Key Notes

- Over 85% of transactions in the Ethereum ecosystem now take place on Layer 2 networks.

- Base has become the dominant L2, accounting for over 80% of all L2 transaction fees and operating at a 98.3% profit margin in May 2025.

- Despite the transaction shift, Ethereum L1 remains the core settlement layer, hosting 90% of stablecoin value and 83% of all real-world assets (RWAs).

A new report highlights a major shift in the Ethereum ETH $3 050 24h volatility: 3.0% Market cap: $368.20 B Vol. 24h: $24.83 B ecosystem, showing that Layer 2 networks now handle over 85% of all transactions.

However, while L2s like Base and Arbitrum ARB $0.43 24h volatility: 6.1% Market cap: $2.14 B Vol. 24h: $375.96 M have become the primary hubs for user activity, Ethereum’s mainnet remains the foundational settlement layer, processing 85% of all value transferred.

The report, published on July 10, 2025 by Dune Analytics, shows that Base has established itself as the dominant L2.

It now accounts for over 80% of all L2 transaction fees and generated $5.8 million in revenue in May 2025 alone, putting it on pace for a $70 million-plus annualized run rate.

A New L2 Economy Fueled by Dencun

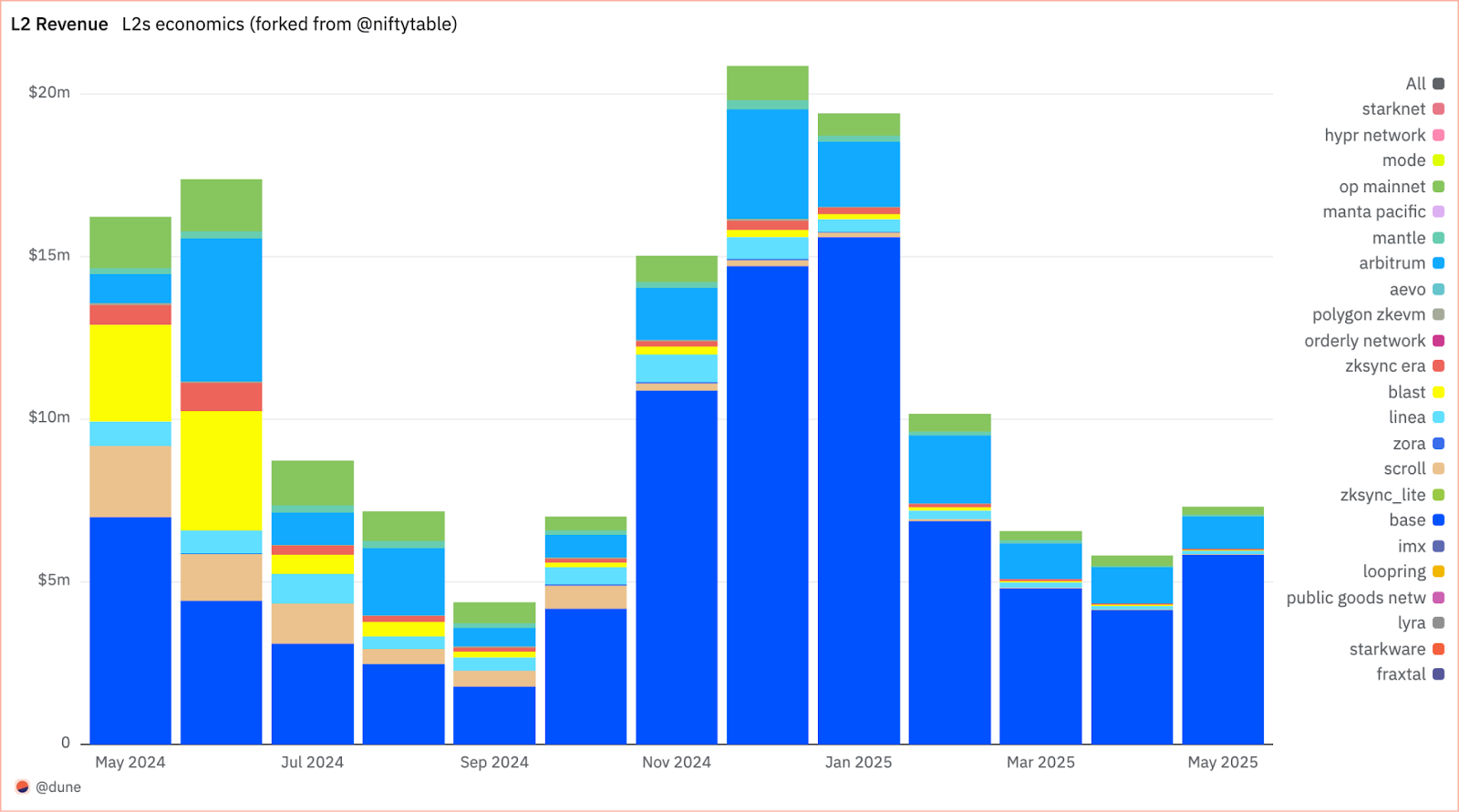

A breakdown of monthly revenue across the Layer 2 ecosystem from May 2024 to May 2025. Base (blue) is shown to be the dominant L2 in terms of revenue generation. | Source: Dune Analytics

A breakdown of monthly revenue across the Layer 2 ecosystem from May 2024 to May 2025. Base (blue) is shown to be the dominant L2 in terms of revenue generation. | Source: Dune Analytics

This growth was supercharged by Ethereum’s Dencun upgrade in March 2024. The introduction of “blobs” drastically reduced data settlement costs to “near-zero” levels, allowing Base to operate at a 98.3% profit margin in May 2025.

The lower costs have made L2s far more attractive to users as well. On decentralized exchanges, the number of trades more than doubled year-over-year to 132 million in May 2025, with Base handling over half of those trades. That same month, Base’s DEX trading volume surpassed Ethereum’s for the first time.

Still, the mainnet continues to be the chain of choice for high-value assets. Ethereum L1 hosts 90% of the $150 billion stablecoin supply and 83% of the $6 billion in real-world assets. This foundational role attracts wider interest and reflects a trend of growing institutional adoption, which includes developments like new ETF proposals featuring Ethereum.

Ultimately, the Dune report paints a clear picture of Ethereum’s modular future. The mainnet is solidifying its role as the core settlement and security backbone for the ecosystem, while L2s have become the primary execution layer where the next generation of consumer applications is being built and scaled.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

As a Web3 marketing strategist and former CMO of DuckDAO, Zoran Spirkovski translates complex crypto concepts into compelling narratives that drive growth. With a background in crypto journalism, he excels in developing go-to-market strategies for DeFi, L2, and GameFi projects.

English (US) ·

English (US) ·