Blockchain gaming dominated the web3 landscape in Q3, capturing over 26% of on-chain activity, according to DappRadar’s latest report.

Web3 gaming accounted for over 26% of on-chain activity in Q3, fueled by 4.4 million daily active wallets, which marks a 21% increase in daily unique active wallets from the previous quarter, according to DappRadar’s data.

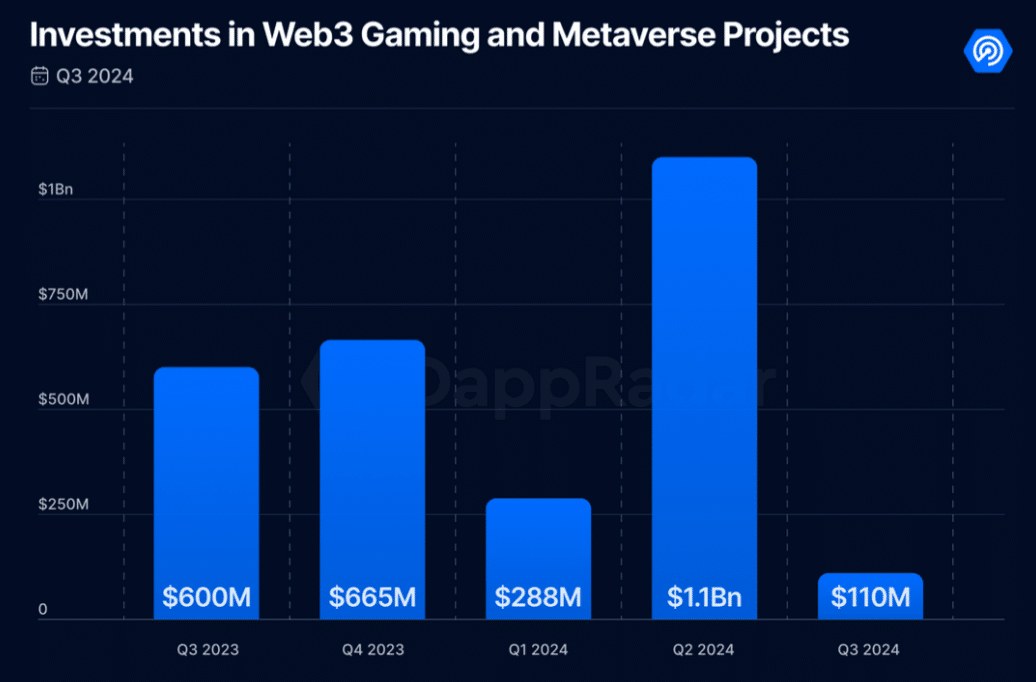

Investments in web3 gaming projects | Source: DappRadar

Investments in web3 gaming projects | Source: DappRadarLeading the charge, the Ronin Network maintained its dominance, attracting over 1 million daily wallets, a 34% growth from Q2, while Oasys and opBNB also saw gains, with Oasys skyrocketing by 4,711% and opBNB by 480%, establishing themselves as top-performing gaming blockchains.

Despite the high on-chain activity, data reveals that investment in blockchain gaming saw a staggering 90% decline from the previous quarter, dropping to $110 million, with 79% of this capital funneled into infrastructure projects.

New @glxyresearch report 🚨

Crypto & Blockchain Venture Capital – Q3 2024

In Q3 2024, venture capitalists invested $2.4bn (-20% QoQ) into crypto and blockchain-focused startups across 478 deals (-17% QoQ). pic.twitter.com/Nv0Hwae1Fn

Recent data from blockchain investment firm Galaxy Digital indicates that total venture capital funding in the crypto sector fell by 20% in Q3, totaling $2.4 billion across 478 deals.

In terms of deal count, Web3/NFT/DAO/Metaverse/Gaming led the way with 25% of deals (120), a 30% QoQ increase, driven by 48 gaming deals. pic.twitter.com/eg0MFQwJbt

— Gabe 博仁 Parker (@hiroto_btc) October 15, 2024Gabe Parker, a research analyst at Galaxy Digital, noted that crypto startups focused on artificial intelligence services saw a fivefold increase in funding quarter-over-quarter, while those centered on non-fungible tokens, the metaverse, and gaming experienced a 39% decline, described by Parker as the “largest QoQ decrease in VC investment across all categories.”

DappRadar’s blockchain analyst, Sara Gherghelas, noted that even though investments into the web3 gaming space dropped sharply from the previous quarter, the industry is still “laying critical infrastructure for future growth.” At the same time, the metaverse experienced a combination of declining trading volume and rising sales, indicating “sustained demand despite fluctuating prices,” Gherghelas said.

English (US) ·

English (US) ·