Goldman Sachs has recently stated that the current downturn in the market is not a crash but a “healthy correction.” This statement aims to calm the fears of investors who are worried about the recent drops in both the stock and crypto markets.

Goldman Sachs believes that this correction is necessary for the long-term health of the market. They argue that the market had risen too quickly and needed to adjust to more sustainable levels. This view is shared by many financial experts who see corrections as an opportunity for the market to reset.

Despite reassurances from Goldman Sachs & other top crypto experts, many investors remain worried. The combined decline in both the stock and crypto markets has created uncertainty. The majority of the investors are concerned about their investments and the potential for further losses.

Market Correction

A market correction happens when there is a drop of 10% or more in the price of stocks, bonds, or other assets from their recent highs. Corrections are common and can help to keep the market from becoming too overheated. They are seen as a natural part of the volatile money market cycle.

Today, in the last 12 hours, the trade price of Bitcoin crashed 18%. But notably, in the last hour, it surged by 6.6%, which means panic is disappearing slowly.

Impact & Stock & Crypto Market

In the past few weeks, the stock market has experienced significant declines. Major indexes like the S&P 500 and the Dow Jones Industrial Average have seen drops. Analysts believe these declines are due to various factors such as inflation concerns, rising interest rates, and uncertainties about the global economy.

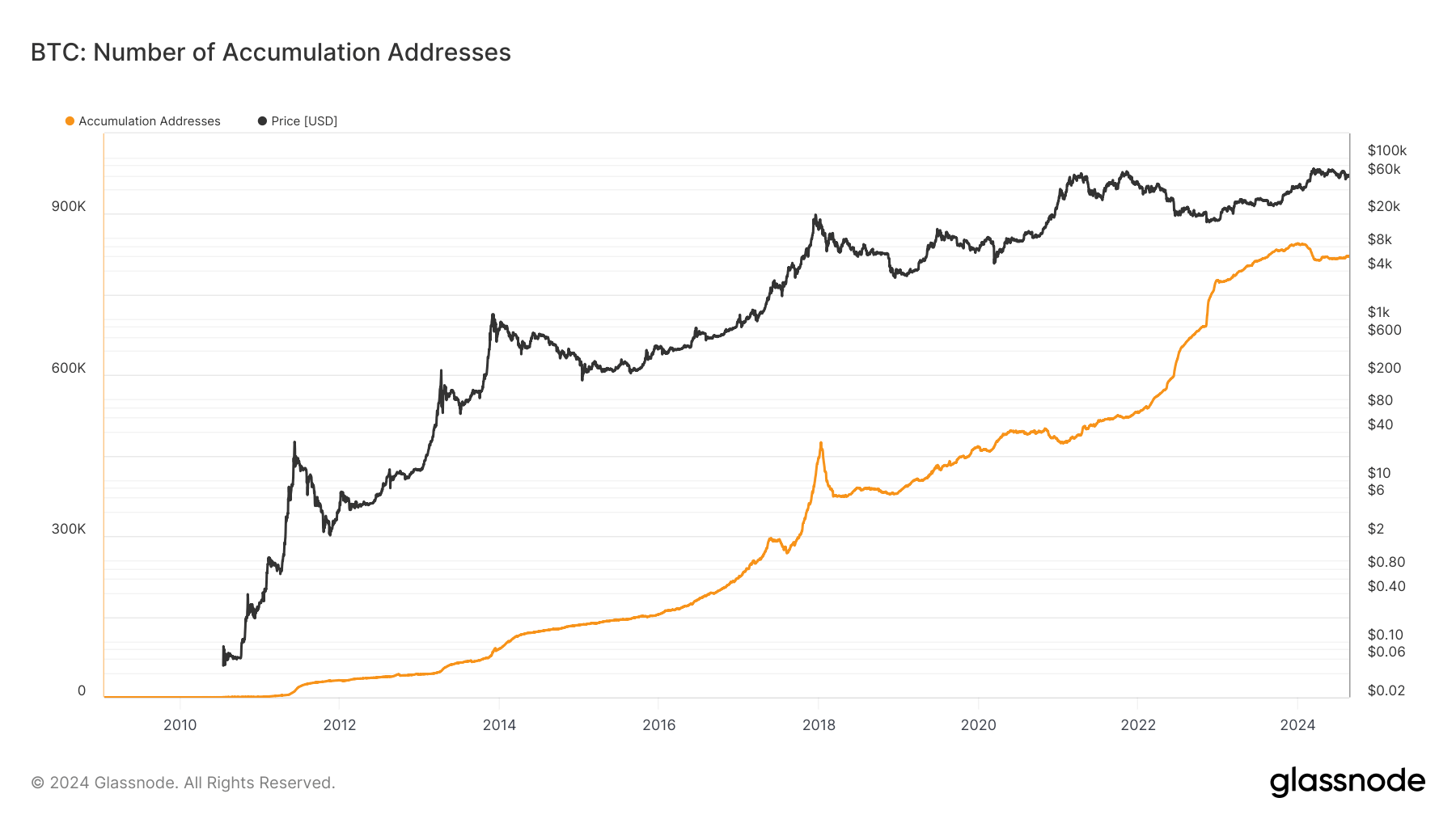

The cryptocurrency market has also taken a hit. Popular cryptocurrencies like Bitcoin and Ethereum have seen their values drop sharply.

As per information provided by multiple crypto media experts, today the crypto market experienced over $1 billion in liquidations.

Bitcoin and Ethereum were hit the hardest, with Bitcoin futures seeing $420 million and Ethereum futures $340 million in liquidations. This massive sell-off affected over 275,000 traders, mainly those who had bet on prices increasing. The sudden downturn was triggered by market fears and rumours about a major market maker exiting the crypto business, exacerbated by broader economic concerns.

Read also: Ripple Faces Developer Backlash Over Edited Podcast Clip

English (US) ·

English (US) ·