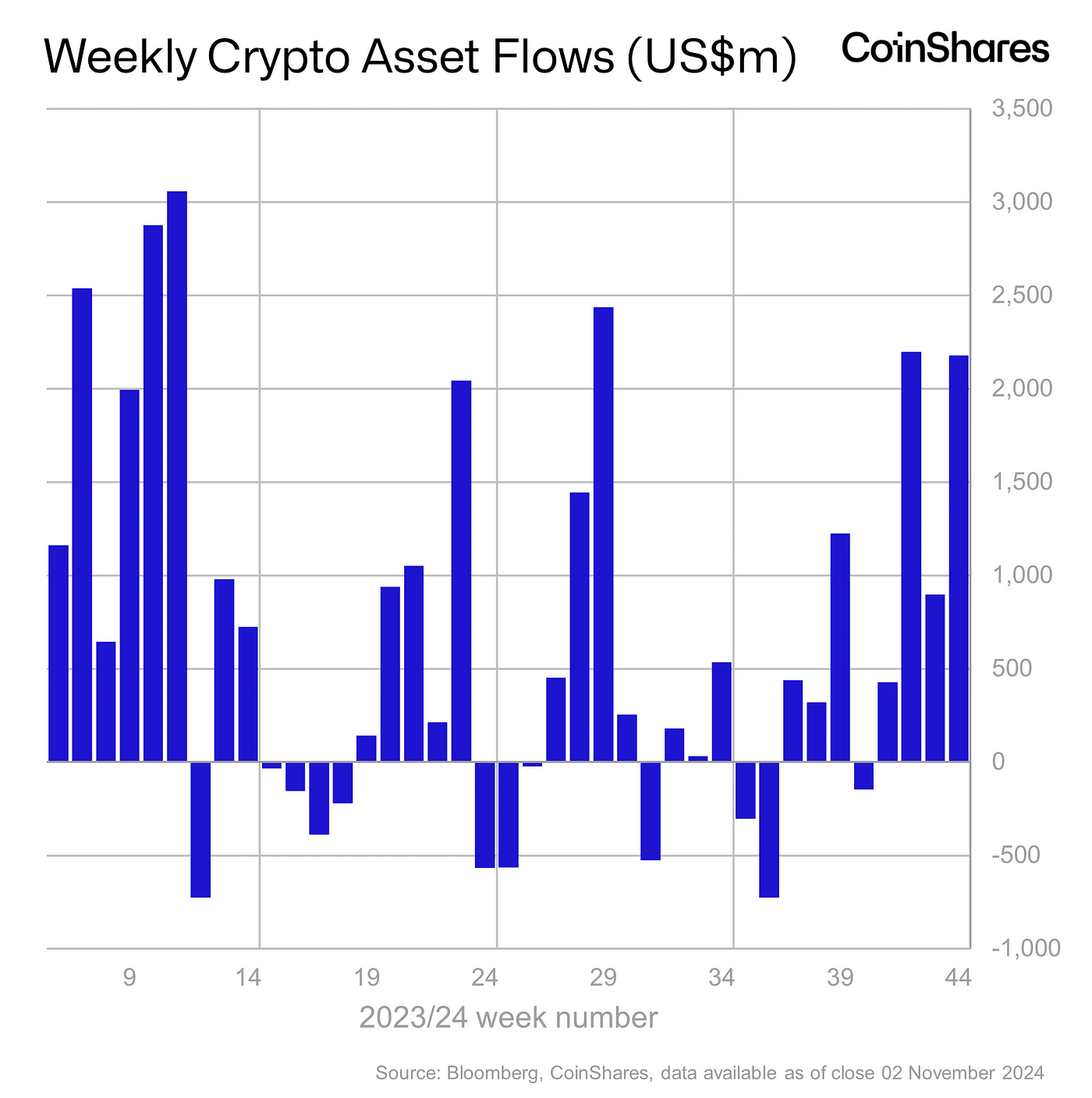

Crypto investment products experienced inflows of $2.2 billion, pushing year-to-date totals to a record $29.2 billion.

Crypto investment products drew $2.2 billion in inflows last week, bringing year-to-date inflows close to $30 billion and total assets under management above $100 billion for only the second time, matching the $102 billion level recorded in early June, according to data from CoinShares.

CoinShares head of research James Butterfill attributed the recent inflows to investor sentiment surrounding the upcoming U.S. elections, saying “euphoria around the prospect of a Republican victory were the likely reason for these inflows as they were in the first few days of last week.”

As the week progressed, however, the mood shifted, with minor outflows observed on Nov. 1, highlighting Bitcoin’s sensitivity to political developments. The U.S. market accounted for the entirety of last week’s inflows, with $2.2 billion, while Germany contributed a modest $5.1 million, the data shows.

Weekly crypto inflows | Source: CoinShares

Weekly crypto inflows | Source: CoinSharesBitcoin (BTC) remained the primary focus, absorbing all $2.2 billion of last week’s inflows, as enthusiasm for the crypto continued to build. Meanwhile, Ethereum (ETH) attracted only $9.5 million in inflows and remains “in stark contrast to the bullishness seen in Bitcoin or Solana,” Butterfill says.

In the broader market, trading volumes surged by 67% week-on-week to $19.2 billion, representing 35% of total trading activity in Bitcoin across crypto exchanges.

As the U.S. election nears, political meme coins have gained traction; Trump-based PolitiFi tokens saw gains of over 120%, while Kamala Harris-themed tokens recorded a 30% rise. The tokens are experiencing heightened activity as the Nov. 5 election approaches, an event anticipated to influence the trajectory of the crypto market in the U.S. and abroad.

English (US) ·

English (US) ·