Clore AI, a fast-growing AI-focused cryptocurrency, continued its recovery as demand for artificial intelligence assets rose.

Clore.ai (CLORE) token rose for two consecutive days, reaching a high of $0.1143, its highest point since Sep. 26. It has risen by 140% from its lowest point this year, though it remains 76% below its year-to-date high.

Clore.ai is a blockchain project that provides distributed Graphics Processing Unit for use in industries like AI training, cryptocurrency mining, and movie rendering. It competes with other larger companies like Akash Network (AKT) and Render (RNDR).

Demand for GPUs has outpaced supply in the past few years, with estimates suggesting that big tech companies will spend over $1 trillion by 2028.

In response, Clore has created a platform where users can lease GPUs and pay as little as 86 cents a day.

There are signs that demand for its solution has continued rising, as the number of rentals has jumped to over 400,000. This trend could persist as the use-case for GPU leasing grows.

🚀 400,000+ Successful Rentals! 🎉

We’re thrilled to announce that the Clore platform has officially surpassed 400,000 successful rentals! 💪

This is a huge testament to the real-world value and impact of our platform. Every rental represents a step forward in building a… pic.twitter.com/CIeLFrC7ZL

According to its statistics page, the number of online machines has soared to a record high of 3,888, up from last month’s low of 3,166.

Clore’s price has also rallied due to the ongoing Nvidia stock rally. After bottoming at $90 in August, Nvidia’s stock has bounced back to $135. It has risen for three consecutive days and is nearing its all-time high of $140.

Palantir, another AI stock, has also rallied for five consecutive weeks, pushing its market cap to over $100 billion. Other AI tokens like Bittensor, Artificial Superintelligence Alliance, and Arkham have also rebounded.

The next few weeks will be critical for AI companies as they publish their third-quarter financial results. AMD, a major Nvidia competitor, will release its earnings on Oct. 29, while Palantir will release its results on Nov. 1.

Clore.ai price faces key resistance

Clore.ai chart by TradingView

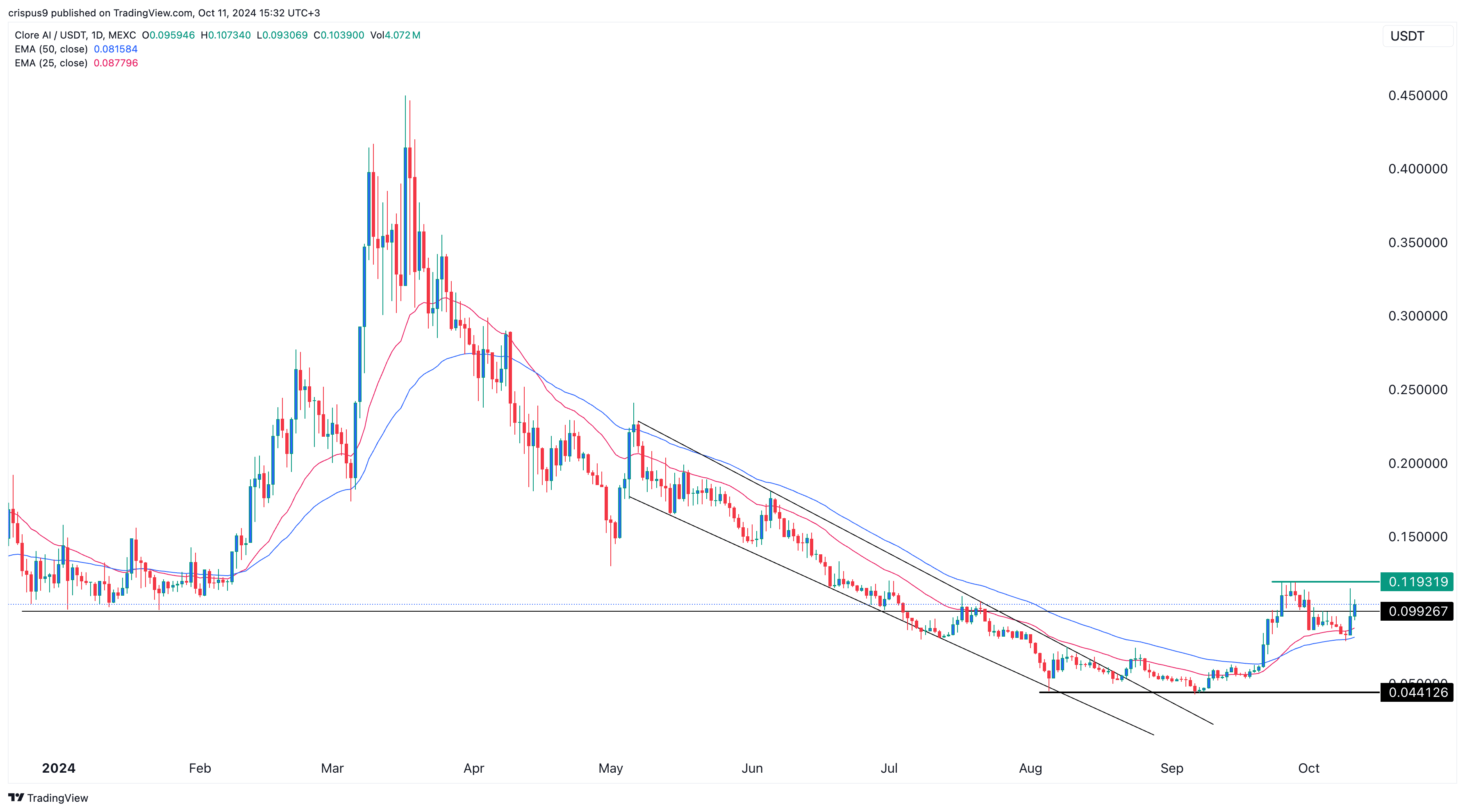

Clore.ai chart by TradingViewCLORE token formed a double-bottom pattern, a highly bullish sign, at $0.04412 in August and September.

It recently formed a small doji candlestick pattern on Oct. 9. A doji occurs when an asset opens and closes at the same level and is considered a bullish sign. The price has moved above the 50-day moving average.

Therefore, more upside will be confirmed if the price rises above the key resistance level at $0.1193, its highest swing in September.

English (US) ·

English (US) ·