Coinbase (NASDAQ: COIN) still can’t do compliance right, Gemini (NASDAQ: GEMI) invested in a privacy-focused digital asset treasury, and Tether wants to own the lending market in both crypto and beyond.

- Ireland fines Coinbase €21.5 million for shoddy AML/KYC

- Coinbase token sales platform seeks to improve ICOs

- Gemini posts underwhelming Q3

- Gemini launches Zcash treasury firm

- Tether invests in Ledn, expands commodity trade loans

Earlier this month, the Central Bank of Ireland (CBI) imposed a nearly €21.5 million penalty on Coinbase Europe Ltd for “breaching its anti-money laundering (AML) and combatting terrorist financing (CFT) obligations with respect to transaction monitoring … between 23 April 2021 and 19 March 2025.” The CBI notes that the financial penalty would have been 30% higher had Coinbase not been willing to admit its faults and accept its lumps.

The CBI says Coinbase failed to properly monitor some 30.4 million transactions over a 12-month period. This represented 31% of all transactions Coinbase Europe conducted in this period, with a combined transaction value of over €176 billion.

Digital asset exchanges are supposed to file suspicious transaction reports (STRs) with Irish authorities “as soon as possible.” But the CBI says it took Coinbase “almost three years” to complete its monitoring of these 30.4 million transactions before filing 2,708 STRs with Ireland’s Financial Intelligence Unit (FIU).

Analysis of these STRs revealed that they “contained suspicions associated with serious criminal activities including: money laundering; fraud/scams; drug trafficking; cyber-attacks (malware/ransomware); and child sexual exploitation.”

The CBI says Coinbase failed to adopt “internal policies, controls and procedures” to detect and report suspicious transactions. As the CBI points out, real-time transaction monitoring and prompt STR filing “is a cornerstone of the effectiveness and efficiency of the AML/CFT regulatory regime.”

Coinbase issued a blog post regarding its “past transaction monitoring errors,” blaming its shortcomings on “three coding errors” that garbled five of its 21 Transaction Monitoring System (TMS) scenarios. One of these errors led to the scenarios overlooking “crypto addresses separated by special characters.”

As part of its settlement, Coinbase apparently got the CBI to agree that it “cannot say that the transactions in these 2,700 [belatedly submitted STRs] actually resulted in criminal activity.” At any rate, Coinbase claims to have enhanced testing and monitoring of its TMS scenarios “to prevent inadvertent errors” in the future.

That would be great, except the CBI’s spanking is by no means Coinbase’s first trip to the regulatory woodshed for transaction monitoring shortcomings. In 2021, Coinbase was fined $6.5 million by the U.S. Commodity Futures Trading Commission (CFTC) for “reckless false, misleading or inaccurate reporting” of its transactions.

In 2023, Coinbase reached a $100 million settlement with New York regulators for “wide-ranging and long-standing failures” in its AML and ‘know your customer’ programs. In 2024, the U.K.’s Financial Conduct Authority (FCA) fined Coinbase £3.5 million ($4.6 million) for “repeated and material breaches” of financial crime controls, even after the FCA warned Coinbase of the “significant weaknesses” of its programs.

In the recent International Consortium of Investigative Journalists (ICIJ) report on crypto’s role in fueling pig butchering scams, a former Coinbase staffer claimed the exchange’s compliance team was overwhelmed by the volume of transactions compared with the number of individuals monitoring those transactions.

Coinbase opened its Dublin office in 2018 and received an e-money license from the CBI the following year. But earlier this year, Coinbase declared Luxembourg would be the headquarters of its European-facing operations overseen by the European Union’s Markets in Crypto-Assets (MiCA) regulations, under which Coinbase was issued a license this summer.

Stateside, Coinbase announced last week that it was shifting its corporate HQ from Delaware to Texas. The company’s chief legal officer Paul Grewal tweeted that the decision “was not made lightly” but said Delaware “no longer has a monopoly on corporate law” and other states (like Texas) “are innovating to offer the right environment for business and innovators to thrive.”

Make ICOs great again

In (potentially) less controversial Coinbase news, the company launched a new “end-to-end token sales platform” earlier this month, calling it “a more sustainable and transparent way for projects to distribute tokens and decentralize.” (Oddly enough, this platform doesn’t appear to have a name beyond ‘token sales.’)

The announcement follows Coinbase’s $375 million purchase of Echo, the crypto crowdfunding site, which has a public token sale platform called Sonar. A Coinbase rep told The Block that the new token sale platform is “independent/separate from the Echo brand.”

Coinbase CEO Brian Armstrong tweeted that the new platform would “give teams a new way to distribute their token to their community, and give the community early access to their favorite tokens.” Armstrong added that “for the first time since 2018, retail users in the United States can widely participate.”

That 2018 date coincides with one of the scammiest periods of the history of digital assets, namely, the initial coin offering (ICO) craze. For those who weren’t around then, studies later found that 80% of these token projects were “identified scams.” The majority of ICO projects failed in under four months, and a 2019 study found that only 15% of ICO tokens were trading at or above their original price.

Regulators eventually stepped in, but only after the insiders who promised their projects would usher in a golden age of blockchain utility had cashed out and fled the scene, leaving retail buyers holding worthless digital Beanie Babies.

It’s said that the most dangerous phrase in finance is ‘this time it’s different.’ But Coinbase’s new platform has established some ground rules, including requiring token issuers to “provide key disclosures,” while issuers “and their affiliates” will be barred from selling tokens elsewhere for six months after their public sale.

Users must submit pre-sale requests for how many tokens of a particular project they wish to buy. Coinbase claims to have an algorithm “designed to promote broader distribution and limit asset concentration among large purchasers” by filling smaller requests more completely before the whales get their fill. To reward “true supporters,” users who re-sell their purchased tokens quickly “may receive smaller allocations in subsequent sales.”

All the token sales will be conducted using USDC, the stablecoin issued by Circle (NASDAQ: CRCL), in which Coinbase holds a significant equity stake. Users won’t pay fees to Coinbase, but the exchange will take a cut from the USDC that issuers receive from selling their tokens.

Token subscription windows will be limited to “a finite amount of time,” and Coinbase plans to host “approximately one token sale per month.” The first project to utilize the platform is the Monad network, whose Ethereum-compatible Layer-1 mainnet launches on November 24. Sales of the MON token got underway on November 17 and will conclude on November 22.

So far, it’s not exactly been a roaring success, with only around two-thirds of the available MON being spoken for after two days. Around 48% of the available MON was sold on Day 1, suggesting slowing interest that could see the sale conclude on Friday on an undersubscribed basis.

Monad co-founder Keone Hon claimed he wasn’t dismayed, tweeting Tuesday that the Coinbase platform gives users “5 ½ days to decide whether to commit, and once they commit, they’re locked in. (That actually incentivizes people to wait until the last minute to evaluate, which is an interesting dynamic that might be revisited for future sales.)” Hon added that “we’ll see how this plays out.”

Gemini posts underwhelming Q3

Coinbase rival Gemini filed its Q3 earnings report earlier this month, and while its first report as a publicly traded company showed sequential gains in most categories, investors appeared less than impressed by the fact that its costs appear to be rising even faster.

Figures released on November 10 show Gemini generated net revenue of $49.8 million, up 52% from Q2, although transaction revenue rose a more modest 26% to $26.3 million. Services revenue more than doubled to $20 million, driven primarily by gains in Gemini’s staking and branded credit card operations.

However, Gemini booked a net loss of nearly $160 million as operating expenses shot up by nearly three-quarters to $171.4 million while sales & marketing expenses doubled to $33 million. Predictably, salaries & compensation showed the largest increases ($82.5 million, +125%) following the company’s Nasdaq listing in September. (Ahead of that listing, Gemini’s H1 salary/compensation exceeded its revenue.)

Gemini remains a retail minnow compared to U.S. rivals Coinbase and Kraken, as its retail trading volume was just $1.8 billion (+20%) in Q3, a fraction of Coinbase’s $59 billion in retail volume during the same period. Institutional volume was up 49% to $14.6 billion, but Gemini’s overall volume of $16.4 billion pales in comparison to Kraken’s nearly $577 billion in Q3.

Despite Gemini’s optimism regarding its performance over the rest of 2025, investors hammered the sell button, pushing the share price down from nearly $17 to ~$14 following the earnings release. The ongoing implosion of token prices since then has pushed the shares down even further, closing Tuesday at $12.09, a 4.5% gain on the day but barely one-third of its post-IPO peak in September.

Gemini launches Zcash treasury firm

Cameron and Tyler Winklevoss, the twins behind Gemini, made waves last week by announcing plans for a new digital asset treasury firm based around the controversial Zcash (ZEC) privacy token.

The news followed a nearly $59 million investment round led by the twins’ venture capital outfit Winklevoss Capital, of which some $50 million has been spent buying ZEC. The treasury firm in question now holds 1.25% of all ZEC, marking the initial push of what Tyler called a plan to acquire “at least 5% of the total ZEC supply.”

The vehicle for this new treasury is former biotech firm Leap Therapeutics, Inc. (NASDAQ: LPTX), which announced this month that it was rebranding as Cypherpunk Technologies Inc (NASDAQ: CYPH). Fitting the pattern of most treasury firms, Leap had fallen on hard times, laying off three-quarters of its staff in June after halting the only ongoing clinical trial of its drugs in development.

Leap’s stock began 2025 at a price of ~$3.50, but a poor result from a drug trial in January pushed the price down to ~$0.22 by summer. News of its treasury pivot boosted the price from ~$0.45 back up over $2. Following the November 12 rebrand, the share price increased to ~$3.55 but closed Tuesday at $2.97.

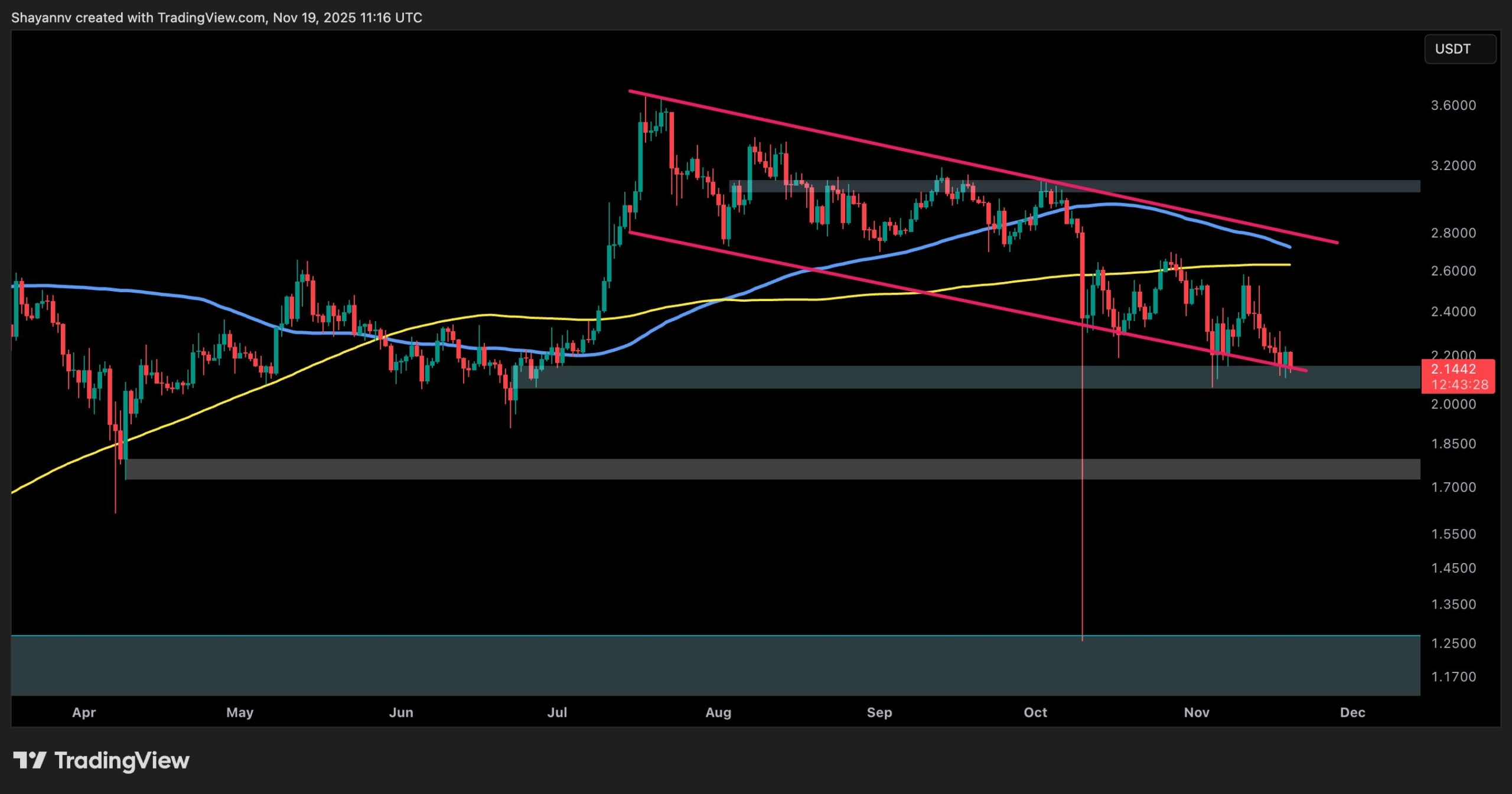

The news also lit a fire under ZEC’s fiat price, which began the year worth ~$58 but began steadily rising in late-September—likely around the time the Winklevii began buying—then surged even higher after the Winklevii buying spree was made public and Tyler laid out their plan to “continue accumulating ZEC rapidly.” As of late Tuesday, ZEC was worth just over $600 after peaking at nearly $700 this month.

Like most so-called privacy coins, Zcash is controversial due to its popularity with criminal groups looking to mask the digital trail of their ill-gotten gains. But Tyler argued that “if bitcoin is digital gold, Zcash is encrypted bitcoin, or digital cash. One is your store of value, the other is how you privately move your value.”

Despite the BTC token having erased all the gains it made this year, Tyler doubled down on his prediction that BTC’s fiat value will hit $1 million “over the next 5-10 years” and predicted that “Zcash will appreciate significantly from here as well.”

Perhaps. But the bloom is well off the digital asset treasury rose, as retail investors clued in to the reality that they could buy tokens directly and actually own the things, rather than pay a premium for some entity to buy tokens on their behalf and do, er, something that pushes their market cap higher than the sum of their token holdings.

Lend us a Tether

Tether, issuer of the market-leading USDT stablecoin, is also making some new investments. And unlike its other recent deals, one involves a company Tether doesn’t already control.

On November 18, Tether announced that it had made an investment of unspecified size in Ledn, the centralized lending platform that allows users to borrow money using their BTC tokens as collateral. Ledn used to also offer loans based on Ethereum’s native token ETH, but the company went ‘bitcoin-only’ this spring.

Ledn has originated $2.8 billion in BTC-backed loans since its 2018 launch. This year is shaping up to be Ledn’s best performance to date, having already recorded $1 billion in lending volume. That sum includes $392 million in Q3 alone, which nearly matches its entire 2024 total. Annual recurring revenue is now over $100 million.

At the same time, it dropped ETH support. Ledn also stopped loaning out its customers’ collateral assets to earn interest, shifting to custodied loans only. The company said at the time the intent was to eliminate “any ambiguity about how your bitcoin collateral is treated” and to provide users with “complete confidence in where your bitcoin is and how it is handled.”

In hindsight, it’s odd that it took Ledn so long to arrive at this conclusion, given the debacles of 2022 that saw digital asset lenders like BlockFi, Celsius, Genesis Global Capital, and Voyager Digital all go bankrupt after their bets with customer assets went very, very wrong.

While the bulk of digital asset lending still occurs on decentralized finance (DeFi) platforms, a Galaxy Digital report from earlier this year flagged Tether as the top centralized lender with $8.2 billion in outstanding loans at the end of 2024 (with Galaxy and Ledn combining for another $1.7 billion). Those controversial loans, which Tether pledged to eliminate from its balance sheet nearly three years ago, have since grown to $14.6 billion as of September 30.

But Tether’s lending ambitions are only getting started. On November 14, Bloomberg quoted Tether CEO Paolo Ardoino saying his company plans to “dramatically” expand its loans to commodity traders, to whom Tether’s Trade Finance unit has already issued ~$1.5 billion worth of credit.

Trade Finance launched last year as part of the Tether Investments offshoot. Trade Finance aims to expand use of the dollar-denominated USDT beyond its dominant role as one side of a crypto trading pair on exchanges, alongside USDT’s less savory reputation as a ‘crime coin.’

One year ago, Trade Finance made its first crude oil transaction between “a publicly traded super-major oil company and a top-tier commodity trader.” Ardoino told Bloomberg the Trade Finance team was “super bullish” about expanding credit issuance for trades in other commodities, including ‘oil, cotton, wheat and other agricultural products.’

Watch: Teranode is the digital backbone of Bitcoin

English (US) ·

English (US) ·