Nigeria’s rapid digital asset adoption has been lauded globally for its impact in easing cross-border transfers and boosting financial inclusion. However, according to the International Monetary Fund (IMF), these assets threaten the country’s monetary stability and foreign exchange controls and played a key role in the naira’s 70% depreciation over the past three years.

In a report titled “Regulating the Crypto Market in Nigeria,” the IMF acknowledged that Nigeria has become one of the world leaders in digital asset adoption. In Chainalysis’ most recent adoption report, it ranked second globally after India. A separate report revealed that between July 2023 and June 2024, the country recorded nearly $60 billion in ‘crypto’ transactions.

Most digital asset trades in Nigeria are relatively small in value, the IMF added. Thirteen percent of the trades in the year ending June 2024 were below $1,000, with another 12% below $10,000.

Nigeria’s ‘crypto’ risks

While the adoption has opened new opportunities for millions of Nigerians, the IMF says it comes with significant risks to the country’s economy.

“Unlicensed crypto-trading platforms can be used to move capital out of Nigeria without being detected by domestic authorities,” the report says.

Nigerians can top up their digital asset wallets with naira via an unlicensed exchange and purchase dollar-denominated assets from a user based abroad. Under such a transaction, financial authorities would not detect or record the capital flow, the agency says.

“By using such methods—or more sophisticated variations—investors have been able to move money overseas through the crypto market, effectively circumventing capital flow regulations.”

Stablecoins pose an even greater risk, it added. As trading volumes grow, Nigerians will transfer even more funds from deposit accounts in local banks to FX-denominated stablecoins like the USDC and USDT, resulting in a decline in bank deposits and capital outflows from Nigeria to the reserve assets managed by custodians in the United States and other advanced economies.

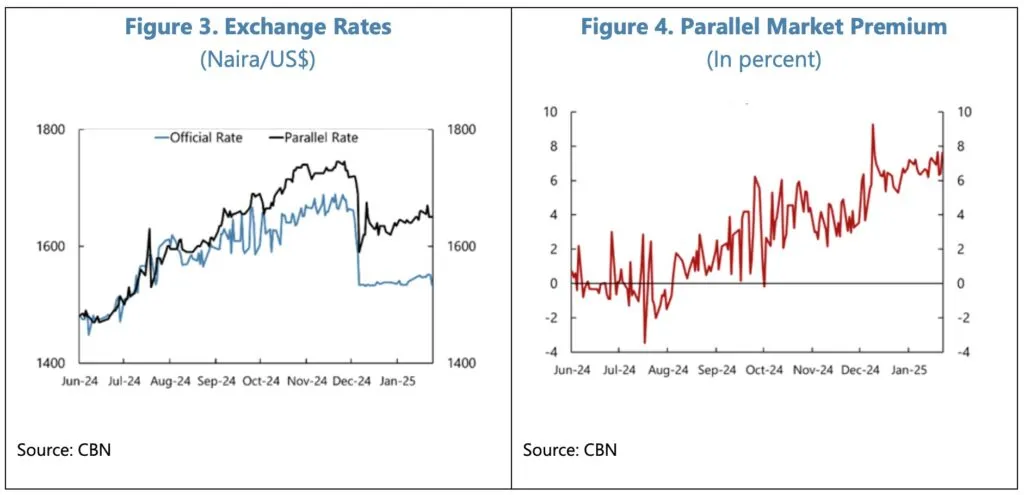

The report claims that stablecoins also threaten the stability of the naira. With Nigerian investors able to purchase USD-linked tokens like USDC, they can acquire and hold foreign currency away from the formal banking channels. IMF alleges that since 2023, Nigerians have been using this channel to arbitrage and speculate against the naira as the official exchange rate from the central bank and the rate offered on ‘crypto’ exchanges diverged by wide margins.

Source: International Monetary Fund

Source: International Monetary FundIt’s not the first time the digital asset market has been blamed for the volatility in Nigeria’s foreign exchange market. In mid-2023, the country’s Bureau de Change operators urged the government to ban Binance for putting the naira under massive pressure. A few months later, operators in the capital, Abuja, and the northwestern state of Kano shut down operations, blaming P2P digital asset operators.

“From the authorities’ standpoint, the activities of global crypto platforms have allowed users to acquire foreign currency outside the formal FX market and facilitated speculative activities against the naira via peer-to-peer (P2P) transactions, thereby posing currency stability risks,” the report notes.

The Nigerian government claimed that over $26 billion had passed through these unregulated exchanges from sources it could not properly identify. This served as one of the stated reasons for banning Binance and other offshore exchanges from the vast market last year. It further charged Binance with orchestrating a ‘sophisticated heist’ against the economy and is now demanding $81 billion from the exchange.

IMF: Nigeria must strengthen ‘crypto’ oversight

Despite criticizing the Nigerian ‘crypto’ market, the Washington-based financier lauded the government’s efforts in policing the sector. The Securities and Exchange Commission (SEC) has become more active in offering guidelines to virtual asset service providers (VASPs) and licensed the first two exchanges under its new regulatory regime last year. Earlier this year, the country also amended the law to tax digital assets.

However, it must do more as the sector evolves at a rapid pace, the IMF says.

“We recommend that authorities continue to monitor developments in the crypto marketplace and ensure that all exchanges operating in Nigeria meet the regulatory standards set by the SEC.”

It also commended the new taxation model but argues that the government lacks a formal approach to track ‘crypto’ ownership, depending on the less effective self-reporting strategy.

To address all the ‘crypto’ risks, “effective enforcement of the regulatory framework is essential and will require new efforts by regulators to shut down all crypto firms that are unwilling or unable to meet the licensing requirements,” it concluded.

Watch: Boosting financial inclusion in Africa with BSV blockchain

English (US) ·

English (US) ·