XRP price is down 2% on the day and nearly 9% over the past seven days, extending its losing streak. The altcoin’s decline has been influenced by legal uncertainty in the Securities and Exchange Commission’s lawsuit against Ripple and the $50 million settlement figure. Bitcoin’s ongoing consolidation may also be contributing to indecisiveness among traders.

XRP price forecast

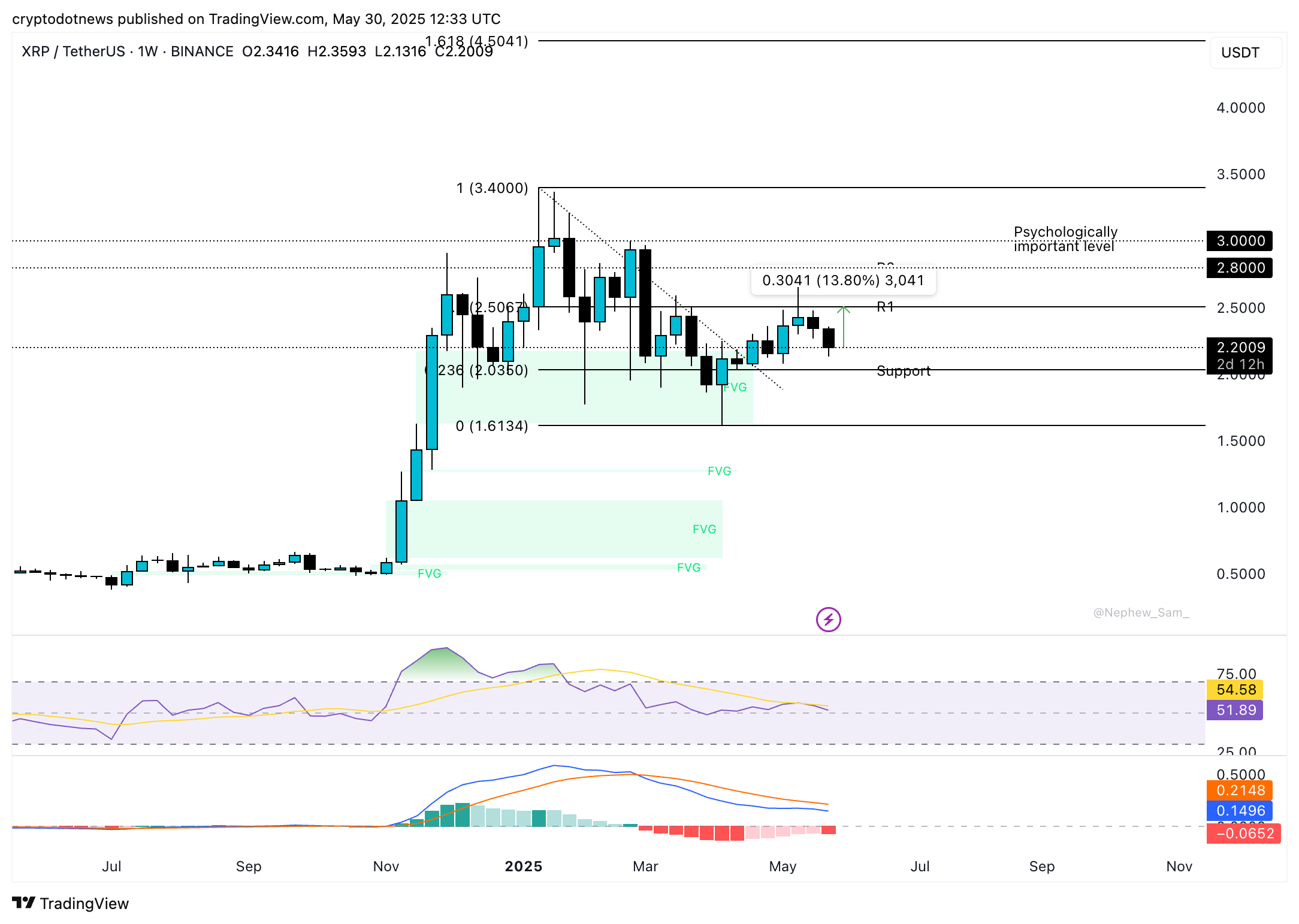

XRP is currently consolidating under the $2.36 level, which previously acted as key support. Technical indicators on the daily chart, specifically the RSI and MACD, support a bearish outlook for the XRPLedger’s native token.

XRP is currently 7.33% above its key support S1 at $2.0350, the 23.6% Fibonacci retracement of the decline from its 2025 peak of $3.4000 to the April low of $1.6134.

A 14% rally could see XRP test resistance at $2.5067, the 50% Fibonacci retracement of the drop from the 2025 peak.

XRP/USDT daily price chart | Source: Crypto.news

XRP/USDT daily price chart | Source: Crypto.news Conversely, a 7.33% decline could send XRP to collect liquidity at $2.0350. If XRP gathers momentum, a recovery is likely once it sweeps liquidity at the support level.

The weekly price chart shows mixed signals. RSI is close to neutral while MACD flashes red histogram bars. XRP could either extend consolidation or break out, depending on the catalysts. The FVG on the weekly price chart is a bullish one, between $2.1743 and $1.6300, meaning that once XRP collects liquidity here, it could attempt a recovery.

In its upward trend, XRP could test resistance at R1, R2, and the psychologically important levels of $2.5067, $2.8000, and $3, respectively.

XRP/USDT weekly price chart | Source: Crypto.news

XRP/USDT weekly price chart | Source: Crypto.news XRP on-chain analysis

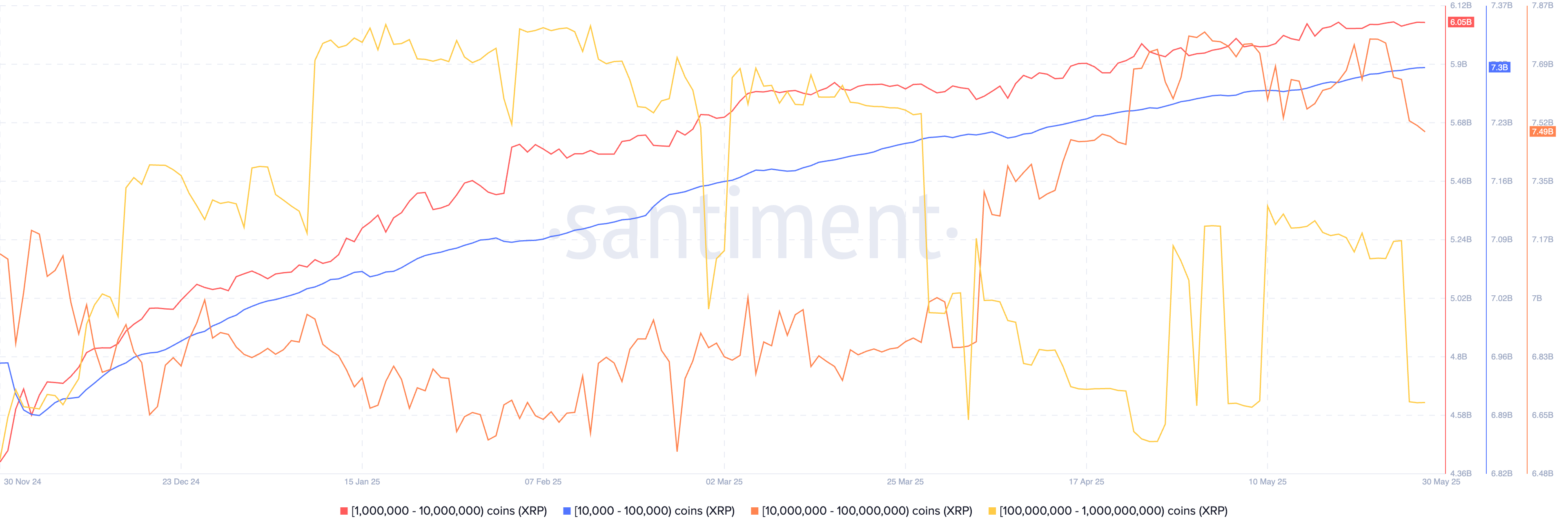

On-chain data from crypto intelligence tracker Santiment shows that among four segments of XRP holders, the retail or smaller wallet investors with balances of 10,000 to 100,000 and 1 million to 10 million XRP tokens have shown consistent accumulation in the last two weeks.

In the same timeframe, XRP wallets holding between 10 million and 100 million XRP and over 100 million XRP tokens have shed their tokens, likely realizing gains or rotating capital from XRP to stablecoins or other tokens.

This is typically not a bullish sign for the asset. However, if demand among segments holding smaller volumes is enough to absorb the selling pressure, it could prevent further decline in XRP price in the short term.

XRP supply distribution | Source: Santiment

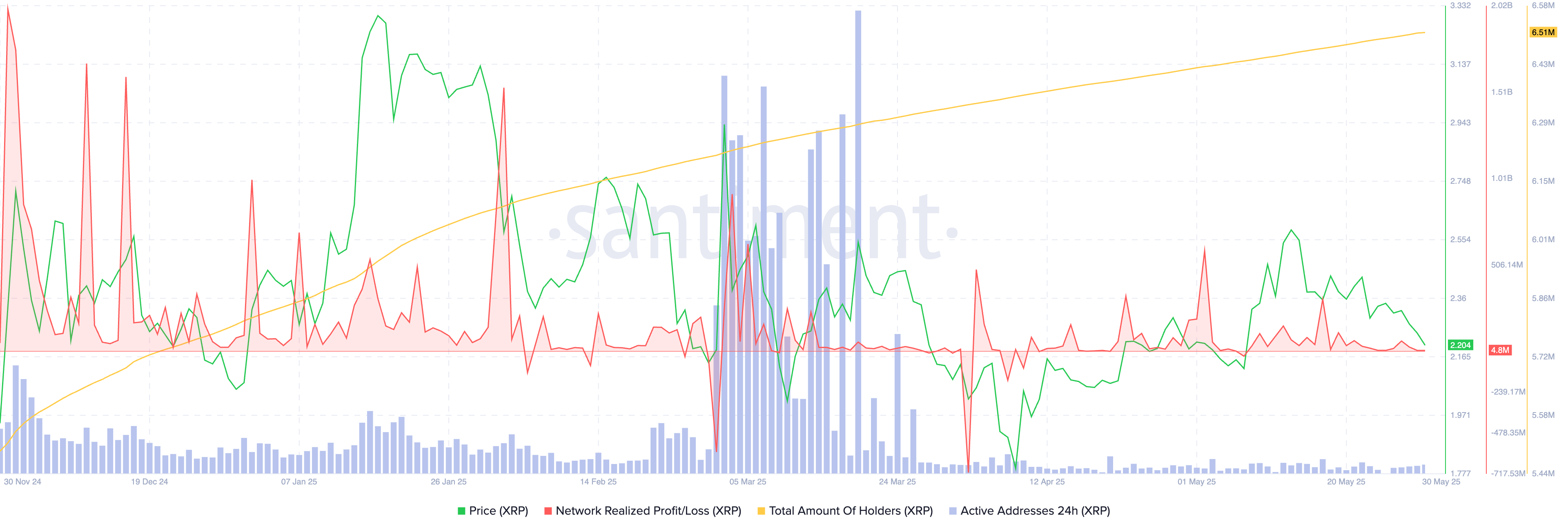

XRP supply distribution | Source: SantimentActive addresses show a lack of participation from traders. Activity on the 24-hour timeframe is below average. The total number of holders has increased throughout 2025. However, consistent profit realization, as seen on the NPL metric, signals that selling pressure is piling up across exchange platforms.

Larger positive spikes in NPL can be considered a precursor to a sell-off in XRP.

XRP on-chain analysis | Source: Santiment

XRP on-chain analysis | Source: Santiment The Skull of Satoshi and XRP’s relationship with Bitcoin

Ripple CEO Brad Garlinghouse commented on the cross-border payment remittance firm’s donation of “the Skull of Satoshi,” an 11-foot-tall art installation by Benjamin Von Wong, a Canadian artist. Wong created the installation in collaboration with Greenpeace USA and unveiled it in March 2023.

Garlinghouse informed the XRP holder community on X that Ripple has donated the art piece to the Bitcoin community; it will be permanently on display at the Bitcoin Museum in Nashville.

While initially intended to critique Bitcoin’s power usage, the installation now represents the strength and adoption of BTC among corporates and retail investors, as miners shift to more sustainable alternatives over the years.

Garlinghouse shed light on the subject of similarities between Bitcoin and XRP and how the two cryptocurrencies have more in common than one may think.

The Skull of Satoshi was originally built to call attention to blockchain energy usage, and today it’s a symbol and reminder of Bitcoin’s incredible staying power to many around the world (including me!).

As crypto and blockchain technologies become widely used, respected and… https://t.co/BZfWui7xCF

Derivatives traders bet on XRP rally

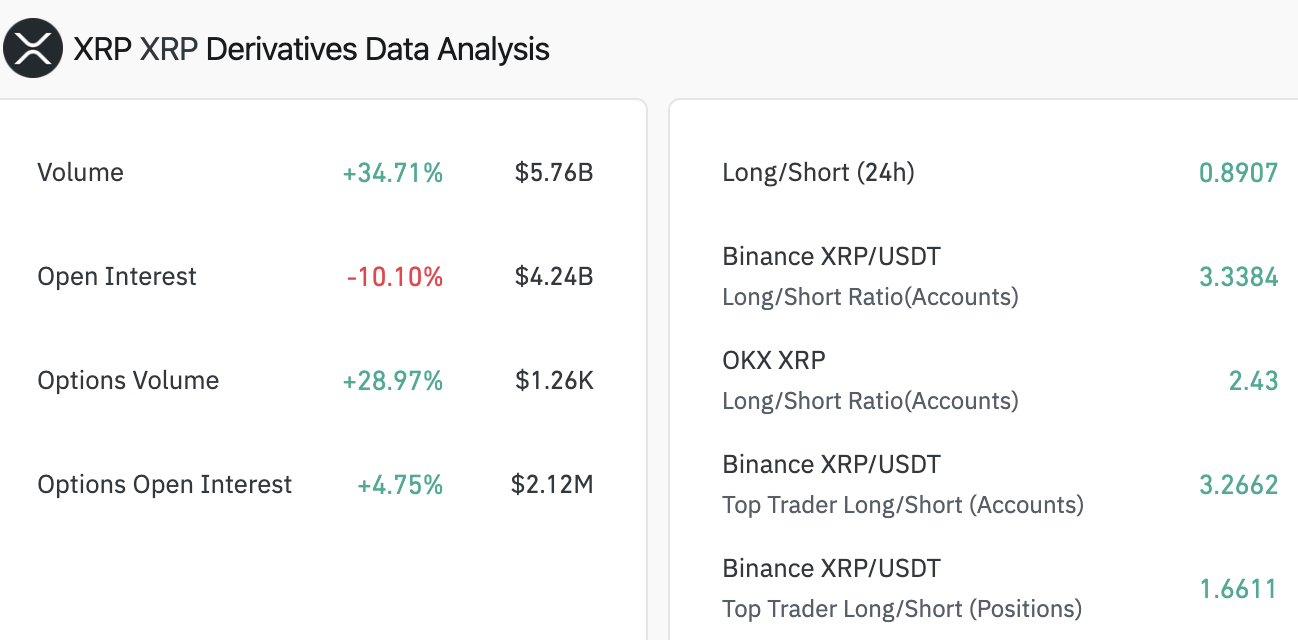

Derivatives data platform Coinglass shows that traders on Binance and OKX are placing more bullish bets on XRP than bearish ones. Measured by the long/short ratio, the bullish sentiment could support a price gain thesis for XRP.

On Binance, the long/short ratio is 3.33; on OKX, it is 2.43. While there is a 10% decrease in open interest, options volume and options open interest soared in the last 24 hours.

XRP derivatives data analysis | Source: Coinglass

XRP derivatives data analysis | Source: CoinglassCorporate giant’s $121 million XRP bet

As seen in a press release on Wednesday, May 28, VivoPower International PLC (VVPR on Nasdaq) reached an agreement with certain investors for the purchase and sale of an aggregate of 20,000,000 ordinary shares of the company for approximately $121 million.

The raised funds will be directed toward the launch of an XRP-focused digital asset treasury strategy. This includes building finance applications on the XRPLedger ecosystem and acquiring XRP for the company’s treasury holdings.

VivoPower’s $121 million XRP bet is a unique one at a time when most Wall Street giants are acquiring Bitcoin for their balance sheets.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

![11 Best Crypto & Bitcoin Casinos in Australia [2025]](https://coincheckup.com/blog/wp-content/uploads/best-crypto-and-bitcoin-casinos-in-australia-coincheckup-1024x576.png)

English (US) ·

English (US) ·