Major investment bank Goldman Sachs has disclosed its significant stake in spot Bitcoin ETFs (exchange-traded funds). The finance behemoth, once a vocal Bitcoin critic, appears to be shifting its investment strategy towards crypto assets, specifically the world’s largest cryptocurrency by market capitalization.

Goldman Sachs Discloses $461 Million In BlackRock’s Bitcoin ETF

On Thursday, November 14, Goldman Sachs disclosed in a filing with the United States Securities and Exchange Commission (SEC) its holdings of about $718 million in eight Bitcoin ETFs. The firm’s latest quarterly report revealed that the bank has expanded its Bitcoin fund portfolio by $300 million.

Goldman Sachs initially ventured into the United States Bitcoin ETF market earlier in 2024’s second quarter, unveiling a Bitcoin fund investment of $418 million. However, the BTC exchange-traded fund portfolio has grown by more than 71%, as it now stands at $718 million.

According to the Nov 14 filing with the United States SEC, Goldman Sachs now holds $461 million in BlackRock’s spot Bitcoin ETF (with the ticker IBIT). The investment bank also revealed a $96 million holding in Fidelity’s Wise Origin Bitcoin Fund (with the ticker FBTC).

Furthermore, Goldman Sachs disclosed $72 million in the Grayscale Bitcoin Trust ETF (GBTC) and roughly $60 million in the Invesco Galaxy Bitcoin exchange-traded fund. It is also worth mentioning the bank’s $22 million and $3 million investments in Bitwise’s Bitcoin fund and Ark/21Shares’ ETF, respectively.

Bitcoin ETFs were not the only crypto endeavors made by Goldman Sachs in the last quarter. The investment banking giant also dabbled in the recently launched spot Ethereum exchange-traded funds, including $22.6 million in Grayscale Ethereum Mini Trust ETF and $2.6 million in the Fidelity Ethereum Fund.

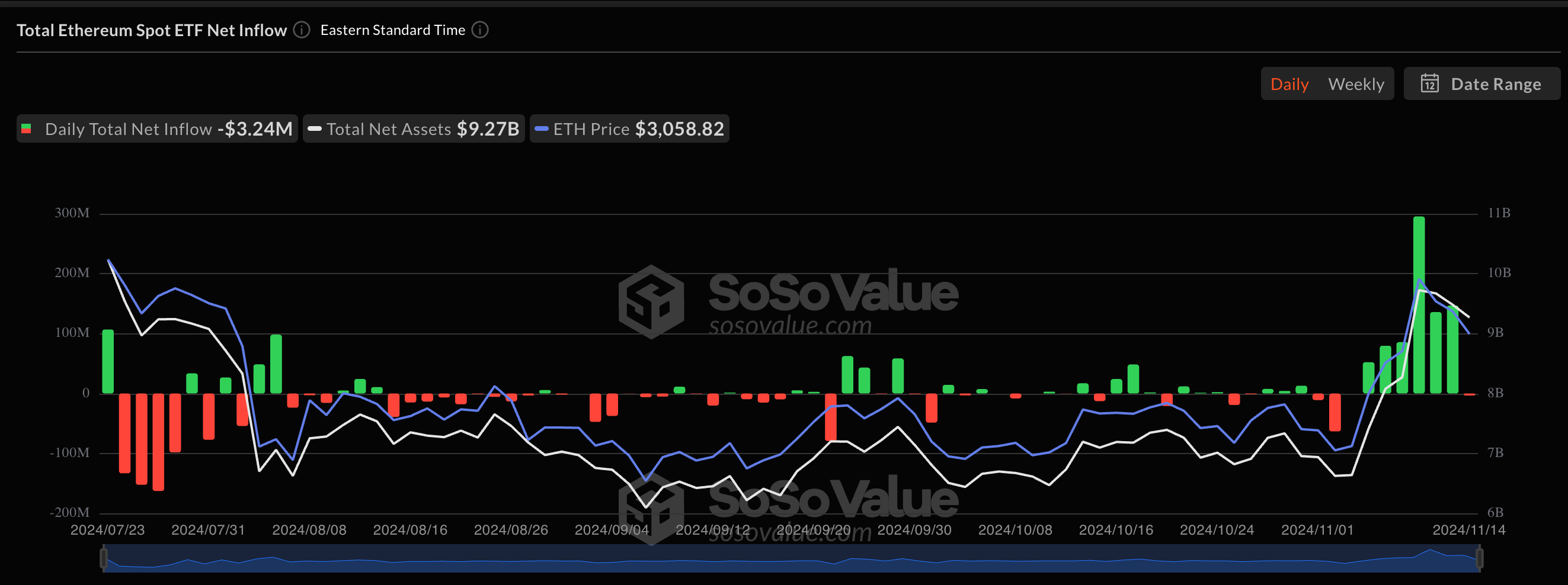

While the spot Bitcoin exchange-traded funds have garnered significant attention and capital since launch, their Ethereum counterparts have largely struggled since hitting the market. However, the Ethereum ETFs appear to be enjoying a period of restitution, having recently recorded six consecutive days of inflows.

What Else Has Goldman Sachs Been Up To?

As mentioned earlier, Goldman Sachs has been making major moves in the cryptocurrency industry since the turn of the year. While investing in crypto exchange-traded funds seems like the obvious path, the banking firm has also been considering blockchain technology ventures.

As reported in July, Goldman Sachs disclosed its plans to expand its crypto offering, specifically focusing on the tokenization sector. Global Head of Digital Assets Matthew McDermott revealed the bank’s intentions to launch three tokenization projects before the end of 2024.

Featured image from The Saudi Boom, chart from TradingView

English (US) ·

English (US) ·