ISO 20022-compliant cryptocurrencies could benefit substantially in the future. They will be prime candidates for financial institutions looking to expand their offerings with the unique advantages offered by blockchain technology. Our ISO 20022 crypto list will help you identify the best cryptocurrencies that comply with the ISO 20022 standard.

In this article, we are going to explain what ISO 20022 is in simple terms and go over cryptocurrencies that are currently compliant with the standard.

Key takeaways:

- The ISO 20022 standard streamlines data interchange between financial institutions, enhancing automation, reducing errors, and improving cash flow visibility.

- As of the latest reports, about 26.4% of banks have achieved ISO 20022 compliance, with others required to comply by March 2025.

- Cryptocurrency companies that have adopted the ISO 20022 standard, like XRP and Stellar, offer easier integration with financial systems and potential industry adoption.

- The adoption of ISO 20022 in cryptocurrency projects like Algorand, Quant, and Hedera enhances compatibility with traditional finance, fostering wider acceptance and technological integration.

What is ISO 20022?

According to SWIFT, ISO 20022 is a methodology for standardizing the interchange of data between financial institutions. ISO 20022 can be used in various areas, including the clearing and settlement of payments, trading and settlement of securities, cash management, account management, and more.

In essence, ISO 20022 addresses the problem of financial institutions using different formats and protocols for electronic data, which leads to inefficiencies. By adopting ISO 20022, financial institutions can cut costs, reduce the likelihood of errors, and reduce the complexity of data interchange.

Here are some of the main benefits of the ISO 20022, according to SWIFT:

“Thanks to its structured and richer data elements, ISO 20022 enables counterparties, intermediaries, and beneficiaries to increase automation in transaction processing, reducing costly manual interventions, and improving visibility on cash flows and cash positions, for example, in payment transactions.”

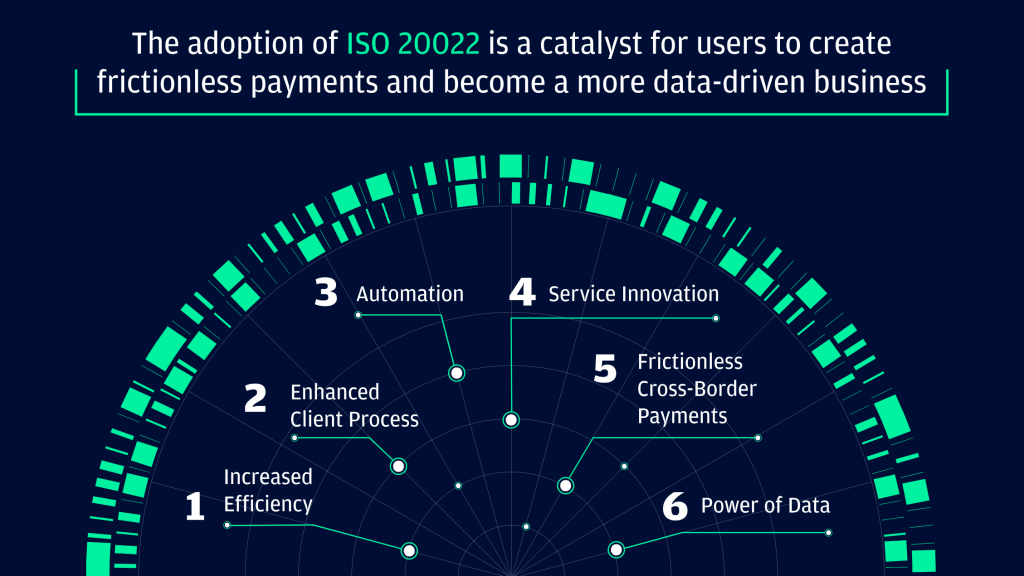

The benefits of adopting ISO 20022. (Source: JPMorgan)

The benefits of adopting ISO 20022. (Source: JPMorgan)It is important to highlight that not all institutions have fully implemented the prerequisites for ISO 20022 readiness. As reported by The Banker last year, approximately 26.4% of banks have achieved ISO 20022 compliance.

For those institutions that have yet to undertake the essential measures to attain ISO 20022 compliance, they will have until 2025 to make the necessary adjustments.

The best ISO 20022-compliant cryptos

Some cryptocurrencies have been designed with the ISO 20022 standard in mind so that they can potentially be integrated into broader financial systems more easily. When we say that a digital asset is an ISO 20022 crypto, we mean that it incorporates messaging language as defined in the ISO 20022 standard, allowing for simpler data exchange between its blockchain and other financial systems such as SWIFT.

ISO 20022 coins could have a head start when it comes to adoption in the financial services industry, as they will be much easier for companies to integrate than cryptocurrencies that weren’t designed with this standard in mind.

Below, you’ll find a list showcasing the ISO 20022-compliant cryptos:

- XRP – Highly efficient cryptocurrency suitable for cross-border payments

- Stellar – Fast and cost-effective blockchain with built-in DEX

- Algorand – Pure Proof-of-Stake blockchain with smart contracts

- Cardano – Research-driven blockchain with a focus on scalability, security, and sustainability

- XDC Network – Hybrid blockchain optimized for enterprise and trade finance applications

- Quant – Platform enabling interoperability between blockchains

- Hedera Hashgraph – A highly efficient DLT based on Hashgraph architecture

- IOTA – DAG-based network for IoT use cases

1. XRP – Highly efficient cryptocurrency suitable for cross-border payments

XRP is a cryptocurrency that uses a unique consensus algorithm called the XRP Ledger Consensus Protocol to provide extremely fast and cost-effective transactions. This makes it suitable as a bridge currency that can enable liquidity between different fiat currencies.

While the XRP Ledger doesn’t offer advanced smart contract functionality, the platform is optimized for payments and can offer the performance and efficiency that are required by global financial institutions.

The main entity spearheading the development of the XRP ecosystem is Ripple, a United States-based company that uses XRP in its cross-border payments products. Ripple is part of the ISO 20022 Standards Body and was the first blockchain-focused company to join it. By adopting the ISO 20022 standard, Ripple can offer its RippleNet solution to a broader range of customers.

XRP summary:

- A distributed ledger using the XRP Ledger Consensus

- XRP can handle 1,500 transactions per second

- Transactions cost fractions of a cent

- Ripple has partnerships with numerous leading financial institutions

2. Stellar – Fast and cost-effective blockchain with built-in DEX

Stellar is a cryptocurrency that was initially launched as a modified version of XRP. One of the co-founders of Stellar is Jed McCaleb, who also played a role in the creation of XRP. The Stellar blockchain also offers extremely fast and efficient transactions.

The Stellar blockchain can be used to make transactions with the platform’s native currency, XLM, but it also offers built-in decentralized exchange functionality to seamlessly swap between the different assets issued on the Stellar blockchain.

Given its emphasis on interoperability between financial institutions, Stellar is poised to readily embrace the ISO 20022 standard. Through the integration of ISO 20022, Stellar will enable more efficient cross-border transactions and foster improved communication with conventional financial systems. XLM is poised to become one of the leading ISO 20022 tokens on the market.

Stellar summary:

- A cryptocurrency with similar properties to XRP

- Built-in decentralized exchange feature

- Useful for cross-border payments and stablecoins

- Smart contracts functionality through the Soroban platform

3. Algorand – Pure Proof-of-Stake blockchain with smart contracts

Algorand is a blockchain platform that supports smart contracts and employs a sophisticated Proof-of-Stake consensus algorithm that allows all ALGO holders to participate in the consensus process. The Algorand project was founded by renowned computer scientist Silvio Micali.

The Algorand mainnet made its debut in 2019. Since then, Algorand has seen multiple enhancements, including improved smart contract functionalities and the capacity to support custom tokens, among other features. Algorand is intentionally structured to be an environmentally conscious and highly efficient blockchain and offers some of the lowest transaction fees among all cryptocurrencies.

Through the incorporation of the ISO 20022 standard, Algorand has the potential to improve its compatibility with conventional financial systems, enabling effortless integration with pre-existing infrastructure.

This could lead to wider adoption of Algorand’s technology, potentially attracting a greater number of developers and enterprises to engage with and build upon the platform.

Algorand summary:

- Pure Proof-of-Stake blockchain

- Supports smart contracts and custom tokens

- Very low transaction fees

- Environmentally friendly

4. Cardano – Research-driven blockchain with a focus on scalability, security, and sustainability

Cardano is a blockchain platform built on rigorous academic research and a layered architecture to enhance scalability, security, and sustainability. Developed by IOHK and led by Ethereum co-founder Charles Hoskinson, it aims to provide an efficient and sustainable blockchain ecosystem for enterprises and individuals.

Cardano’s Ouroboros Proof-of-Stake (PoS) consensus ensures energy efficiency while maintaining high security. Its dual-layer architecture separates ADA transactions from smart contract execution, enabling flexibility and scalability. The Plutus smart contract platform and Hydra layer-2 solution further boost network efficiency and adoption potential.

By aligning with ISO 20022, Cardano strengthens its compatibility with financial systems, making it a strong candidate for integration into traditional banking and enterprise applications.

Cardano summary:

- Proof-of-Stake blockchain with a research-driven approach

- Scalable and energy-efficient, designed for long-term sustainability

- Layered architecture enables seamless upgrades and enhanced security

- Supports smart contracts through the Plutus platform

- Hydra scaling solution to significantly boost transaction speeds

- ISO 20022 integration enhances interoperability with financial systems

5. XDC Network – Hybrid blockchain optimized for enterprise and trade finance applications

XDC Network (XinFin Digital Contract) is a hybrid blockchain that merges public and private architecture, making it ideal for enterprises and institutions. It is specifically designed to enhance trade finance, supply chain operations, and cross-border settlements with fast, secure, and cost-effective transactions.

Using a Delegated Proof-of-Stake (DPoS) consensus, XDC Network ensures high throughput, low latency, and minimal energy consumption. Transactions settle in two seconds, with fees significantly lower than Ethereum.

A key advantage of XDC Network is its ISO 20022 compliance, enabling seamless integration with banks and financial institutions. It supports smart contracts, tokenization, and interoperability with legacy systems, facilitating real-world financial applications.

As trade finance digitizes, XDC Network stands out as a fast, transparent, and regulatory-compliant blockchain, bridging blockchain technology with traditional finance.

XDC Network summary:

- Hybrid blockchain that combines public and private blockchain features

- Optimized for enterprise and trade finance applications

- Delegated Proof-of-Stake (DPoS) ensures fast and energy-efficient transactions

- Finality within two seconds and low-cost transactions

- ISO 20022-compliant, making it bank-friendly and interoperable with financial institutions

- Supports smart contracts, tokenization, and seamless integration with legacy financial systems

6. Quant – Platform enabling interoperability between blockchains

Quant is a blockchain platform that enables interoperability and establishes seamless connections among multiple blockchain networks. It relies on the Overledger protocol to facilitate the exchange of information between different blockchain ecosystems. The Quant platform enables collaboration and innovation, empowering developers and enterprises to launch decentralized applications that can interact with a multitude of blockchains.

Through the adoption of the ISO 20022 standard, Quant aspires to boost its compatibility with traditional financial systems, streamlining the secure exchange of data across various networks. Achieving ISO 20022 compliance could position Quant in a pivotal role, bridging the divide between various blockchain platforms and strengthening its role in the blockchain ecosystem.

Quant summary:

- Blockchain focused on enabling interoperability

- Allows developers to launch mDApps, which are decentralized applications that function with multiple blockchains

- Supports a variety of blockchains, including the likes of Bitcoin, Ethereum, and XRP

- Designed for financial institutions and SMEs

7. Hedera Hashgraph – A highly efficient DLT based on Hashgraph architecture

Hedera Hashgraph is a decentralized network that provides functionality similar to blockchains but is based on an innovative architecture called a hashgraph. Hashgraph provides an alternative and arguably superior way to achieve distributed consensus.

The platform offers transaction fees as low as $0.001, and transactions on Hashgraph achieve finality in between 3 to 5 seconds. According to Hedera Hashgraph’s development team, the platform can facilitate upwards of 10,000 transactions per second.

The Hedera Hashgraph platform supports smart contracts that are compatible with the Ethereum Virtual Machine, making it a suitable platform for developers who are accustomed to building with the Ethereum ecosystem’s smart contract tools.

Through its adoption of the ISO 20022 standard, Hedera aims to bolster its compatibility with conventional financial systems, enabling the smooth integration of decentralized applications (dApps) with the pre-existing infrastructure.

Hedera Hashgraph summary:

- Distributed ledger based on Hashgraph technology

- Can process over 10,000 transactions per second

- EVM-compatible smart contracts

- Low fees, transactions achieve finality in 3-5 seconds

8. IOTA – DAG-based network for IoT use cases

IOTA is another distributed ledger platform that forgoes the traditional blockchain architecture in an effort to achieve superior scalability. In the case of IOTA, the platform is built using a directed acyclic graph (DAG) architecture, which allows it to support zero-fee transactions. IOTA’s DAG network is called the Tangle.

The network’s immense efficiency makes IOTA a suitable candidate for Internet of Things (IoT) applications where handling large amounts of data in a short period of time is of the utmost importance.

By incorporating the ISO 20022 standard, IOTA strives to establish a framework for standardized and secure data transfers among Internet of Things (IoT) devices. This strategic choice aims to facilitate the effortless integration of IOTA into the wider IoT ecosystem, ensuring a consistent and secure flow of data among IoT devices.

IOTA summary:

- Distributed ledger platform based on a DAG architecture

- Fee-free transactions

- Suitable for IoT applications

- Can handle around 1,000 transactions per second

The bottom line

We hope that our ISO 20022 crypto list helped you understand the ISO 20022 standard and how it relates to the cryptocurrency space. As we can see, the list of ISO 20022-compliant crypto tokens mostly consists of projects targeting enterprise use.

Many of the coins featured on this list feature extremely low transaction fees, which allows them to be used in enterprise-grade applications that require handling an extremely large number of transactions in a short period of time. To learn more about this topic, make sure to check out our list of the cheapest cryptos to transfer.

English (US) ·

English (US) ·