The Crypto x AI sector comprises just 1% of the entire crypto market cap, says David Cheung. However, he believes that there is room for the sector’s growth.

David Cheung took to X to post an analysis where he found that crypto and AI have major potential for growth. The analysis, done by Syncracy Capital, which Cheung co-founded, reflected that only 1% of the $3.83 trillion crypto market comprises Crypto x AI. He also believes Crypto x AI is in its infancy compared to DeFi, which peaked at 6% of the total market cap in 2020.

He also emphasized that the early positioning will stand out as a great opportunity for exponential growth, and Crypto x AI is well-placed to come out bigger in shares in the future years. Cheung is not the only one who expects the crypto x AI market to boom.

Despite the recent run up, Crypto x AI is still just sitting at ~1% of total crypto market cap.

Sector could easily 10x from here as we progress through the cycle with the leading AI Infra, AI Agent Platforms and AI Agents outperforming disproportionally.

Still early. pic.twitter.com/hu82LZkzyM

Industry leaders, like investor Andrew Kang, have mentioned that AI has a significant role to play in cryptocurrency trading. “In the near future, any decent discretionary traders will no longer click buttons to trade themselves,” Kang wrote on X. Instead, heuristics and mental models are fed into AI systems, which open up the possibility of efficient decision-making on autopilot. This is part of a larger trend in AI-powered trading models, wherein manual work is being replaced by computerized workflows.

In the near future, any decent discretionary traders will no longer click buttons to trade themselves. That would be like solving large math problems by hand instead of using a calculator. Primative, time wasting, a thing of the past.

Instead, traders (and investors) will be…

“There is a strong, natural fit between the two technologies due to their relationship with data. However, there is also a sense of urgency in combining them as we look to address the shortcomings of both technologies as they are starting to fall into the hands of billions of users,” said Jaspere De Maere of Outlier Ventures.

The current challenges in the Crypto x AI sector

Crypto x AI adoption comes with some challenges, including data privacy and security and the difficulty of protecting sensitive information. Misinformation and overwhelming data complicate the reliability of AI, while algorithmic bias and centralization hinder decentralization efforts. Moreover, AI-driven bots are eroding trust and authenticity within blockchain ecosystems and further complicating user interactions.

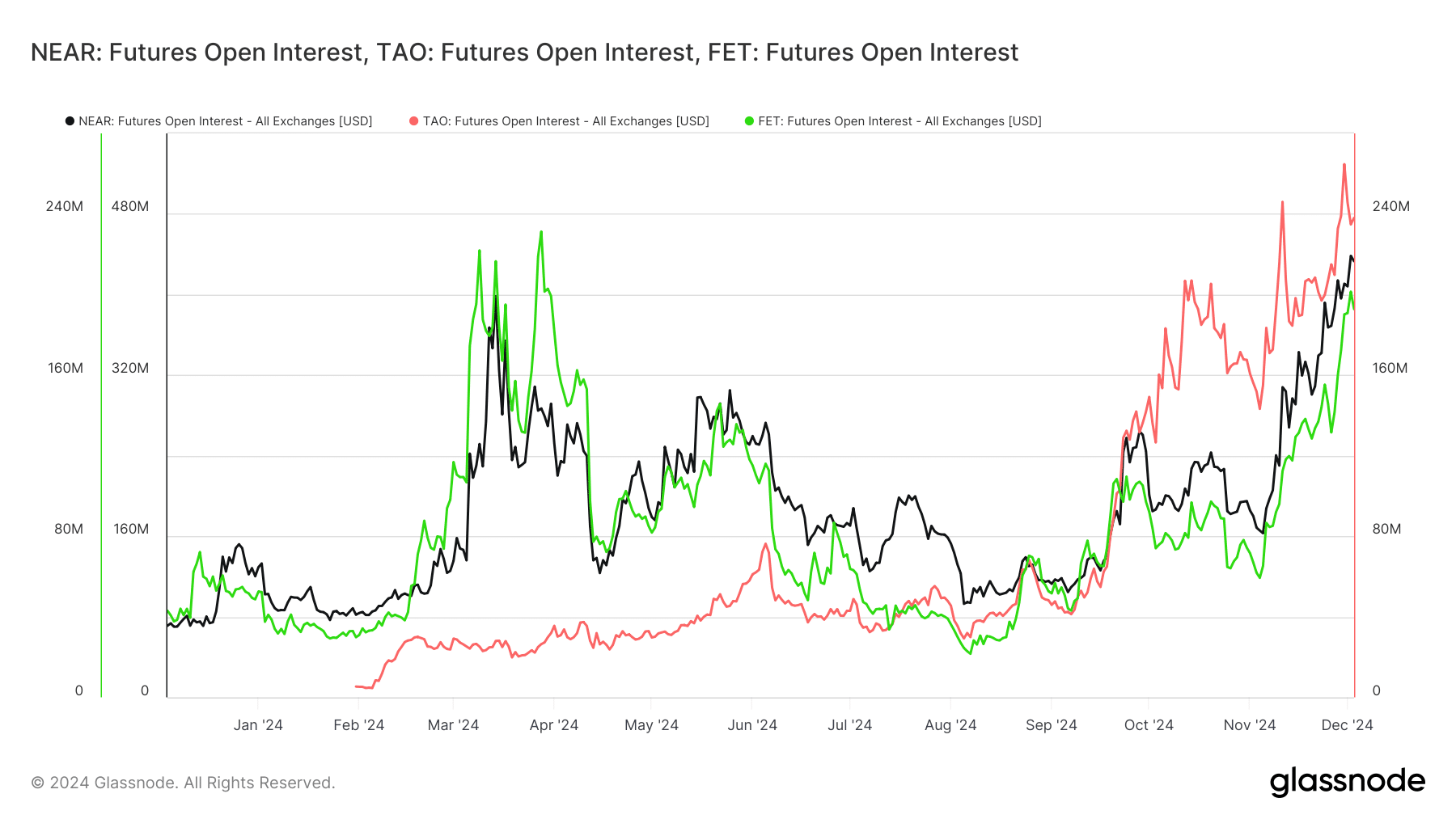

Futures open interest in AI-driven cryptocurrencies like TAO, NEAR, and FET has surged in 2024, with TAO reaching $240 million in December, reflecting growing investor confidence in the Crypto x AI sector. Data sourced from Glassnode.

Futures open interest in AI-driven cryptocurrencies like TAO, NEAR, and FET has surged in 2024, with TAO reaching $240 million in December, reflecting growing investor confidence in the Crypto x AI sector. Data sourced from Glassnode.The future outlook:

An increasingly rising open interest is visible for the AI-focused cryptocurrencies NEAR Protocol (NEAR), Fetch.ai (FET), and Bittensor (TAO), which translates to increased investor interest in Crypto x AI projects. The tokens with AI power in place have seen a pick-up in trading across the year 2024, leaving room for more adoption.

.

English (US) ·

English (US) ·