U.S. Bitcoin miner Marathon Digital Holdings has spent approximately $67 million on its latest Bitcoin purchase, following a $1 billion convertible note sale with a 0% interest rate.

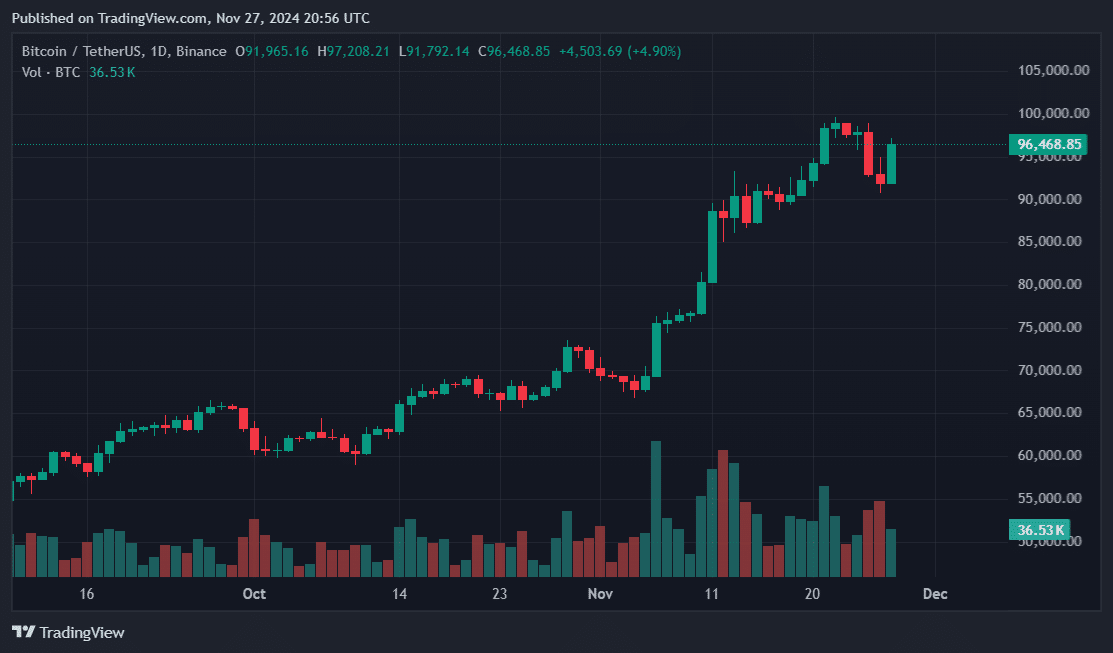

According to a post on X by MARA Holdings, the Florida-based Bitcoin (BTC) startup has increased its BTC portfolio to 34,794 tokens, valued at approximately $3.3 billion based on a spot price of $95,000. At the time of writing on Nov. 27, BTC was trading at $96,400.

24-hour BTC price chart – Nov. 24 | Source: crypto.news

24-hour BTC price chart – Nov. 24 | Source: crypto.newsMarathon Digital disclosed that it had executed note buybacks worth $200 million and retained $160 million in capital for additional Bitcoin purchases. The company hinted at employing a “buy the dip” strategy. Mara also updated its year-to-date BTC yield to a 36.7% increase, using a metric that measures the growth of BTC holdings relative to share dilution.

The use of BTC yield as a performance indicator has gained traction among corporate Bitcoin holders, particularly after convertible note offerings. MicroStrategy pioneered this trend over four years of Bitcoin acquisitions, financed partly through stock and note sales.

With our 0% $1 billion convertible notes offering, we are excited to share an update:

– Acquired an additional 703 BTC, bringing the total to 6,474 BTC, at an average price of $95,395 per BTC

– YTD BTC Yield Per Share 36.7%

– Total owned BTC: ~34,794 BTC, currently valued at… pic.twitter.com/bzbunlyBRN

Other companies have adopted the process, announcing individual BTC reserves and Treasuries. Firms like Semler Scientific in the medical sector, artificial intelligence developer Genius Group, and Tokyo behemoth Metaplanet.

Countries and governments also raced to create national strategic BTC stockpiles. U.S. Senator Cynthia Lummis proposed buying 4% of the total 21 million token supply. Brazil’s Chamber of Deputies pitched a BTC reverse to cushion financial risks.

States also flocked to the idea, potentially planning to front-run federal administrations. Pennsylvania tabled its BTC reserve framework as it passed a Bitcoin Rights bill following President Donald Trump’s imminent return to the White House.

In Canada, Vancouver Mayor Ken Sim has put forward a motion to preserve the city’s purchasing power through BTC-friendly policies, including establishing a Bitcoin reserve.

English (US) ·

English (US) ·