Key Notes

- Five spot XRP ETFs have officially appeared on the DTCC.

- Technical indicators suggest XRP is consolidating in a bullish wedge pattern.

- Analysts see $1.90 as the final retest before a possible breakout toward $10.

This week, five spot XRP XRP $2.48 24h volatility: 8.3% Market cap: $149.32 B Vol. 24h: $4.19 B exchange-traded funds from Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares appeared on the Depository Trust and Clearing Corporation (DTCC), the same platform that processed Bitcoin and Ethereum ETFs before their official market debut.

The listings mark a key logistical milestone, indicating that a US launch could occur within weeks.

According to CryptoBriefing, five spot XRP ETFs from Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares have appeared on the DTCC list — Franklin XRP Trust (XRPZ), 21Shares XRP ETF (TOXR), Bitwise XRP ETF (XRP), Canary XRP ETF (XRPC), and CoinShares XRP ETF…

— Wu Blockchain (@WuBlockchain) November 10, 2025

Exposure to XRP

The five registered products (Franklin XRP Trust (XRPZ), 21Shares XRP ETF (TOXR), Bitwise XRP ETF (XRP), Canary XRP ETF (XRPC), and CoinShares XRP ETF (XRPL)) include a diverse lineup of issuers, awaiting to provide customers with exposure to XRP.

At Ripple Swell 2025, Canary Capital CEO Steven McClurg announced plans to launch the XRPC ETF as early as next week, using a “no-delay amendment” to fast-track approval within 20 days.

McClurg pointed out the firm’s successful launches of Litecoin LTC $107.6 24h volatility: 6.2% Market cap: $8.23 B Vol. 24h: $1.75 B and Hedera HBAR $0.19 24h volatility: 9.3% Market cap: $7.93 B Vol. 24h: $260.15 M ETFs as a template for XRP’s entry. Meanwhile, Grayscale is preparing to convert its existing XRP Trust, currently holding about $14 million in AUM, into a spot ETF.

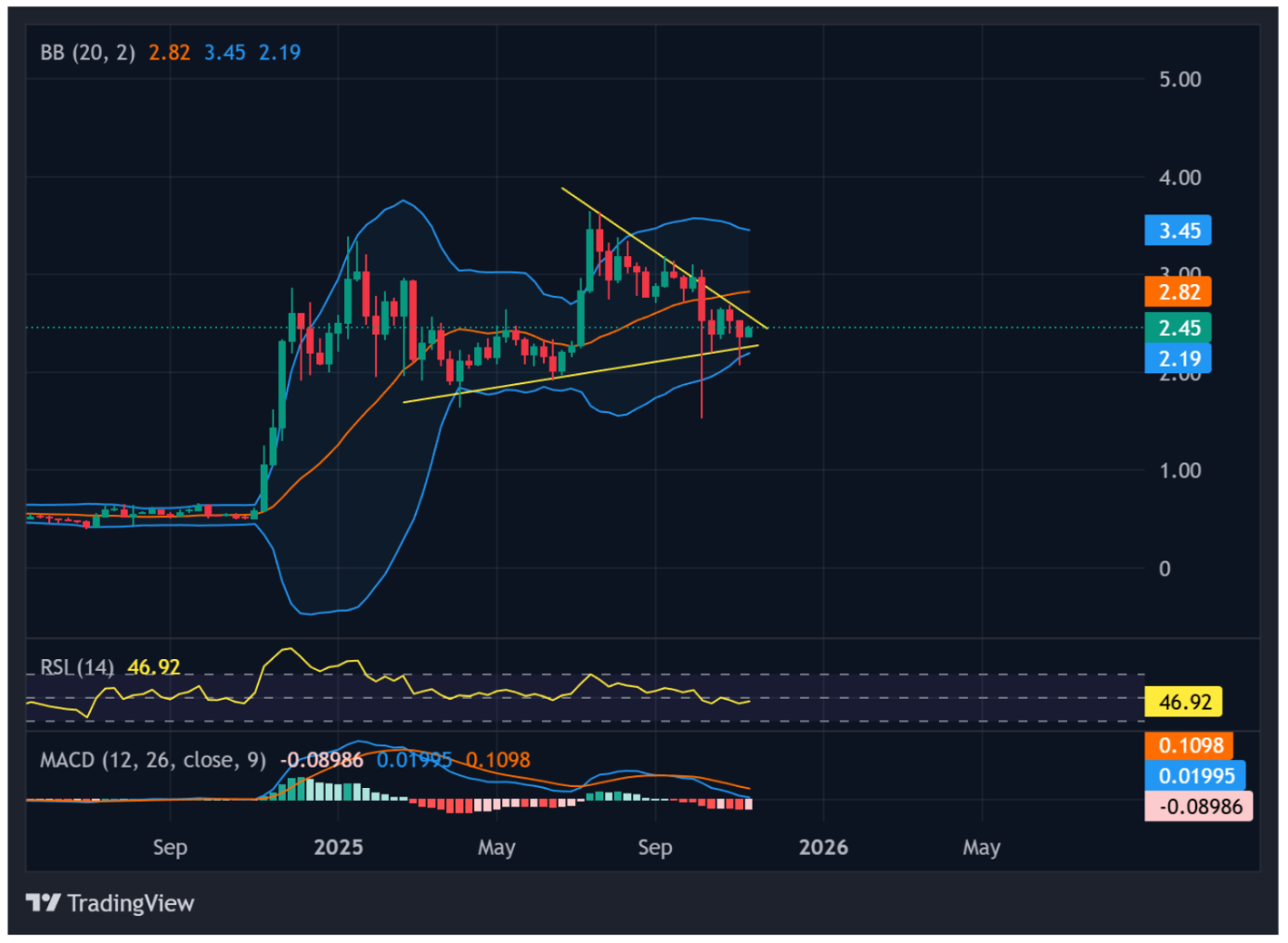

Chart Setup: Flag Forming Before a Major Move

XRP has risen 7.45% in the past 24 hours, supported by a 64.86% surge in trading volume, and appears to be consolidating within a descending wedge pattern, often a precursor to an upside breakout.

The Bollinger Bands are tightening while the RSI sits around 46.9. Meanwhile, the MACD line is curling upward near the zero axis, hinting at a possible bullish crossover in the coming sessions.

Immediate resistance is near $2.82, with a breakout above the upper wedge trendline opening the door toward $3.45 and potentially $4 in the near term.

XRP weekly chart with RSI and MACD | Source: TradingView

On the other hand, the nearest support is $2.19, and a sustained close below this level could trigger a retest around $1.90, the same level analyst Ali Martinez calls the “final retest” in his $10 dream scenario.

The dream scenario: $XRP is forming a bullish flag, and a dip to $1.90 could be the spark for a rally toward $10. pic.twitter.com/LpTiPQ1FQG

— Ali (@ali_charts) November 9, 2025

Martinez pointed out a “bullish flag” formation where a brief correction sets the stage for an explosive move higher. If the pattern completes, the next impulse could drive XRP toward $10, making the token one of the best crypto to buy in 2025.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.

English (US) ·

English (US) ·