Polygon’s price rebounded slightly on Tuesday as the crypto fear and greed index moved back into the greed zone.

Polygon (POL), one of the top layer-2 networks, rose to a high of $0.3340, marking a 10% increase from its lowest level this month. It remains 25% below its September peak, when it transitioned from MATIC to POL.

Polygon’s recovery coincided with improved on-chain data. According to PolygonScan, the network’s transaction volume rose to 3.1 million on Monday, a significant increase from the September low of 2.3 million.

Additional data revealed that the number of unique addresses on the network climbed to 470 million, marking an increase of 190,000 from the previous day. Polygon PoS chain utilization also rose slightly to 49%.

Polygon has become a key player in the blockchain industry, largely due to Polymarket, a platform that has gained popularity as a prediction market. Data shows that the largest prediction market on the network holds over $2.6 billion in assets.

Data from DeFi Llama Polymarket’s trading volume surged to over $2.08 billion in October, a significant increase from $533 million in the prior month. Its 24-hour trading volume reached $118 million, a trend that may continue in the coming days.

Polymarket operates on Polygon, as users must deposit USD Coin (USDC) on Polygon’s network to participate in trading.

However, more data shows that the Polygon network has lost market share in key areas of the blockchain industry. For example, it has over $1.12 billion in total value locked in the decentralized finance industry, making it the third-biggest layer-2 network after Base and Arbitrum.

Polygon has also seen a reduction in its share of the decentralized exchange industry. Its DEX volume in October was $5.1 billion, much lower than Base’s $25 billion and Arbitrum’s $15 billion. This decline is notable as Polygon was one of the first mainstream layer-2 networks.

Polygon is attempting to recover

POL chart by TradingView

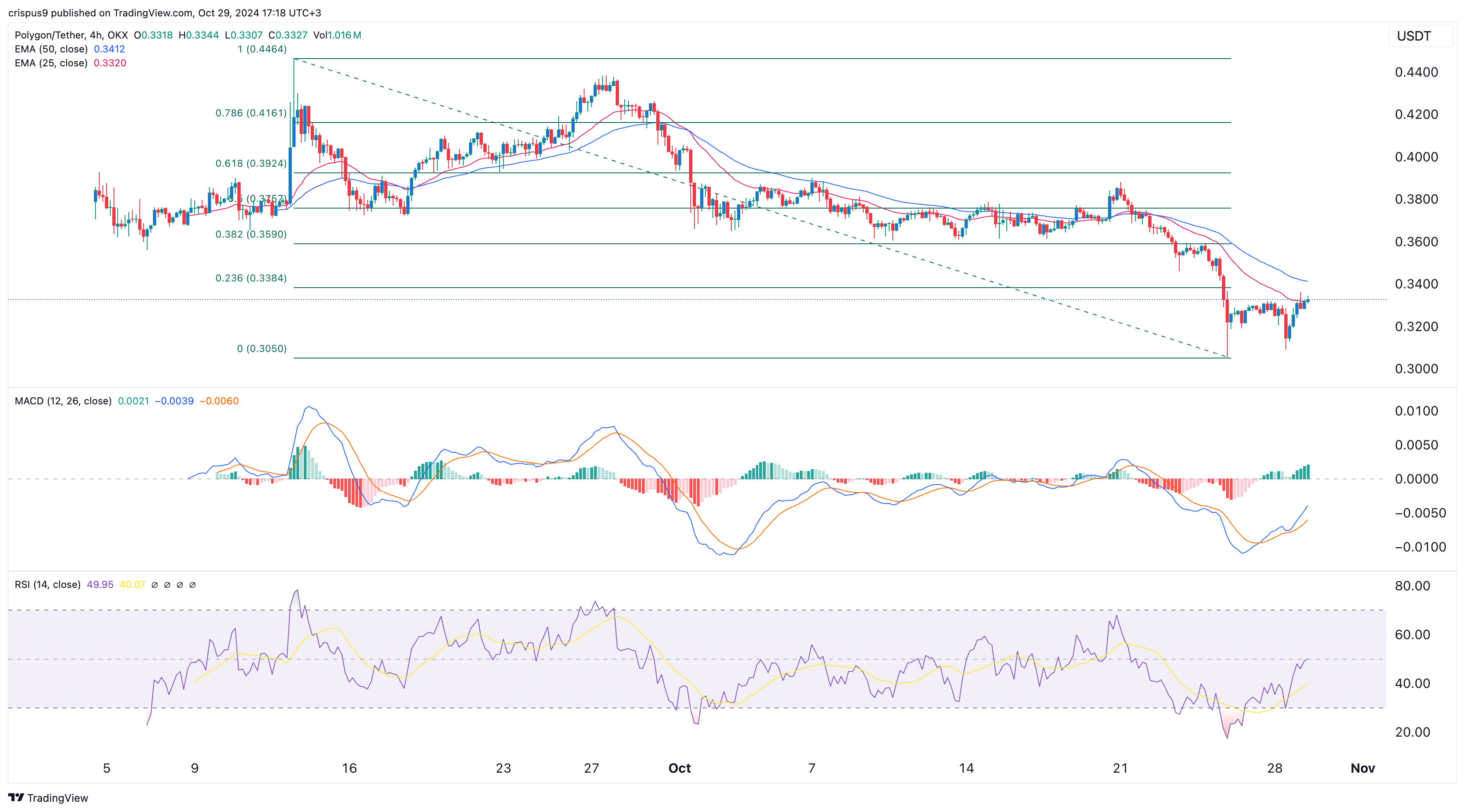

POL chart by TradingViewThe 4-hour chart shows that the Polygon token bottomed at $0.3050 on Oct. 25 and has rebounded to $0.3330, its highest level since Oct. 25.

It remains below the 23.6% Fibonacci retracement level and the 50-period and 25-period Exponential Moving Averages.

The two lines of the MACD indicator have formed a bullish crossover pattern, a commonly observed bullish signal. Additionally, the Relative Strength Index is pointing upward and has moved to the neutral level of 50.

Therefore, Polygon’s price will likely continue rising as bulls target the 50% retracement level at $0.3750.

English (US) ·

English (US) ·