Ethereum is recording impressive interest from large holders as its price surpasses the three-month high of $2,800.

Ethereum (ETH) gained 8% in the past 24 hours and is trading around the $2,800 mark. The leading altcoin saw its market cap surpass $336 billion. Its daily trading volume increased by 27%, reaching $38 billion.

ETH price | Source: crypto.news

ETH price | Source: crypto.newsEarlier today, ETH rose to a local high of $2,870, but witnessed a quick correction due to short-term profit-taking.

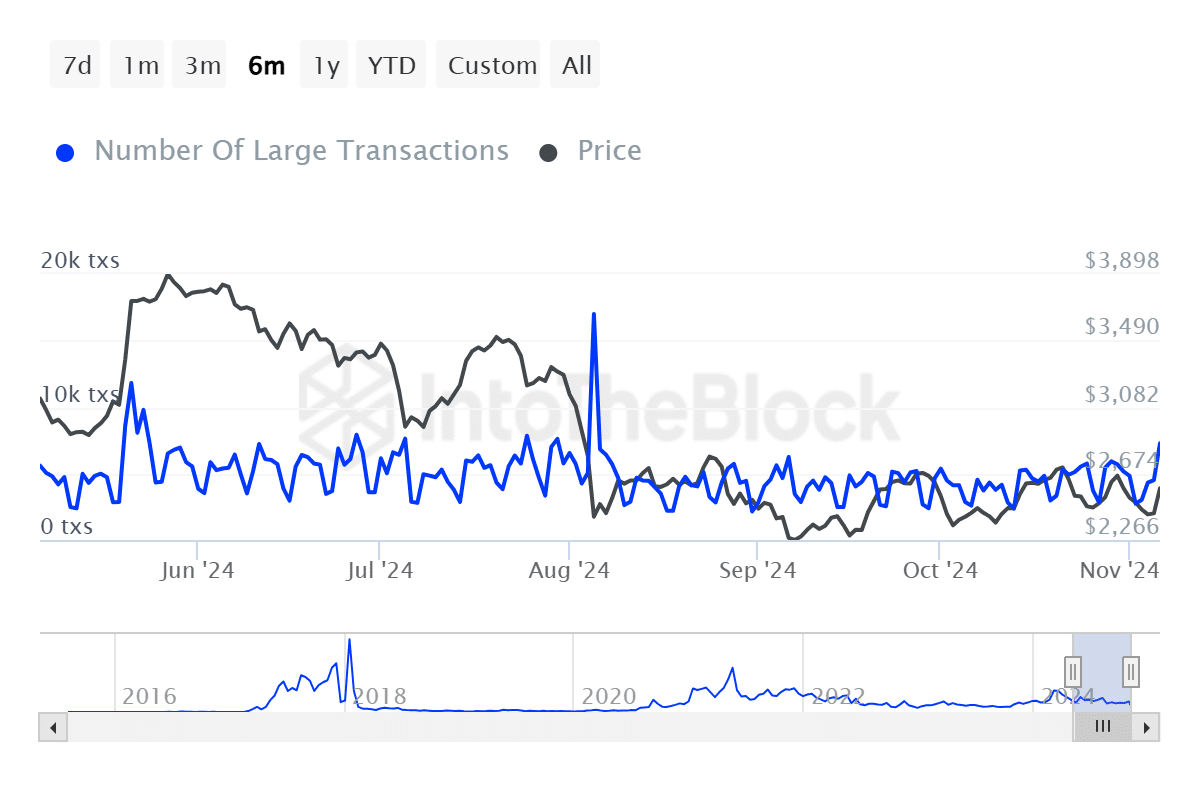

The ETH price hike was accompanied by a strong wave of whale transactions. According to data provided by IntoTheBlock, Ethereum recorded a 60% surge in the number of large transactions, worth at least $100,000, on Wednesday, Nov. 6—reaching a three-month high of 7,270 unique transactions.

Large ETH transactions | Source: IntoTheBlock

Large ETH transactions | Source: IntoTheBlockData from ITB shows that large holders moved over $8.7 billion worth of ETH yesterday.

On the other hand, the ETH whale accumulation has been slowing down over the past week. Per ITB data, the asset’s large-holder net inflow declined from 91,300 ETH on Oct. 31 to 5,930 ETH on Nov. 6.

The declining whale activity could hint at uncertainty among Ethereum whales as the market surge has been triggered by the U.S. presidential election news.

It’s important to note that 53% of the ETH supply is sitting in whale addresses. If whales start making deposits into the exchanges, it could soon trigger another phase of fear, uncertainty and doubt, also known as FUD, among retail investors.

The Ethereum exchange net inflow dropped to 4,170 ETH yesterday after a major decline from Tuesday’s 71,720 ETH, according to ITB data.

At this point, 71% of the ETH holders are in profit. A mild profit-taking scenario would be considered normal as over 74% of the addresses have been holding ETH for over a year, per ITB data.

English (US) ·

English (US) ·