Eastern Europe sees growth in crypto usage as institutional and grassroots adoption rise in Ukraine and Russia, fueled by large transactions and retail use amid regional instability.

Crypto adoption is accelerating across Eastern Europe, led by robust institutional and grassroots engagement in Ukraine and Russia, a Chainalysis report reveals.

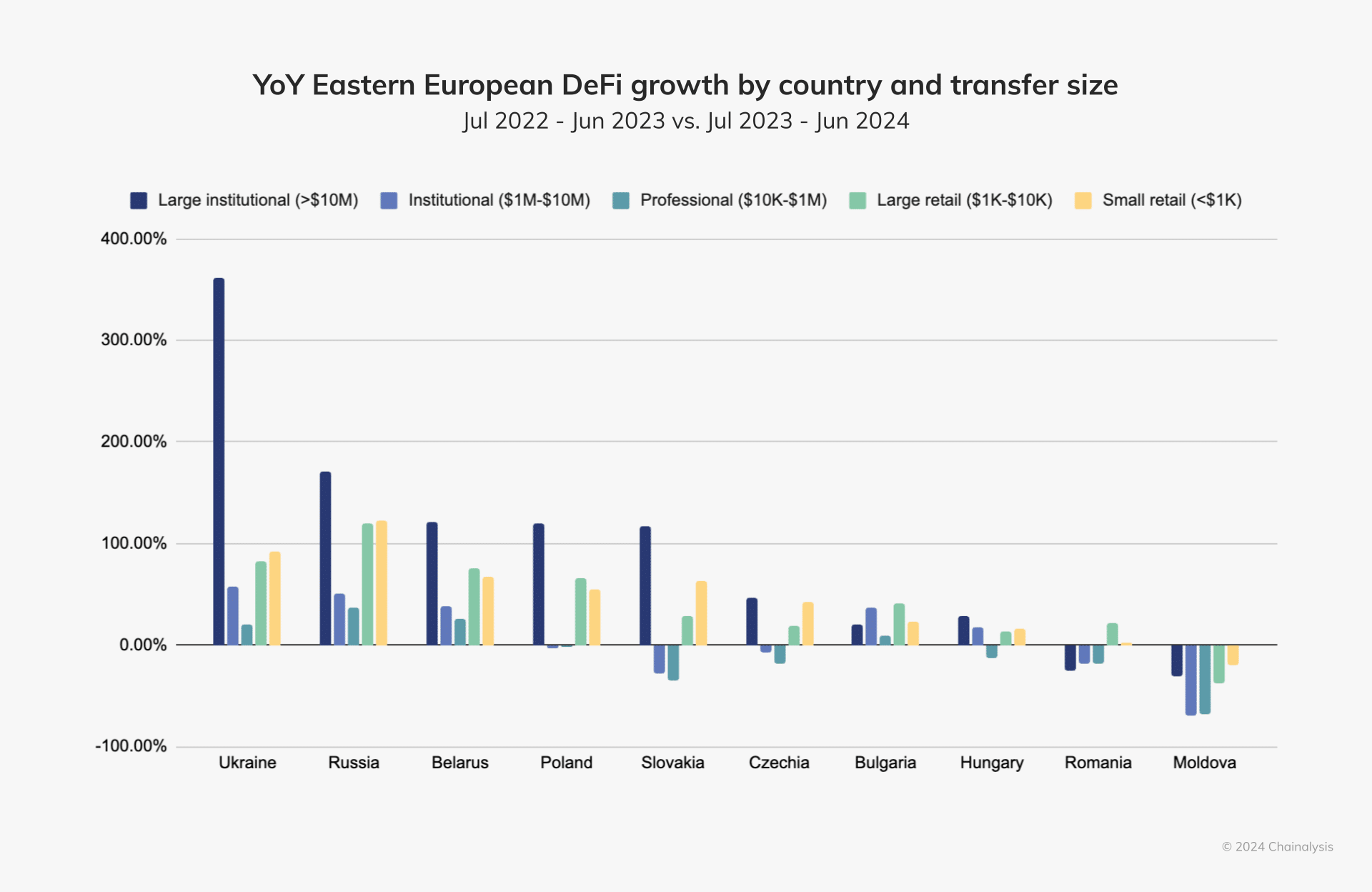

Over the past year, Ukraine recorded a nearly 362% increase in large institutional decentralized finance transactions (exceeding $10 million), fueling much of its decentralized finance growth. In Russia, along with Belarus, Poland, and Slovakia, large institutional transfers similarly drove decentralized finance expansion, according to the New York-based blockchain forensic firm.

YoY Eastern European defi growth by country and transfer size | Source: Chainalysis

YoY Eastern European defi growth by country and transfer size | Source: ChainalysisRetail crypto activity is also on the rise in Ukraine, where small and large retail transactions have increased by 82.2% and nearly 92%, respectively. Chainalysis explains that small transactions typically indicate “grassroots adoption,” and, given the region’s geopolitical instability and Ukraine’s recent recovery from inflation, these smaller transactions could demonstrate investors using crypto to bolster everyday purchasing power.

Decentralized finance booms in Eastern Europe

Data compiled by Chainalysis also revealed that decentralized exchanges in Eastern Europe saw the largest increase in crypto inflows. Regionwide, decentralized exchanges received $148.6 billion in crypto.

“Crypto sent to DEXes in Ukraine and Russia grew by 160.2% and 173.8%, respectively, with Ukrainian DEXes receiving $34.9 billion and Russian DEXes, $58.4 billion.”

Chainalysis

Chainalysis analysts highlighted that in 2023, decentralized finance accounted for over 33% of all crypto activity in Eastern Europe. Globally, Eastern Europe ranks third in year-over-year decentralized finance growth, following Latin America and Sub-Saharan Africa, particularly in regions where regulatory conditions remain uncertain.

English (US) ·

English (US) ·