Key Notes

- The partnership enables Kraken clients to access enhanced liquidity and lower conversion costs for stablecoin transactions.

- Circle's USDC maintains its position as the world's second-largest USD stablecoin with $68 billion market capitalization.

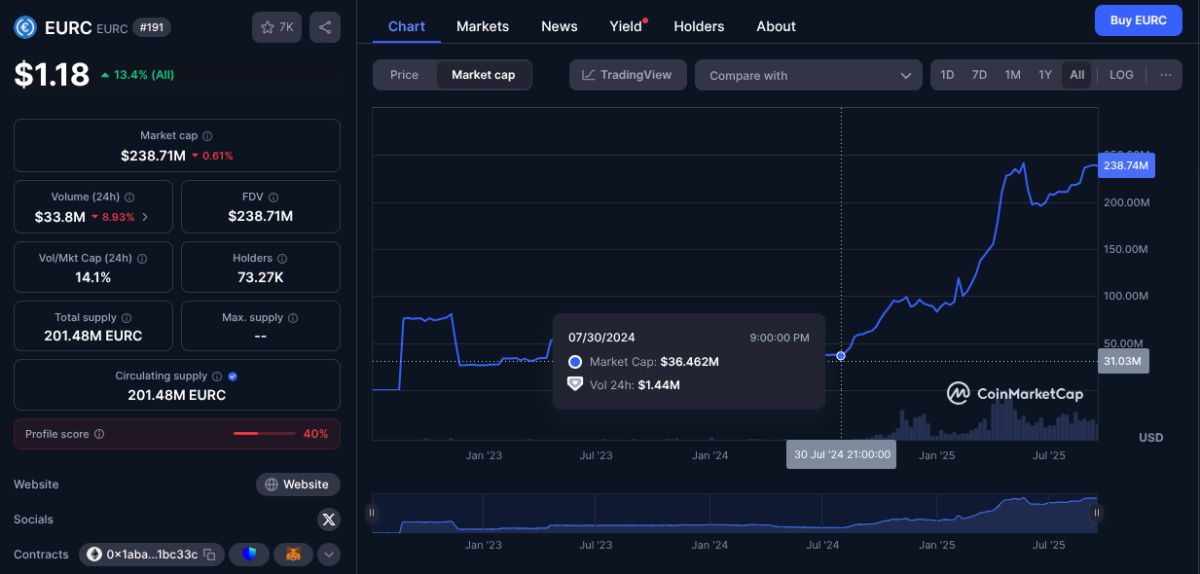

- EURC demonstrates steady growth potential despite its smaller $238.71 million market cap compared to other stablecoins.

Kraken and Circle have announced a partnership that promises to expand “access to a powerful suite of stablecoin infrastructure” on the platform, deepening support for the dollar stablecoin, USDC, and adding support for the euro stablecoin, EURC.

According to the announcement published by Circle on Sept. 17, Kraken clients will gain access to increased liquidity, reduced conversion fees, and new opportunities to deploy USDC across Kraken’s applications. Additionally, the crypto exchange will introduce access to EURC, which was still lacking.

Kraken is a leading cryptocurrency exchange, ranked 13th by spot trading volume in August, with $46.96 billion, per Colin Wu’s CEX Data Report from Sept. 16 covered by Coinspeaker, registering significant growth in the industry. Kraken was also the centralized exchange with the 11th largest volume for derivatives trading last month, with $46.01 billion.

Circle Stablecoins USDC and EURC

Circle (NYSE:CRCL) is a leading stablecoin issuer, responsible for the second-largest USD stablecoin by market cap and trading volume, USDC, with $661 billion as its 30-day volume, according to data from CoinMarketCap at the time of this writing.

“We’re focused on building the world’s largest, most widely used stablecoin network, and partnering with leading platforms, like Kraken, to drive new opportunities for onchain finance […] Expanding access to Circle’s products across Kraken’s established ecosystem can help extend the benefits of stablecoins to their millions of users,” said Kash Razzaghi, Chief Commercial Officer at Circle.

According to a recent post by Axelar Network, USDC is “world’s most widely used, regulated stablecoin,” currently with a $68 billion market cap. Circle’s dollar-pegged product has seen sustained growth since Donald Trump was elected President of the United States, while the entire stablecoin market cap has grown 54% since Trump’s election in 2024.

How did @circle’s USDC blaze a trail to become the world's most widely used, regulated stablecoin? 👇 pic.twitter.com/O7q58ki6hv

— Axelar Network (@axelar) September 17, 2025

Moreover, USDC and EURC are two of the four stablecoins accepted by Visa (NYSE:V) across four blockchains. An excerpt from the GS conference shared by DragonFly investor, Omar, on X highlights a four-fold growth in stablecoin settlement volume from $250 million to $1 billion, “just in the space of several months,” said Jack Forestell, Visa’s Chief Product & Strategy Officer.

Interesting excerpt from the GS conference: Visa stablecoin settlement volumes now up to ~$1b run-rate, up 4x from earlier this year

Direct stablecoin settlement lets Visa's partners bypass traditional bank/fiat rails for instant 24/7 settlement on the network. I.e. issuers… pic.twitter.com/A215RJECLV

— Omar (@TheOneandOmsy) September 16, 2025

Meanwhile, EURC is still a small $238.71 million-cap asset, with $33.8 million volume in the last 24 hours. Yet, the euro-based stablecoin is displaying consistent growth of over $200 million, rising from a $36.46 market cap 14 months ago, on July 30.

EURC market data as of Sept. 17 | Source: CoinMarketCap

This new partnership with Kraken creates a win-win-win scenario, benefiting the two companies involved in the deal, together with all stablecoin users around the world. Stablecoins like USDC and EURC have an important role in the cryptocurrency market, often seen as an indicator for growth. For example, Coinspeaker reported how a Tether 2 billion USDT issuance could foreshadow a historical bull rally in the coming months.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

English (US) ·

English (US) ·