.

How Calyx works: A frictionless cross-chain experience

Calyx makes token sales easier by breaking down the typical walls. Here is how to participate (in three key steps):

Participate: Join sales with any asset, any chain

Most launchpads require users to bridge assets or swap tokens prior to participating in a sale. Calyx distinguishes itself from the crowd by enabling users to use any supported assets: ETH on Ethereum, SOL on Solana, USDC on Arbitrum and all from their own wallets. Connect, sign one transaction and you’re in.

Ponder is an investor with USDT on Tron wishing to participate in a sale for a new project on Ethereum. On regular exchanges, they would have to bridge their USDT to Ethereum, pay gas fees, and pray the transaction goes through before the sale ends. Now with Calyx, all they do is connect their Tron wallet, sign the transaction, and participate directly, no additional steps.

Claim: Unlock tokens instantly across chains

The tokens become continuously unlocked since the vesting period for a sale starts. Claiming them is just as easy: a single transaction lets users withdraw to any of the 19+ supported chains or leave them on Calyx for trading. Say goodbye to bridge waits and failed transfers.

Trade: Cross-chain liquidity from day one

Tokens created on Calyx can be traded across all chains immediately. This means no liquidity silos, no matter if you are using Avalanche, BSC or Polygon, you can buy, sell and hold without limitations. The platform’s OmniBridge technology guarantees that tokens remain portable without requiring redeployment, a significant benefit for projects seeking mass adoption.

| Step | Traditional Launchpads | Calyx |

| Participation | Bridge assets, swap tokens, multiple transactions | Use any asset, one transaction |

| Claiming | Manual bridging, high gas fees | Instant claim, cross-chain withdrawal |

| Trading | Limited to original chain | Available on 19+ chains from day one |

For projects: Why launch on Calyx?

Calyx isn’t just for investors, it’s a powerful tool for founders. That’s what makes it such a compelling opportunity for projects:

Cross-chain reach without the hassle

Many launchpads force projects to one blockchain, significantly shrinking their potential audience. Calyx turns the script on its head following the traditional launchpads by allowing cross-chain sales immediately. A project launching on Ethereum is able to invite users from Solana, Arbitrum, or even NEAR to participate without having to switch networks. That scales up exponentially.

Comprehensive support: Tokenomics to liquidity

Calyx doesn’t only host sales, it gives full-spectrum assistance:

Pre-launch: Reviewing tokenomics, developing GTM (go-to-market) and compliance (including KYB for projects and optional KYC for participants).

Post-sale: Liquidity management tools, agentic liquidity (auto-rebalancing across chains), KYT (Know Your Transaction) monitoring for security.

Take Intellex, a project which capped its sale on Calyx in less than five hours, raising 137% of its $50K target. Using Calyx’s cross-chain infrastructure, Intellex drew 203 participants from different ecosystems, a logistical nightmare if confined to a “single-chain” platform.

Security and compliance built in

Calyx’s smart contracts are audited, and the platform requires KYB (Know Your Business) for projects to avoid rug pulls. KYC (optional) for participants is another layer of trust – while KYT is keeping the transactions clean.For founders, it means fewer headaches with regulators and more confidence for investors.

No redeployments, just expansion

OmniBridge means projects will not have to rewrite contracts to deploy to more chains. Tokens can be easily carried from one ecosystem to another, reducing time and cost to developers. In a way, this is a game-changer for teams that just want to get bigger without sinking into technical debt.

Calyx rewards: Earn while you participate

Calyx isn’t just a launchpad, it’s a rewards vault. Users can earn by:

- Taking part in sales (bonuses for early supporters).

- Staking AURORA token.

- Referring friends.

Despite the rewards mechanism being less developed than platforms such as Binance Launchpad, it’s a nice bonus for active users.

Security: Can you trust Calyx?

Security is what makes or breaks launchpads. Here’s how Calyx safeguards its users:

- Audited smart contracts: Calyx’s code has been subject to third-party audits to halt exploits.

- Projects must undergo KYB: Every project needs to verify its business credentials before it, you know, does anything.

- Optional KYC for users: While not mandatory, KYC adds a layer of trust.

- KYT monitoring: Transactions are checked for suspicious activity.

- Non-custodial: You keep hold of your funds until you make a sale.

That said, no platform is 100% risk-free. Investors should still:

- Do your own due diligence on the projects.

- Keep your large holdings in hardware wallets.

How to get started with Calyx

Ready to dive in? Here’s how to get started:

- Head to Calyx.xyz, then connect your wallet.

- Check active sales in the “Launch on Calyx” tab.

- Participate in a sale with your current assets, no bridging needed.

- Mint and trade your tokens on multiple chains post-vesting Start vesting now.

For projects the process is simple:

- Apply your project (tokenomics, roadmap, team details).

- Receive strategic and compliance advice from the Calyx team.

- Launch cross-chain and reach participants on 19+ ecosystems.

Final verdict: Is Calyx worth it?

For projects:

So, if you are launching a token and want maximum reach with minimum pain, Calyx is a clear pick. The ability now to access 19+ chains without having to redeploy contracts again is a major time- saver, and the integrated compliance tools help mitigate regulatory risks. The success of the Intellex sale (137% funded in 5 hours) demonstrates the model is sound.

For investors: Calyx addresses the two biggest headaches with traditional launchpads, no bridging, no swaps, no chain restrictions. If you’re sick of trying to juggle multiple wallets or missing sales because of gas fees, this is a breath of fresh air. The rewards system is a bonus, though it’s not as robust as some competitors

English (US) ·

English (US) ·