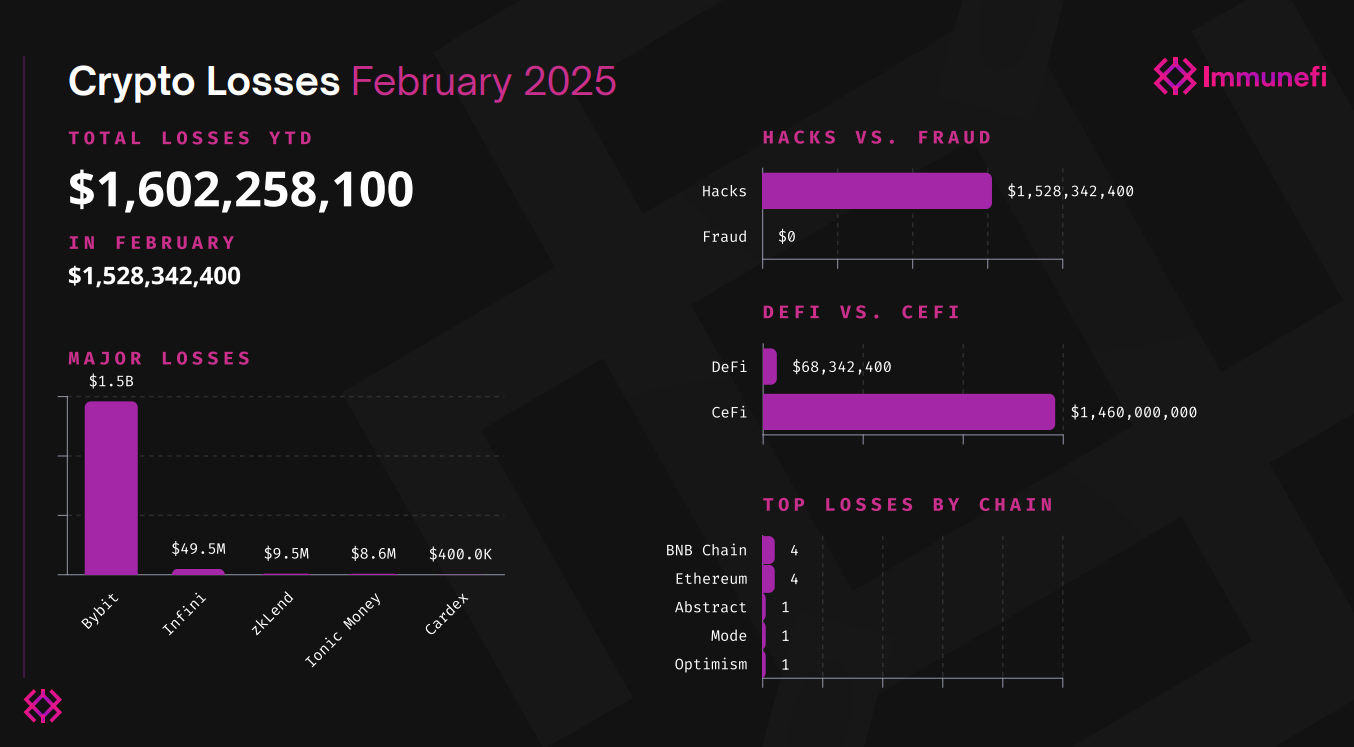

February 2025 saw $1.53 billion in crypto losses, an 18x increase from a year ago, largely driven by a $1.46 billion Bybit hack.

Crypto hacks drained $1.53 billion in February 2025, an 18x jump from last year, with most of it coming from a $1.46 billion Bybit hack. That pushed total losses for the year to $1.6 billion, already surpassing all of 2024, according to Immunefi.

Crypto losses in February 2025 | Source: Immunefi

Crypto losses in February 2025 | Source: ImmunefiIn a research report, Immunefi explained that most of February’s losses came just from two incidents: crypto exchange Bybit, which lost $1.46 billion, and stablecoin bank Infini, which suffered a $49.5 million hack. The remaining losses were spread across seven smaller attacks, with zkLend and Ionic Money losing $9.5 million and $8.6 million, respectively.

“In February 2025, CeFi accounted for 95.5% of the total losses with a single incident, while DeFi, which experienced 8 cases, accounted for the remaining 4.5% of the total volume of funds lost.”

Immunefi

Losses in February jumped 20x from January’s $73.9 million, showing the growing impact of security breaches. Centralized finance platforms accounted for 95.5% of total losses due to a single major attack, while decentralized finance protocols saw only eight incidents, making up 4.5% of losses.

Per Immunefi, hacks “continued to be the predominant cause of losses compared to fraud.”

“In February 2025, hacks continued to be the predominant cause of losses compared to fraud, accounting for 100% of the total losses.”

Immunefi

The most targeted blockchains were BNB Chain and Ethereum, which suffered four attacks each, making up 72.8% of total losses. Other affected chains included Abstract, Mode, and Optimism, each hit by a single attack, the data shows.

As crypto.news reported earlier, the Bybit attacker has already laundered over 266,300 ETH (about $614 million) in the past five days, averaging 48,420 ETH per day. At this rate, the remaining 233,086 ETH could be fully laundered within another five days.

English (US) ·

English (US) ·