Kenya collected $78 million from digital asset traders in the last financial year, the country’s taxman has revealed as it pledged to double down on the budding sector.

The Kenya Revenue Authority revealed that in the 2023-24 financial year, the country collected 10 billion shillings ($77.8 million) from 384 digital asset dealers. The agency didn’t disclose who these dealers were or whether they were individuals, corporations, or VASPs. However, these dealers each remitted $202,100 in the last financial year, or $16,870 monthly, which is way beyond the expected tax payments for regular digital asset traders.

Speaking at the annual Taxpayers’ Day celebration at State House, KRA board chairman Anthony Mwaura said he’s confident the agency can collect even more. He has set an ambitious initial target of $466.3 million, amounting to nearly 3% of the agency’s revenue from the last financial year.

“The staff told us that if we agree with the Central Bank of Kenya within this year, we will be able to talk to those dealers, and we can net Sh 60 billion ($466 million),” Mwaura stated.

KRA is scrambling to tax a sector that has recorded explosive growth in the East African country. Kenya has been one of Africa’s most active digital asset hubs, ranking highly globally for adoption, especially in peer-to-peer trading volume. A young tech-savvy population, high internet penetration, and a ubiquitous digital money presence through M-Pesa have set the foundation for this explosion.

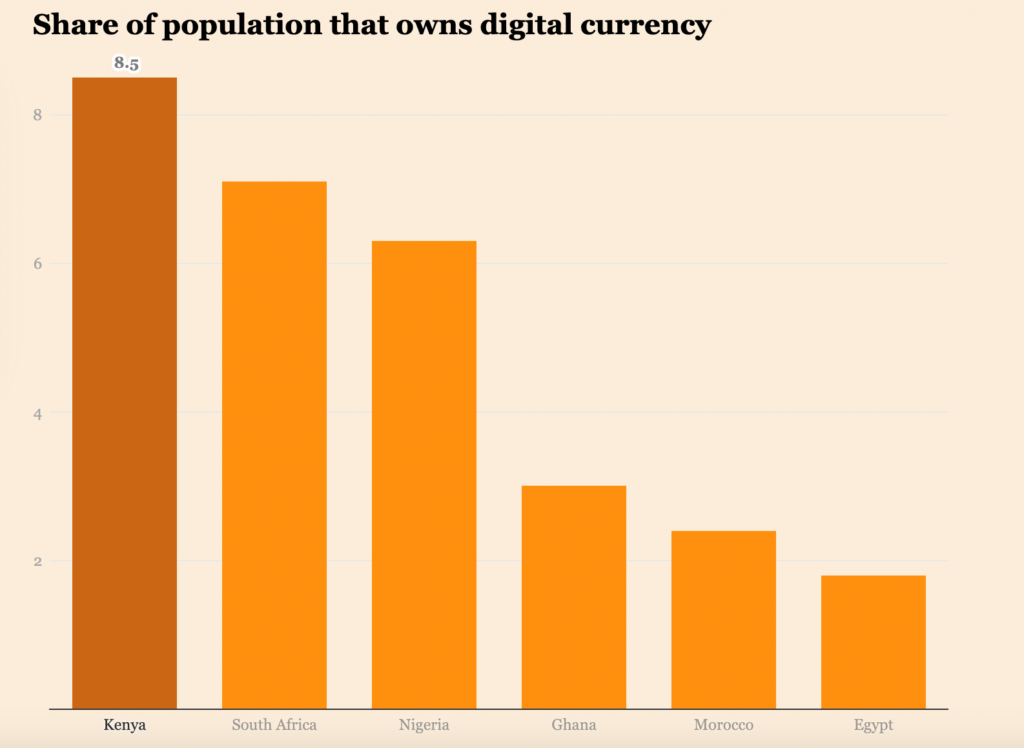

A UN report previously estimated that over four million Kenyans (8.5% of the population) owned digital assets, the highest share in Africa, while another report put the number at 6 million. KRA further estimated that in the 2021-22 financial year, Kenyans traded over 2.4 trillion shillings ($18.6 billion) in digital assets.

Taxation without regulation

Despite the surging adoption, Kenya, like many other digital asset hubs globally, has struggled to tax traders. Last year, the government pledged to impose a 1.5% digital tax on digital asset exchanges, aligning them with other digital businesses. A few months later, it passed a controversial Finance Bill that imposed a 3% tax on digital asset traders. The exchanges would deduct this tax, and offshore platforms would be given 24 hours to remit the taxes to the government.

All these tax pledges have not translated into the expected success. One key impediment is the lack of a formal policy framework, which leaves the exchanges and traders in regulatory limbo.

However, the taxman says that even though “the sector remains unregulated by reporting authorities i.e. CBK and CMA, the earnings from the sector are legally taxable.”

“The lack of a robust system to collect taxes on cryptocurrency transactions has resulted in significant loss of revenue for the government,” KRA lamented last month.

The Kenyan digital asset community has pledged to pay its fair share of the taxes. However, there have been two key demands: that the taxes be more tailored to the unique nature of digital assets and that the government implement a formal regulatory framework for the industry.

On the first demand, the Blockchain Association of Kenya (BAK) sued the government over the proposed 3% tax, claiming it was punitive and poorly structured.

“Despite being an income tax, the impugned digital asset tax is imposed on the gross value of the digital asset. This places a tax liability even on transactions that result in a net loss rather than focusing solely on the taxation of gains and profits,” BAK told one local outlet.

On regulation, BAK is also at the heart of the industry’s push for better policies. Last year, its efforts paid off when legislators called on the association to help draft Kenya’s first-ever digital asset regulatory framework. No proposals have emerged from this campaign, however.

Other African countries are also struggling with digital asset taxation. Last month, South Africa’s Revenue Service (SARS) warned digital asset holders against withholding taxes, which it says is a common practice in the country.

“Let all know that technology has enhanced SARS’ ability to root out non-compliant taxpayers and that SARS will pursue all without fear, favour or prejudice,” the taxman warned.

Watch: Converging IPv6 & Bitcoin for decentralized future

English (US) ·

English (US) ·