content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Ethereum is trading below the $1,900 level as selling pressure continues to mount, raising concerns that the recent downtrend could extend further. After losing the critical $2,500 support in late February, bulls have struggled to regain control. What began as a minor pullback has turned into a broader correction, disappointing investors who had anticipated a bullish 2025 for ETH.

The failure to reclaim key levels has eroded market confidence, and price action remains weak across both short and mid-term timeframes. Ethereum’s inability to sustain even brief recoveries has only reinforced the bearish sentiment that has gripped the crypto space in recent weeks.

Adding to the negative outlook, new data from Santiment reveals that whales have sold approximately 500,000 ETH over the past 48 hours. This massive distribution by large holders highlights a clear lack of confidence among some of the most influential players in the market — a trend that could weigh heavily on Ethereum’s near-term performance.

As ETH hovers below $1,900, all eyes are on whether bulls can defend remaining support levels, or if continued selling from whales and broader market uncertainty will drive the price further down in the days ahead.

Ethereum Whale Selling Fuels Bearish Outlook

Ethereum is down 55% from its December high, with price action continuing to reflect the broader market’s weakness. The selloff has been sharp and consistent, fueled by growing macroeconomic uncertainty and global instability. The latest wave of volatility was triggered by US President Donald Trump’s renewed tariff threats and unpredictable policy direction, which have spooked financial markets and driven capital away from high-risk assets.

As a result, Ethereum — a key altcoin with deep ties to speculative sentiment — has become one of the hardest-hit major cryptocurrencies. Bulls are struggling to hold support near the $1,800 level, and every attempt to rally has been met with renewed selling pressure. Without a clear shift in trend, ETH remains vulnerable to further downside in the near term.

Adding to the bearish sentiment, top analyst Ali Martinez shared data showing that whales sold 500,000 ETH over the last 48 hours. This massive distribution from large wallets suggests that even experienced market participants are growing increasingly cautious. Such activity tends to precede deeper corrections, particularly when accompanied by weak technicals and broader risk-off sentiment.

Ethereum whales sold 500,000 ETH in 48H | Source: Ali Martinez on X

Ethereum whales sold 500,000 ETH in 48H | Source: Ali Martinez on XUnless Ethereum can reclaim key resistance levels and show signs of accumulation, the current trend may continue to favor sellers. As markets digest macro developments, ETH holders are watching closely for any indication that the worst is over — but for now, the pressure remains firmly to the downside.

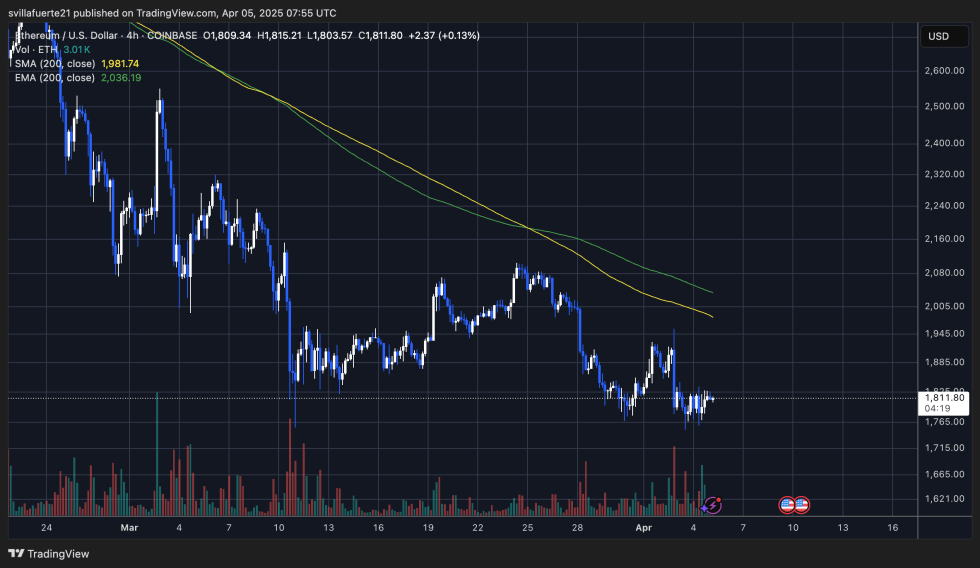

Ethereum Trades At $1,810 As Bulls Defend Crucial Support

Ethereum is trading at $1,810 after repeated failed attempts to reclaim the $1,900 level. The price continues to face strong resistance, and bullish momentum has significantly weakened in recent weeks. Bulls are now in a critical position, with $1,800 emerging as the most important support level in the current cycle. A decisive breakdown below this mark could trigger a deeper correction, potentially sending ETH as low as $1,550 — a zone not seen since mid-2023.

ETH holding above $1,800 | Source: ETHUSDT chart on TardingView

ETH holding above $1,800 | Source: ETHUSDT chart on TardingViewThe broader crypto market remains under pressure, and Ethereum’s price action reflects that. Sentiment has been weighed down by macroeconomic headwinds and aggressive selling from whales, adding to the difficulty for bulls to regain control. Still, hope remains if ETH can stabilize and push higher in the coming sessions.

A breakout above the $2,000 level would mark a significant shift in momentum and could spark a strong recovery rally. That level remains the psychological and technical threshold for a potential trend reversal. Until then, Ethereum continues to walk a tightrope between consolidation and further downside, with bulls needing to hold $1,800 at all costs to avoid cascading losses. The next few days will be crucial in determining ETH’s short-term direction.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

English (US) ·

English (US) ·