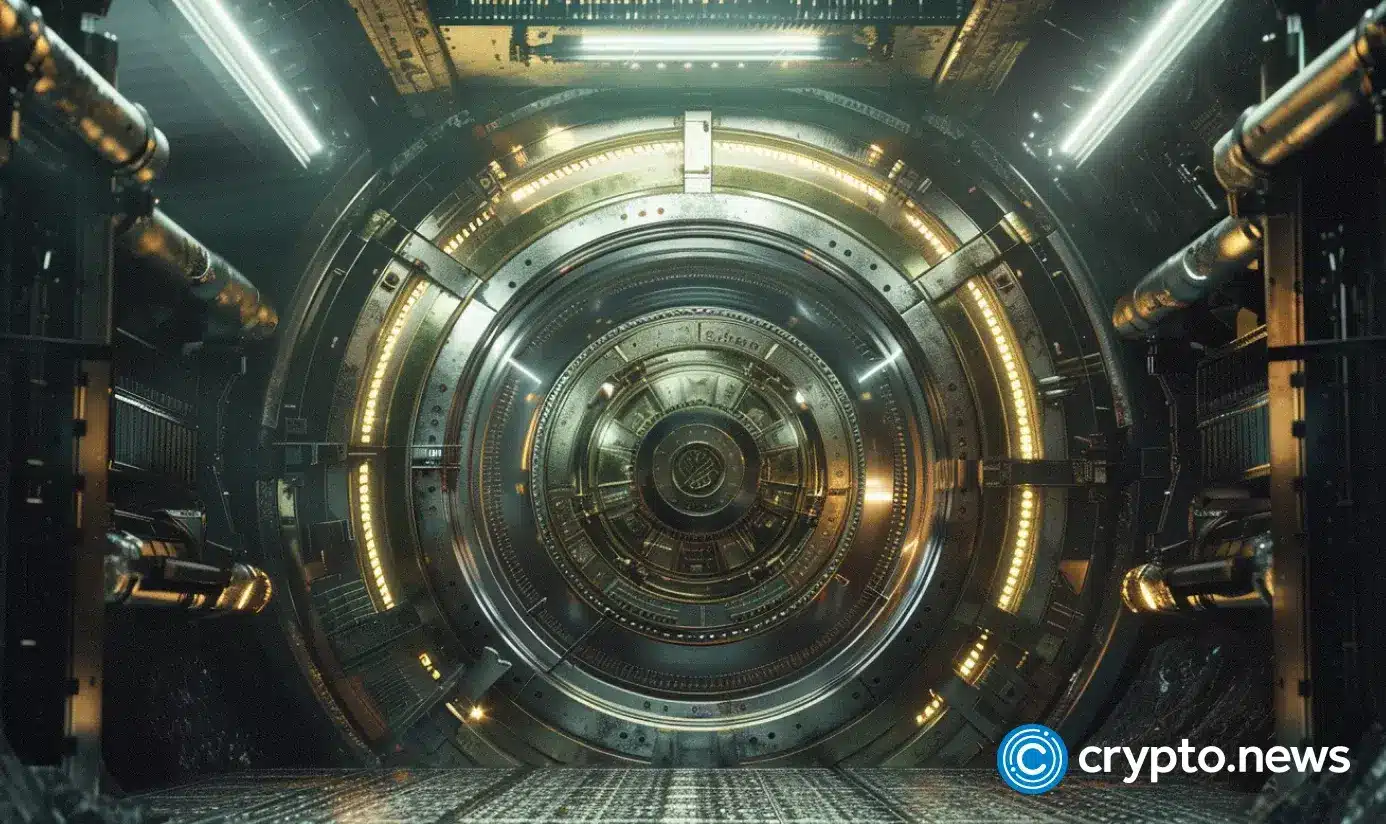

The rise of blockchain in mainstream finance is paving the way for institutional investors to tap into digital fund shares.

Key Takeaways

- Goldman Sachs and BNY Mellon launched a platform for institutional investors to access tokenized money market funds.

- Tokenized funds provide yield and efficient transactions, attracting major asset managers and institutional clients.

Goldman Sachs and BNY Mellon are launching a new platform that allows institutional clients to invest in tokenized money market funds, CNBC reported Wednesday, and it already has backing from titans like BlackRock, Fidelity, and Federated Hermes.

Under the initiative, BNY Mellon clients, such as hedge funds, pensions, and corporate treasurers, will gain access to tokenized fund share classes recorded directly on Goldman’s private blockchain.

Tokenized money market shares promise an alternative to stablecoins. Unlike stablecoins, money market funds generate real returns, making them a compelling on-chain instrument for parking idle capital with low risk and high liquidity.

In March 2024, Goldman Sachs, BNY Mellon, and other financial institutions participated in a network test on Digital Asset’s Canton Network to facilitate seamless transactions and settlements of tokenized assets.

The pilot involved 15 asset managers, 13 banks, four custodians, and three exchanges, demonstrating the potential of enterprise blockchain to reduce risks, optimize capital, and enable more efficient financial processes.

Disclaimer

7 hours ago

1

7 hours ago

1

English (US) ·

English (US) ·