Major crypto exchanges face scrutiny over token listing fees and practices.

Key Takeaways

- Justin Sun and Andre Cronje claim Binance charges no listing fees while Coinbase demands up to $300 million.

- According to Moonrock Capital CEO, Binance requests a significant portion of a project's total token supply as a fee for listing.

Tron founder Justin Sun and Fantom Network founder Andre Cronje asserted that Binance did not charge fees for listing their tokens. In contrast, Coinbase requested millions of dollars for similar services, which contradicts Coinbase CEO Brian Armstrong’s public statement that listings are free.

Controversy surrounding listing fees on Coinbase and Binance stemmed from a post from Moonrock Capital CEO Simon Dedic. Dedic expressed frustration with the practices of crypto exchanges, specifically Binance.

According to him, projects that wanted to list on Binance had to go through “a year of due diligence.” Once they passed this step, they were asked for a significant portion of a project’s total token supply as a fee for listing.

“Not only is this unaffordable for projects, but these tokens are also the biggest reason for bleeding charts,” he said.

In response to Dedic’s post, Armstrong said that “asset listings on Coinbase are free,” inviting projects to apply through their Asset Hub.

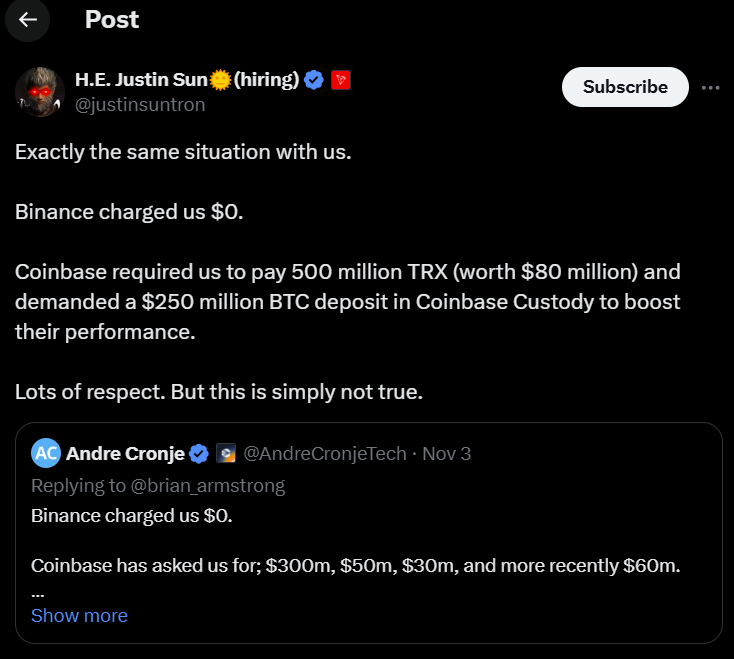

However, Cronje, commenting on Armstrong’s post, revealed that his experience was different. Coinbase had approached his project, Fantom, with requests for listing fees ranging from $30 million to $300 million, with a recent quote of $60 million.

Sun backed Cronje’s assertions, disclosing that Coinbase requested 500 million TRX (approximately $80 million) for listing TRON on its platform. He also mentioned that Coinbase required a $250 million Bitcoin deposit to be held in custody to enhance liquidity.

Not all projects can secure a listing simply by paying a fee, says Binance’s He Yi

He Yi, co-founder of Binance, said that if a project does not pass the exchange’s rigorous review process, it will not be listed regardless of the financial offer or percentage of tokens provided.

Yi clarified that Binance evaluates projects based on their overall quality and potential, rather than just their willingness to pay. She also mentioned that while Binance has clear rules regarding airdrops and collaborations, simply offering tokens or airdrops does not guarantee a listing.

Responding to Yi’s statements, Dedic expressed skepticism about her claims of not charging exorbitant fees for token listings.

“So you are saying those are pure lies and Binance never asked a project for 15% or more tokens? Eventually it doesn’t matter how you call those fees as long as you are taking it from hard working founders,” he said.

Disclaimer

2 weeks ago

5

2 weeks ago

5

English (US) ·

English (US) ·