North America remains the top spot for the crypto market, accounting for about $1.3 trillion, or 22.5% of on-chain activity on the international level, data from Chainalysis shows.

Cryptocurrencies keep concentrating in North America despite unclear local regulatory climate, as recent data from Chainalysis shows that the continent received $1.3 trillion in on-chain value, representing 22.5% of global activity between July 2023 and June this year.

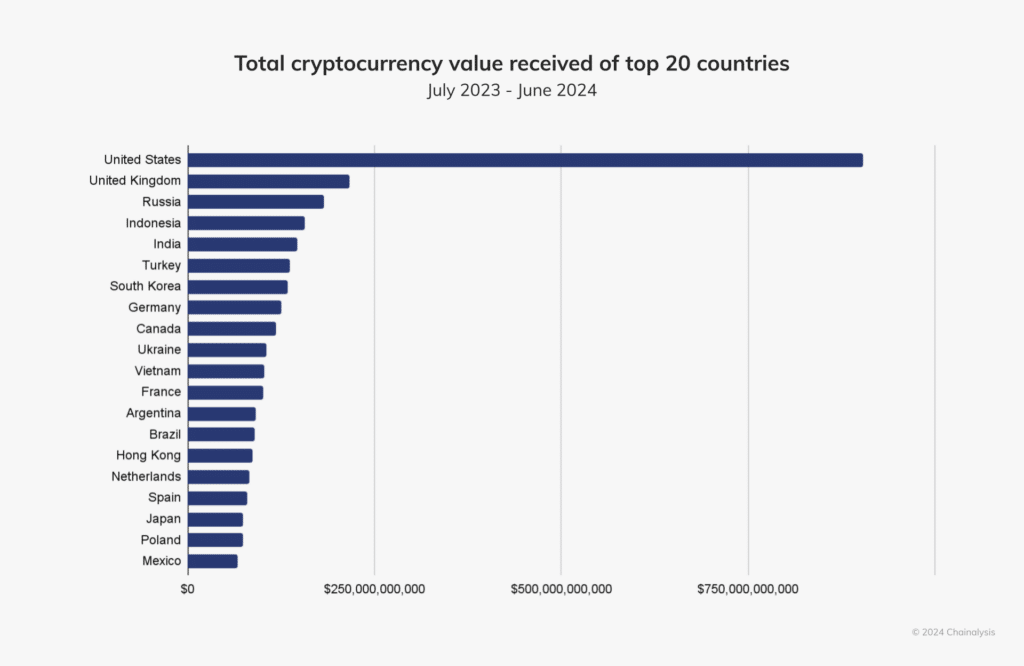

Total crypto value received between July 2023 and June 2024 | Source: Chainalysis

Total crypto value received between July 2023 and June 2024 | Source: ChainalysisAnalysts at the New York-based blockchain forensic firm say the landscape is mainly driven by institutional investors, adding that approximately 70% of the region’s crypto activity “consisted of transfers exceeding $1 million.” And while U.S. markets appear to be the largest in the world, they are also “more volatile than global markets in terms of growth,” analysts say.

“In recent quarters, the U.S. has demonstrated heightened sensitivity to both bull and bear markets. When cryptocurrency prices rise, the U.S. market shows larger increases in growth than the global market — and the inverse is true when cryptocurrency markets decline.”

Chainalysis

However, the U.S. markets have encountered challenges over the past year, particularly as stablecoin activity has shifted away from U.S.-regulated platforms, the report highlights.

Chainalysis points out that until 2023, the share of stablecoin transactions on U.S.-regulated exchanges had been “steadily increasing,” but in 2024, this trend “began to reverse.” As a result, crypto exchanges outside the U.S. have started to see rising volumes of stablecoin transactions, indicating that global stablecoin adoption is “outpacing U.S. growth,” according to Chainalysis.

Although smaller than their U.S. counterparts, the Canadian market also remains big in North America, with approximately $119 billion in value received during the period, the data indicates.

In early October, Chainalysis revealed that Latin America became the second-fastest-growing region with a year-over-year growth rate exceeding 42%. Per the firm’s data, Brazil received nearly $90.3 billion in crypto between July 2023 and June this year, trailing closely behind Argentina.

English (US) ·

English (US) ·