Livepeer token formed a God candle on Friday, May 30, reaching its highest point since January 23 as other cryptocurrencies retreated.

Livepeer (LPT) price surged to a high of $12.22, up 265% from its lowest point this month. The move occurred in a high-volume environment, with 24-hour trading volume climbing to over $1.4 billion.

Livepeer, which offers decentralized video infrastructure, spiked after it was listed on dYdX and Upbit. dYdX is one of the top platforms in decentralized finance, while Upbit is the largest exchange in South Korea. It is common for tokens to rally sharply after being listed on major exchanges.

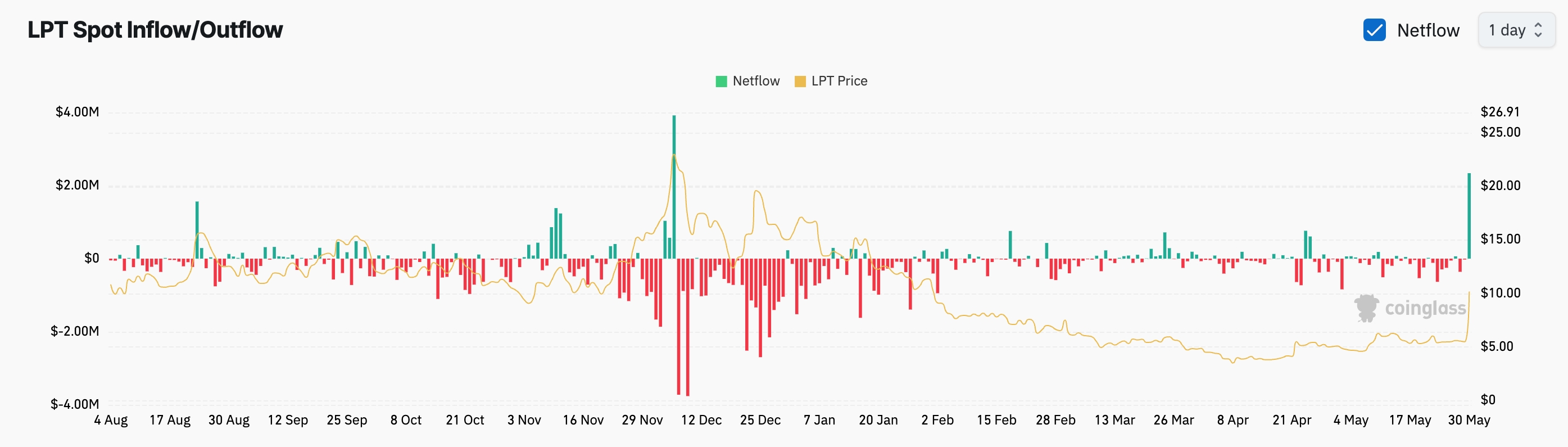

However, these gains could be short-lived as the excitement around the listings fades. On-chain data shows that the supply of LPT on exchanges jumped to over 2.3 million on Friday, the biggest increase since December last year. Rising inflows to exchanges often indicate that investors are beginning to take profits.

LPT inflow and outflow | Source: CoinGlass

LPT inflow and outflow | Source: CoinGlassAnother reason the Livepeer rally may lose steam is that the funding rate has dropped to its lowest level in months. It fell to minus 1.7%, one of the steepest declines in recent years. A falling funding rate suggests that traders expect the future price to be lower than the current level.

Additionally, LPT gained traction after Grayscale included it on its list of top crypto projects in the artificial intelligence sector. Other coins on the list include Bittensor, Near, Render, and Worldcoin.

Introducing the Artificial Intelligence Crypto Sector.

The #AI Sector includes 20 tokens with a combined market capitalization of $20 billion — up from just $4.5 billion in Q1 2023*.

Learn more about the AI Crypto Sector: https://t.co/LmvVvv9WHr

*Source: Artemis, Grayscale… pic.twitter.com/xrlPMBYK2o

Livepeer price technical analysis

LPT price chart | Source: crypto.news

LPT price chart | Source: crypto.newsThe daily chart shows that LPT surged suddenly, forming a God candle that pushed the token to its highest level since January 23. It broke above key resistance at $6.67, the previous high from May 15.

Livepeer also climbed above the 50-day and 100-day Exponential Moving Averages, with all oscillators spiking.

The most likely scenario is a loss of momentum and a pullback, possibly toward the support level at $6.67, a 40% drop from current prices.

![11 Best Crypto & Bitcoin Casinos in Australia [2025]](https://coincheckup.com/blog/wp-content/uploads/best-crypto-and-bitcoin-casinos-in-australia-coincheckup-1024x576.png)

English (US) ·

English (US) ·