The crypto market is in a state of widespread panic as total crypto liquidations reached over $1.30 billion in the span of 24 hours. Traders on X are accusing exchanges of ‘capping’ long liquidations and manipulating the market.

According to data from Coinglass, in the past 24 hours, 367,789 traders saw their long and short positions liquidated, with total liquidations coming up to $1.34 billion. So far, the largest single liquidation order happened on Binance – BTCUSDT, with a transaction value of $20.80 million.

In the past 8 hours, at least $235 billion has been wiped off the crypto market cap, equal to a nearly 9% drop. Major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) and Solana (SOL) have all gone red in the past trading day following these mass liquidations.

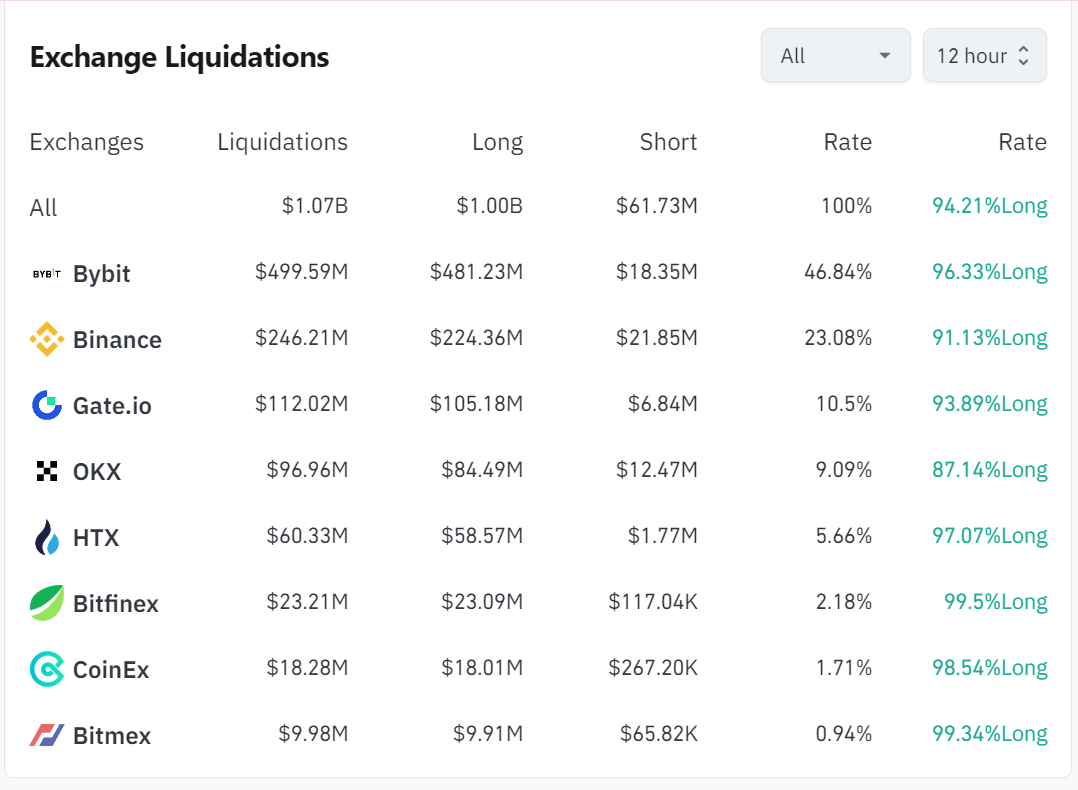

At press time, long liquidations have reached $1.24 billion, far exceeding the amount of short liquidations which currently stand at $96.4 million. Most of the liquidations are coming from Bybit, which have just begun to recover from a massive $1.4 billion hack, contributing to nearly $500 million liquidations in the past 12 hours. According to Coinglass, 96% of the liquidations on Bybit are long.

In second place is Binance with $246 million in liquidations. Like Bybit, the vast majority of Binance liquidations are the long kind, specifically around 90%. The same can be said about the other exchanges on the list, which have seen on average more than 90% of their long positions liquidated.

Exchange liquidations have exceeded $1 billion in the past 12 hours of trading, February 25, 2025 | Source: Coinglass

Exchange liquidations have exceeded $1 billion in the past 12 hours of trading, February 25, 2025 | Source: CoinglassLong liquidations are positions held by traders betting on ‘the long game’ as they anticipate a price increase. If the price of the asset falls far, exceeding the set margin, the crypto exchange will automatically close these long positions to prevent further losses.

Traders on X have begun speculating that exchanges are “flushing out” long positions in order to manipulate the market. One trader, MartyParty, accused Binance of “capulating the market” in order to liquidate more positions, calling out centralized exchanges for discouraging crypto traders from holding long positions.

“Leverage traders that have any liquidity left, learn the lessons, use low leverage only. 1.8 to 3x max,” he warned his followers.

On the other hand, according to Coinank, Binance’s Bitcoin liquidation map shows that the major BTC price drop “doesn’t offer as much profit” from liquidating long positions compared to “the price rising to liquidate short positions.” Bitcoin has fallen below $90,000 for the first time since November last year.

Although there has not been any conclusive evidence to support the claims that centralized exchanges are forcibly closing long liquidations, it is clear that long positions make up the majority of liquidations in today’s crypto market crash.

Why is crypto down today?

As previously mentioned, Bitcoin has taken a dive by more than 6%, plummeting as low as $88,615 in the past 24 hours. BTC is currently trading hands at $89,742. Often regarded as the cornerstone of crypto, a dip in Bitcoin value usually drags the rest of the major coins and altcoins down with it.

The decrease in Bitcoin comes at a peculiar moment, as just a day prior Strategy CEO Michael Saylor bought 20,356 Bitcoin worth nearly $2 billion at the time of purchase. A large BTC purchase usually signals a boost in prices, but that is clearly not the case today.

At press time, Solana has gone down by more than 13%, falling as low as $134.97 in the past day. Similarly, Ethereum has also taken the plunge by around 10%, falling to $2,337 in the past 24 hours of trading.

Additionally, major crypto exchanges like Binance and Bybit have been seen selling a lot of their crypto holdings. On Feb. 25, Binance offloaded millions worth of Ethereum and Solana from their portfolio, leading to many investors speculating that the exchange is preparing for a massive shake in the market.

Bybit, despite having suffered a $1.4 billion Ethereum hack, recently sold around $260 million worth of assets. It is possible that the increased wallet activity comes from Bybit returning loans from other exchanges like Bitget and Binance, which have helped sustain its liquidity after the attack.

Another possible trigger is President Trump’s declaration that the 25% trade tariffs on Canada and Mexico will proceed as scheduled. Trump’s tariff announcement shook the not only the stock market, but it has also oddly affected the crypto market.

In previous instances, trade tariffs would lead to an increase interest in alternative assets like Bitcoin and other cryptocurrencies as conventional traders seek to store their funds in “safe-haven assets” that are not as affected by inflation. However, it seems to be having the opposite affect as of late.

English (US) ·

English (US) ·